According to the theory of the Capital Asset Pricing Model (CAPM), total risk can be broken into two components, systematic risk and idiosyncratic risk. Which of the following events would be considered a systematic, undiversifiable event according to the theory of the CAPM?

The total return of any asset can be broken down in different ways. One possible way is to use the dividend discount model (or Gordon growth model):

###p_0 = \frac{c_1}{r_\text{total}-r_\text{capital}}###

Which, since ##c_1/p_0## is the income return (##r_\text{income}##), can be expressed as:

###r_\text{total}=r_\text{income}+r_\text{capital}###

So the total return of an asset is the income component plus the capital or price growth component.

Another way to break up total return is to use the Capital Asset Pricing Model:

###r_\text{total}=r_\text{f}+β(r_\text{m}- r_\text{f})###

###r_\text{total}=r_\text{time value}+r_\text{risk premium}###

So the risk free rate is the time value of money and the term ##β(r_\text{m}- r_\text{f})## is the compensation for taking on systematic risk.

Using the above theory and your general knowledge, which of the below equations, if any, are correct?

(I) ##r_\text{income}=r_\text{time value}##

(II) ##r_\text{income}=r_\text{risk premium}##

(III) ##r_\text{capital}=r_\text{time value}##

(IV) ##r_\text{capital}=r_\text{risk premium}##

(V) ##r_\text{income}+r_\text{capital}=r_\text{time value}+r_\text{risk premium}##

Which of the equations are correct?

When someone says that they're "buying American dollars" (USD), what type of asset are they probably buying? They're probably buying:

Which firms tend to have low forward-looking price-earnings (PE) ratios?

Only consider firms with positive earnings, disregard firms with negative earnings and therefore negative PE ratios.

Question 604 inflation, real and nominal returns and cash flows

Apples and oranges currently cost $1 each. Inflation is 5% pa, and apples and oranges are equally affected by this inflation rate. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

Which of the following statements is NOT correct?

A company conducts a 10 for 3 stock split. What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

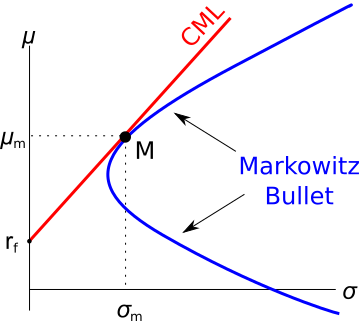

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 790 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate, log-normal distribution, VaR, confidence interval

A risk manager has identified that their hedge fund’s continuously compounded portfolio returns are normally distributed with a mean of 10% pa and a standard deviation of 30% pa. The hedge fund’s portfolio is currently valued at $100 million. Assume that there is no estimation error in these figures and that the normal cumulative density function at 1.644853627 is 95%.

Which of the following statements is NOT correct? All answers are rounded to the nearest dollar.

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include:

Question 852 gross domestic product, inflation, employment, no explanation

When the economy is booming (in an upswing), you tend to see: