You operate a cattle farm that supplies hamburger meat to the big fast food chains. You buy a lot of grain to feed your cattle, and you sell the fully grown cattle on the livestock market.

You're afraid of adverse movements in grain and livestock prices. What options should you buy to hedge your exposures in the grain and cattle livestock markets?

Select the most correct response:

A five year bond has a face value of $100, a yield of 12% and a fixed coupon rate of 6%, paid semi-annually.

What is the bond's price?

A project has the following cash flows. Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $105 at time 2 is actually earned smoothly from t=1 to t=2:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -90 |

| 1 | 30 |

| 2 | 105 |

What is the payback period of the project in years?

A firm wishes to raise $10 million now. They will issue 6% pa semi-annual coupon bonds that will mature in 8 years and have a face value of $1,000 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue? All numbers are rounded up.

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

One method for calculating a firm's free cash flow (FFCF, or CFFA) is to ignore interest expense. That is, pretend that interest expense ##(IntExp)## is zero:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp \\ &= (Rev - COGS - Depr - FC - 0)(1-t_c) + Depr - CapEx -\Delta NWC - 0\\ \end{aligned}###

Question 638 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

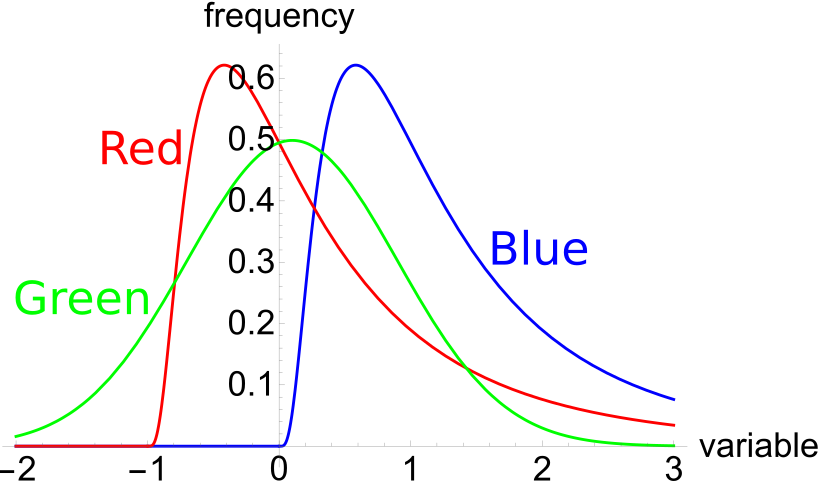

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Which of the below statements is NOT correct?

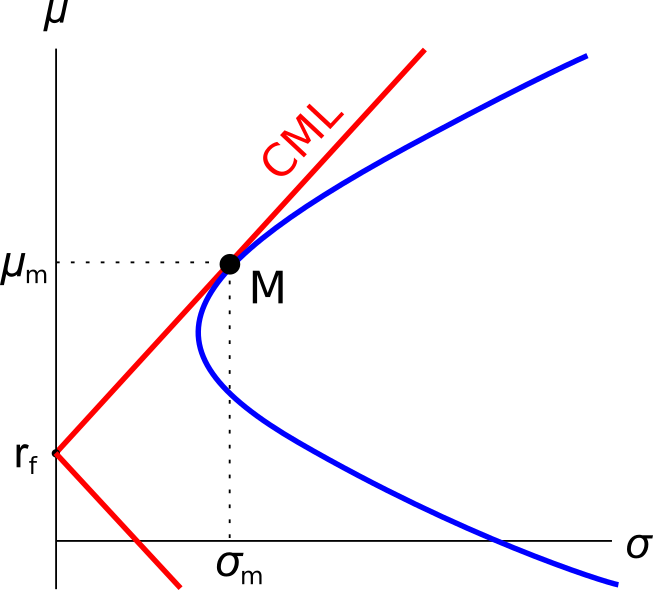

Question 809 Markowitz portfolio theory, CAPM, Jensens alpha, CML, systematic and idiosyncratic risk

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the graph below. The CML is the capital market line.

Which of the following statements about this graph, Markowitz portfolio theory and the Capital Asset Pricing Model (CAPM) theory is NOT correct?

Question 825 future, hedging, tailing the hedge, speculation, no explanation

An equity index fund manager controls a USD500 million diversified equity portfolio with a beta of 0.9. The equity manager expects a significant rally in equity prices next year. The market does not think that this will happen. If the fund manager wishes to increase his portfolio beta to 1.5, how many S&P500 futures should he buy?

The US market equity index is the S&P500. One year CME futures on the S&P500 currently trade at 2,155 points and the spot price is 2,180 points. Each point is worth $250.

The number of one year S&P500 futures contracts that the fund manager should buy is: