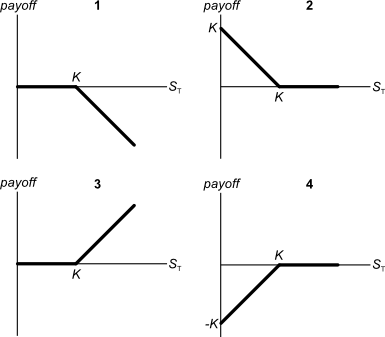

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered

A three year bond has a fixed coupon rate of 12% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value is $100. What is its price?

A share just paid its semi-annual dividend of $5. The dividend is expected to grow at 1% every 6 months forever. This 1% growth rate is an effective 6 month rate.

Therefore the next dividend will be $5.05 in six months. The required return of the stock 8% pa, given as an effective annual rate.

What is the price of the share now?

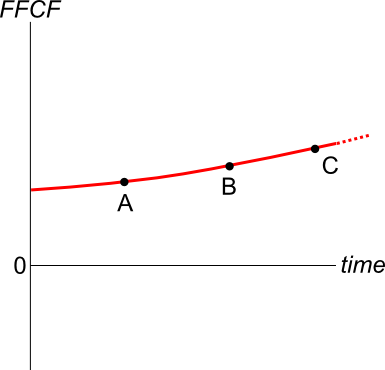

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

The following cash flows are expected:

- Constant perpetual yearly payments of $70, with the first payment in 2.5 years from now (first payment at t=2.5).

- A single payment of $600 in 3 years and 9 months (t=3.75) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Question 559 variance, standard deviation, covariance, correlation

Which of the following statements about standard statistical mathematics notation is NOT correct?

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

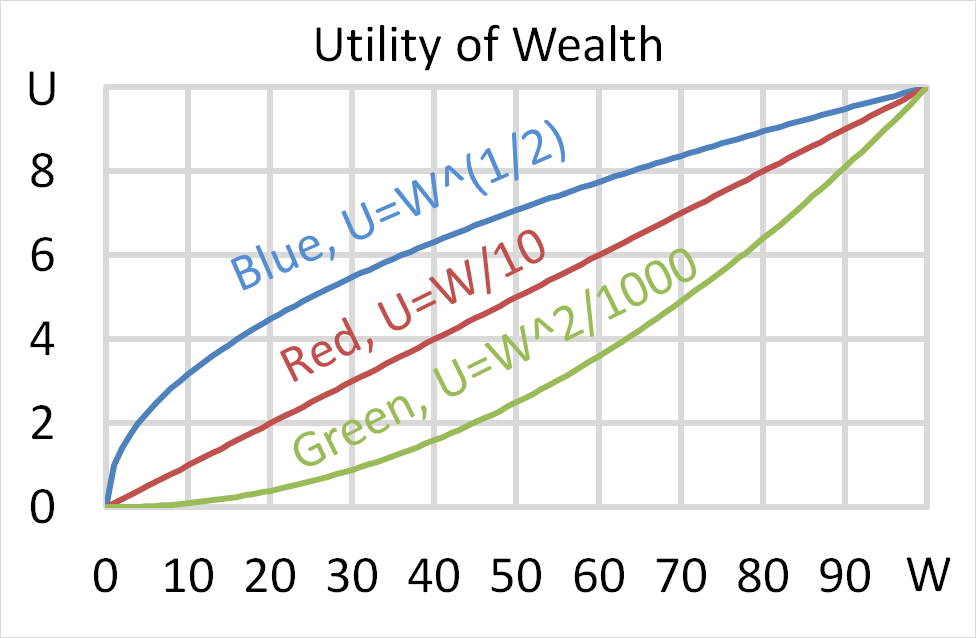

Which of the below statements about utility is NOT generally accepted by economists? Most people are thought to:

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?