The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

Question 545 income and capital returns, fully amortising loan, no explanation

Which of the following statements about the capital and income returns of a 25 year fully amortising loan asset is correct?

Assume that the yield curve (which shows total returns over different maturities) is flat and is not expected to change.

Over the 25 years from issuance to maturity, a fully amortising loan's expected annual effective:

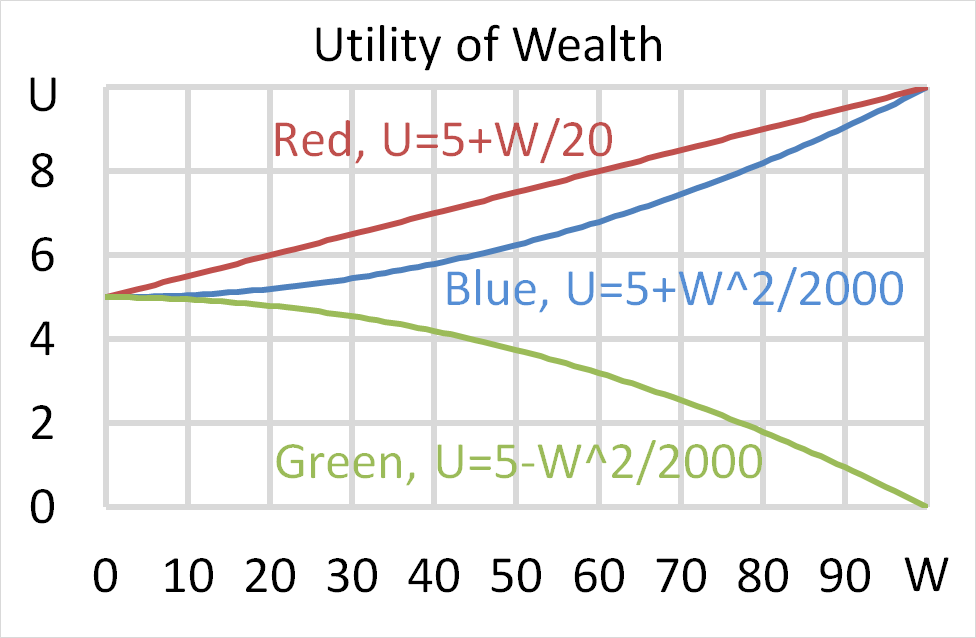

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 708 continuously compounding rate, continuously compounding rate conversion

Convert a 10% continuously compounded annual rate ##(r_\text{cc annual})## into an effective annual rate ##(r_\text{eff annual})##. The equivalent effective annual rate is:

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

A stock is expected to pay a dividend of $1 in one year. Its future annual dividends are expected to grow by 10% pa. So the first dividend of $1 is in one year, and the year after that the dividend will be $1.1 (=1*(1+0.1)^1), and a year later $1.21 (=1*(1+0.1)^2) and so on forever.

Its required total return is 30% pa. The total required return and growth rate of dividends are given as effective annual rates. The stock is fairly priced.

Calculate the pay back period of buying the stock and holding onto it forever, assuming that the dividends are received as at each time, not smoothly over each year.

On 1 February 2016 you were told that your refinery company will need to purchase oil on 1 July 2016. You were afraid of the oil price rising between now and then so you bought some August 2016 futures contracts on 1 February 2016 to hedge against changes in the oil price. On 1 February 2016 the oil price was $40 and the August 2016 futures price was $43.

It's now 1 July 2016 and oil price is $45 and the August 2016 futures price is $46. You bought the spot oil and closed out your futures position on 1 July 2016.

What was the effective price paid for the oil, taking into account basis risk? All spot and futures oil prices quoted above and below are per barrel.