You're trying to save enough money to buy your first car which costs $2,500. You can save $100 at the end of each month starting from now. You currently have no money at all. You just opened a bank account with an interest rate of 6% pa payable monthly.

How many months will it take to save enough money to buy the car? Assume that the price of the car will stay the same over time.

There are a number of ways that assets can be depreciated. Generally the government's tax office stipulates a certain method.

But if it didn't, what would be the ideal way to depreciate an asset from the perspective of a businesses owner?

Question 448 franking credit, personal tax on dividends, imputation tax system

A small private company has a single shareholder. This year the firm earned a $100 profit before tax. All of the firm's after tax profits will be paid out as dividends to the owner.

The corporate tax rate is 30% and the sole shareholder's personal marginal tax rate is 45%.

The Australian imputation tax system applies because the company generates all of its income in Australia and pays corporate tax to the Australian Tax Office. Therefore all of the company's dividends are fully franked. The sole shareholder is an Australian for tax purposes and can therefore use the franking credits to offset his personal income tax liability.

What will be the personal tax payable by the shareholder and the corporate tax payable by the company?

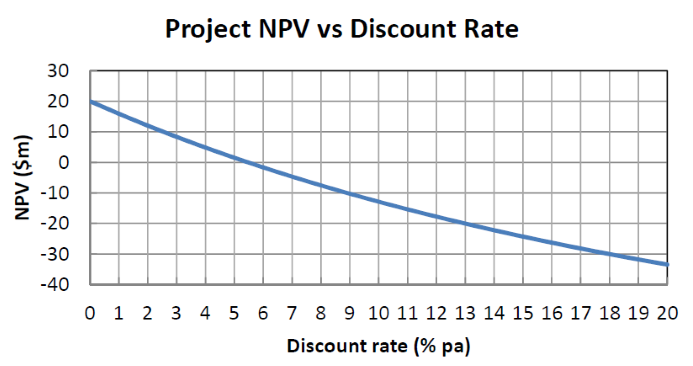

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

A company conducts a 4 for 3 stock split. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order.

Which of the below statements about utility is NOT generally accepted by economists? Most people are thought to:

Question 771 debt terminology, interest expense, interest tax shield, credit risk, no explanation

You deposit money into a bank account. Which of the following statements about this deposit is NOT correct?

A firm wishes to raise $30 million now. The firm's current market value of equity is $60m and the market price per share is $20. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $15. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.

Question 989 PE ratio, Multiples valuation, leverage, accounting ratio

A firm has 20 million stocks, earnings (or net income) of $100 million per annum and a 60% debt-to-equity ratio where both the debt and asset values are market values rather than book values. Similar firms have a PE ratio of 12.

Which of the below statements is NOT correct based on a PE multiples valuation?