Question 108 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds:

- A 1 year zero coupon bond at a yield of 10% pa, and

- A 2 year zero coupon bond at a yield of 8% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

Which one of the following bonds is trading at a discount?

A project's NPV is positive. Select the most correct statement:

A fairly priced stock has a beta that is the same as the market portfolio's beta. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the expected return of the stock?

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

A trader just bought a European style put option on CBA stock. The current option premium is $2, the exercise price is $75, the option matures in one year and the spot CBA stock price is $74.

Which of the following statements is NOT correct?

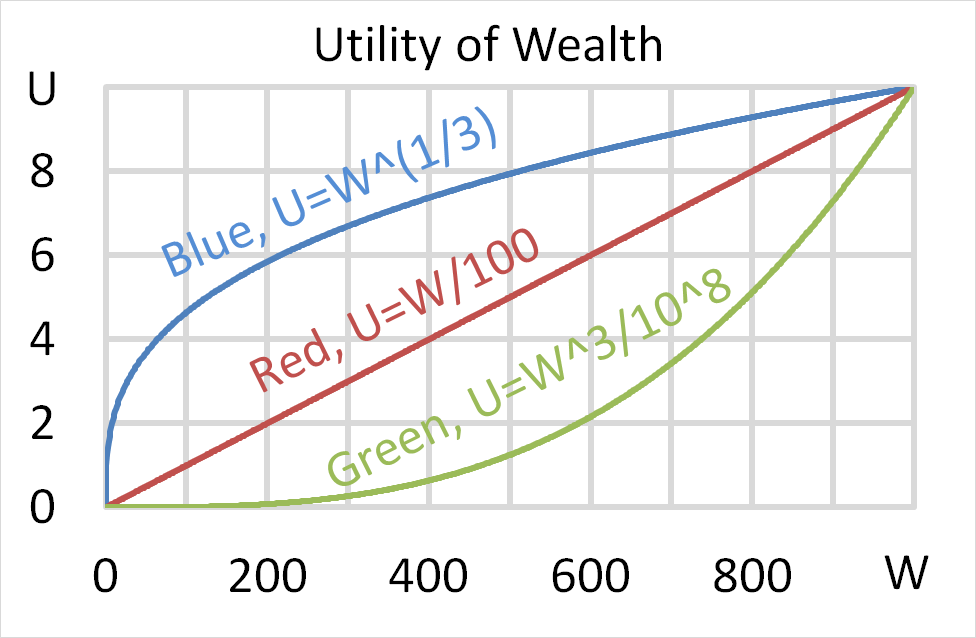

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Note that a fair gamble is a bet that has an expected value of zero, such as paying $0.50 to win $1 in a coin flip with heads or nothing if it lands tails. Fairly priced insurance is when the expected present value of the insurance premiums is equal to the expected loss from the disaster that the insurance protects against, such as the cost of rebuilding a home after a catastrophic fire.

Which of the following statements is NOT correct?

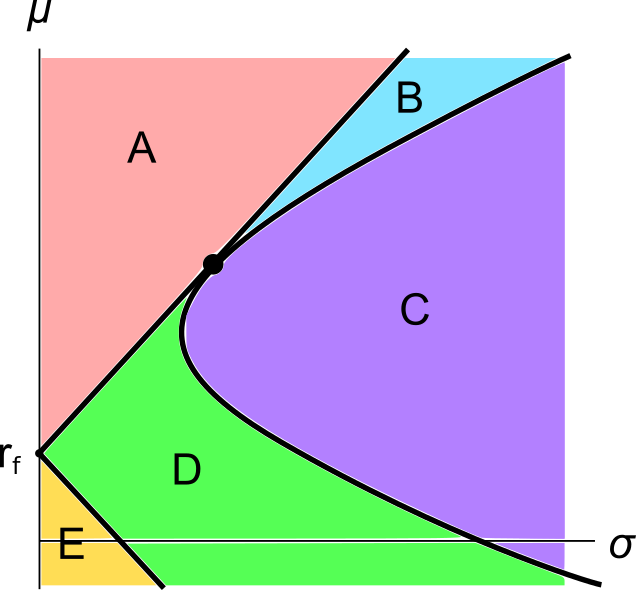

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the below diagram.

Each letter corresponds to a separate coloured area. The portfolios at the boundary of the areas, on the black lines, are excluded from each area. Assume that all assets represented in this graph are fairly priced, and that all risky assets can be short-sold.

Which of the following statements about this graph and Markowitz portfolio theory is NOT correct?