Suppose that the US government recently announced that subsidies for fresh milk producers will be gradually phased out over the next year. Newspapers say that there are expectations of a 40% increase in the spot price of fresh milk over the next year.

Option prices on fresh milk trading on the Chicago Mercantile Exchange (CME) reflect expectations of this 40% increase in spot prices over the next year. Similarly to the rest of the market, you believe that prices will rise by 40% over the next year.

What option trades are likely to be profitable, or to be more specific, result in a positive Net Present Value (NPV)?

Assume that:

- Only the spot price is expected to increase and there is no change in expected volatility or other variables that affect option prices.

- No taxes, transaction costs, information asymmetry, bid-ask spreads or other market frictions.

A zero coupon bond that matures in 6 months has a face value of $1,000.

The firm that issued this bond is trying to forecast its income statement for the year. It needs to calculate the interest expense of the bond this year.

The bond is highly illiquid and hasn't traded on the market. But the finance department have assessed the bond's fair value to be $950 and this is its book value right now at the start of the year.

Assume that:

- the firm uses the 'effective interest method' to calculate interest expense.

- the market value of the bond is the same as the book value.

- the firm is only interested in this bond's interest expense. Do not include the interest expense for a new bond issued to refinance the current one, as would normally happen.

What will be the interest expense of the bond this year for the purpose of forecasting the income statement?

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

A company conducts a 4 for 3 stock split. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order.

Which of the below formulas gives the payoff at maturity ##(f_T)## from being long a future? Let the underlying asset price at maturity be ##S_T## and the locked-in futures price be ##K_T##.

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

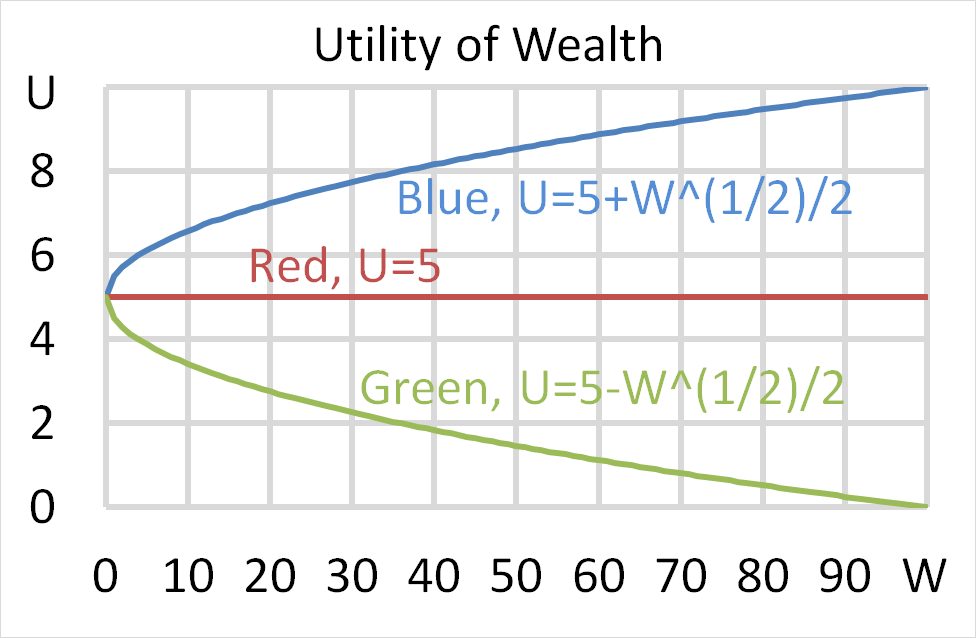

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

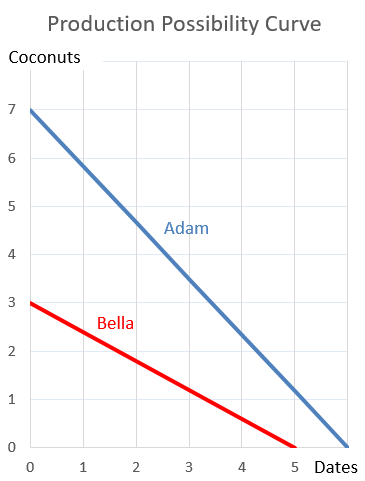

Question 895 comparative advantage in trade, production possibilities curve

Adam and Bella are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Adam can pick 7 coconuts per hour, 6 dates per hour or any linear combination of coconuts and dates. For example, he could pick 3.5 coconuts and 3 dates per hour.

Bella can pick 3 coconuts per hour, 5 dates per hour or any linear combination. For example, she could pick 1.5 coconuts and 2.5 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Adam | 7 | 6 |

| Bella | 3 | 5 |

Which of the following statements is NOT correct?