A company runs a number of slaughterhouses which supply hamburger meat to McDonalds. The company is afraid that live cattle prices will increase over the next year, even though there is widespread belief in the market that they will be stable. What can the company do to hedge against the risk of increasing live cattle prices? Which statement(s) are correct?

(i) buy call options on live cattle.

(ii) buy put options on live cattle.

(iii) sell call options on live cattle.

Select the most correct response:

A project has the following cash flows. Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $250 at time 2 is actually earned smoothly from t=1 to t=2:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the payback period of the project in years?

A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

A 90-day $1 million Bank Accepted Bill (BAB) was bought for $990,000 and sold 30 days later for $996,000 (at t=30 days).

What was the total return, capital return and income return over the 30 days it was held?

Despite the fact that money market instruments such as bills are normally quoted with simple interest rates, please calculate your answers as compound interest rates, specifically, as effective 30-day rates, which is how the below answer choices are listed.

##r_\text{total}##, ##r_\text{capital}##, ## r_\text{income}##

In the dividend discount model:

### P_0= \frac{d_1}{r-g} ###

The pronumeral ##g## is supposed to be the:

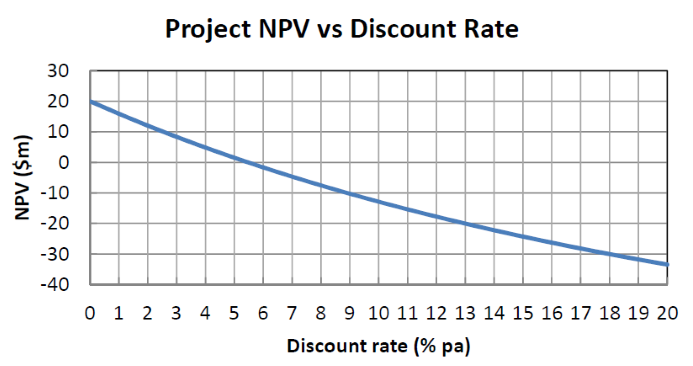

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

Which of the following statements about option contracts is NOT correct? For every:

A trader buys one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Telsa Motors advertises that its Model S electric car saves $570 per month in fuel costs. Assume that Tesla cars last for 10 years, fuel and electricity costs remain the same, and savings are made at the end of each month with the first saving of $570 in one month from now.

The effective annual interest rate is 15.8%, and the effective monthly interest rate is 1.23%. What is the present value of the savings?

Question 920 SML, CAPM, Sharpe ratio, Treynor ratio, Jensens alpha, no explanation

Over-priced assets should NOT: