A company has:

- 100 million ordinary shares outstanding which are trading at a price of $5 each. Market analysts estimated that the company's ordinary stock has a beta of 1.5. The risk-free rate is 5% and the market return is 10%.

- 1 million preferred shares which have a face (or par) value of $100 and pay a constant annual dividend of 9% of par. The next dividend will be paid in one year. Assume that all preference dividends will be paid when promised. They currently trade at a price of $90 each.

- Debentures that have a total face value of $200 million and a yield to maturity of 6% per annum. They are publicly traded and their market price is equal to 110% of their face value.

The corporate tax rate is 30%. All returns and yields are given as effective annual rates.

What is the company's after-tax Weighted Average Cost of Capital (WACC)? Assume a classical tax system.

You just bought a nice dress which you plan to wear once per month on nights out. You bought it a moment ago for $600 (at t=0). In your experience, dresses used once per month last for 6 years.

Your younger sister is a student with no money and wants to borrow your dress once a month when she hits the town. With the increased use, your dress will only last for another 3 years rather than 6.

What is the present value of the cost of letting your sister use your current dress for the next 3 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new dress when your current one wears out; your sister will only use the current dress, not the next one that you will buy; and the price of a new dress never changes.

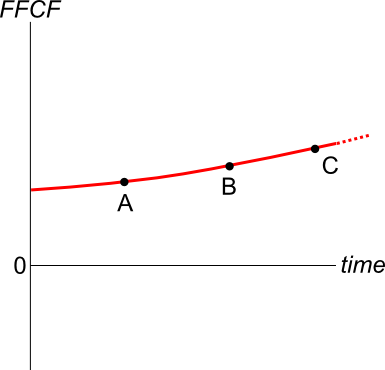

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

A mature firm has constant expected future earnings and dividends. Both amounts are equal. So earnings and dividends are expected to be equal and unchanging.

Which of the following statements is NOT correct?

Question 432 option, option intrinsic value, no explanation

An American style call option with a strike price of ##K## dollars will mature in ##T## years. The underlying asset has a price of ##S## dollars.

What is an expression for the current intrinsic value in dollars from owning (being long) the American style call option? Note that the intrinsic value of an option does not subtract the premium paid to buy the option.

A young lady is trying to decide if she should attend university or not.

The young lady's parents say that she must attend university because otherwise all of her hard work studying and attending school during her childhood was a waste.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The hard work studying at school in her childhood should be classified as:

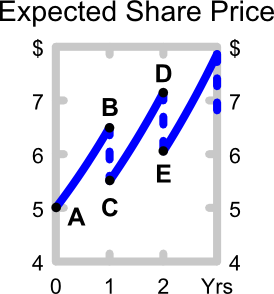

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

Question 538 bond pricing, income and capital returns, no explanation

Risk-free government bonds that have coupon rates greater than their yields:

Question 636 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

A trader buys a one year futures contract on crude oil. The contract is for the delivery of 1,000 barrels. The current futures price is $38.94 per barrel. The initial margin is $3,410 per contract, and the maintenance margin is $3,100 per contract.

What is the smallest price change that would lead to a margin call for the buyer?