The US firm Google operates in the online advertising business. In 2011 Google bought Motorola Mobility which manufactures mobile phones.

Assume the following:

- Google had a 10% after-tax weighted average cost of capital (WACC) before it bought Motorola.

- Motorola had a 20% after-tax WACC before it merged with Google.

- Google and Motorola have the same level of gearing.

- Both companies operate in a classical tax system.

You are a manager at Motorola. You must value a project for making mobile phones. Which method(s) will give the correct valuation of the mobile phone manufacturing project? Select the most correct answer.

The mobile phone manufacturing project's:

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

Which of the below formulas gives the profit ##(\pi)## from being short a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

A trader sells one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Bob buys a future from Chris.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

An equity index stands at 100 points and the one year equity futures price is 107.

The equity index is expected to have a dividend yield of 3% pa. Assume that investors are risk-neutral so their total required return on the shares is the same as the risk free Treasury bond yield which is 10% pa. Both are given as discrete effective annual rates.

Assuming that the equity index is fairly priced, an arbitrageur would recognise that the equity futures are:

Question 798 idiom, diversification, market efficiency, sunk cost, no explanation

The following quotes are most closely related to which financial concept?

- “Opportunity is missed by most people because it is dressed in overalls and looks like work” -Thomas Edison

- “The only place where success comes before work is in the dictionary” -Vidal Sassoon

- “The safest way to double your money is to fold it over and put it in your pocket” - Kin Hubbard

The famous investor Warren Buffett is one of few portfolio managers who appears to have consistently beaten the market. His company Berkshire Hathaway (BRK) appears to have outperformed the US S&P500 market index, shown in the graph below.

Read the below statements about Warren Buffett and the implications for the Efficient Markets Hypothesis (EMH) theory of Eugene Fama. Assume that the first sentence is true. Analyse the second sentence and select the answer option which is NOT correct. In other words, find the false statement in the second sentence.

Question 817 expected and historical returns, income and capital returns

Over the last year, a constant-dividend-paying stock's price fell, while it's future expected dividends and profit remained the same. Assume that:

- Now is ##t=0##, last year is ##t=-1## and next year is ##t=1##;

- The dividend is paid at the end of each year, the last dividend was just paid today ##(C_0)## and the next dividend will be paid next year ##(C_1)##;

- Markets are efficient and the dividend discount model is suitable for valuing the stock.

Which of the following statements is NOT correct? The stock's:

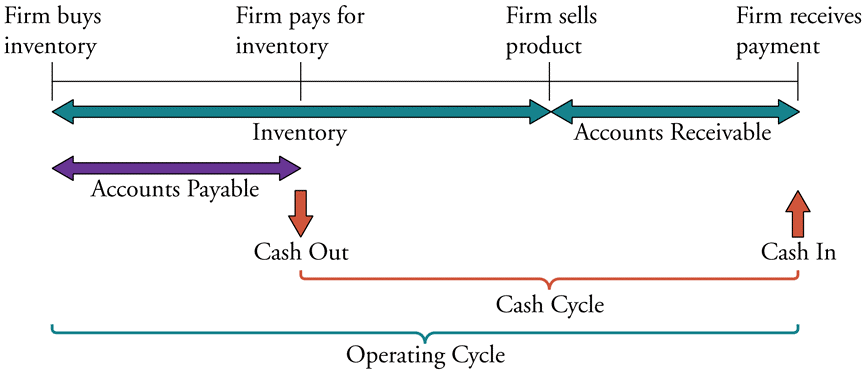

The below diagram shows a firm’s cash cycle.

Which of the following statements about companies’ cash cycle is NOT correct?