For a price of $100, Vera will sell you a 2 year bond paying semi-annual coupons of 10% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 8% pa.

Your main expense is fuel for your car which costs $100 per month. You just refueled, so you won't need any more fuel for another month (first payment at t=1 month).

You have $2,500 in a bank account which pays interest at a rate of 6% pa, payable monthly. Interest rates are not expected to change.

Assuming that you have no income, in how many months time will you not have enough money to fully refuel your car?

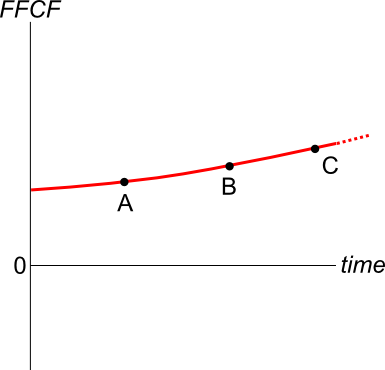

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Question 382 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's shares is equivalent to:

Question 415 income and capital returns, real estate, no explanation

You just bought a residential apartment as an investment property for $500,000.

You intend to rent it out to tenants. They are ready to move in, they would just like to know how much the monthly rental payments will be, then they will sign a twelve-month lease.

You require a total return of 8% pa and a rental yield of 5% pa.

What would the monthly paid-in-advance rental payments have to be this year to receive that 5% annual rental yield?

Also, if monthly rental payments can be increased each year when a new lease agreement is signed, by how much must you increase rents per year to realise the 8% pa total return on the property?

Ignore all taxes and the costs of renting such as maintenance costs, real estate agent fees, utilities and so on. Assume that there will be no periods of vacancy and that tenants will promptly pay the rental prices you charge.

Note that the first rental payment will be received at t=0. The first lease agreement specifies the first 12 equal payments from t=0 to 11. The next lease agreement can have a rental increase, so the next twelve equal payments from t=12 to 23 can be higher than previously, and so on forever.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

Question 743 price gains and returns over time, no explanation

How many years will it take for an asset's price to triple (increase from say $1 to $3) if it grows by 5% pa?

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

You are an equities analyst trying to value the equity of the Australian supermarket conglomerate Woolworths, with ticker WOW. In Australia, listed companies like Woolworths tend to pay dividends every 6 months. The payment around September is the final dividend and the payment around March is called the interim dividend. Both occur annually.

- Today is mid-November 2018.

- WOW's last final dividend of $0.50 was two months ago in mid-September 2018.

- WOW's last interim dividend of $0.43 was eight months ago in mid-March 2018.

- Judging by the dividend history and WOW's prospects, you judge that the growth rate in the dividends will be 3% pa forever.

- Assume that WOW's total cost of equity is 6.5% pa. All rates are quoted as nominal effective rates.

- The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What should be the current share price of WOW?