When using the dividend discount model to price a stock:

### p_{0} = \frac{d_1}{r - g} ###

The growth rate of dividends (g):

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

Question 446 working capital decision, corporate financial decision theory

The working capital decision primarily affects which part of a business?

The expression 'you have to spend money to make money' relates to which business decision?

The price of gold is currently $700 per ounce. The forward price for delivery in 1 year is $800. An arbitrageur can borrow money at 10% per annum given as an effective discrete annual rate. Assume that gold is fairly priced and the cost of storing gold is zero.

What is the best way to conduct an arbitrage in this situation? The best arbitrage strategy requires zero capital, has zero risk and makes money straight away. An arbitrageur should sell 1 forward on gold and:

An equity index is currently at 4,800 points. The 1.5 year futures price is 5,100 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

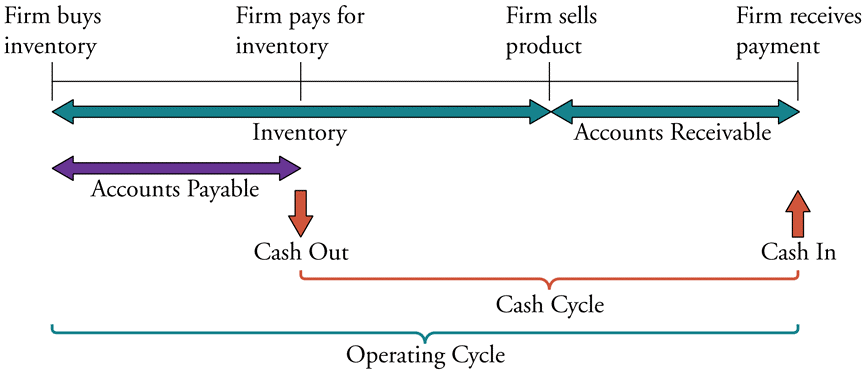

The below diagram shows a firm’s cash cycle.

Which of the following statements about companies’ cash cycle is NOT correct?

RBA analyst Adam Hamilton wrote in the December 2018 Bulletin article ‘Understanding Exchange Rates and Why They Are Important’ the following passage about bilateral exchange rates:

A bilateral exchange rate refers to the value of one currency relative to another. It is the most commonly referenced type of exchange rate. Most bilateral exchange rates are quoted against the US dollar (USD), as it is the most traded currency globally. Looking at the Australian dollar (AUD), the AUD/USD exchange rate gives you the amount of US dollars that you will receive for each Australian dollar that you convert (or sell). For example, an AUD/USD exchange rate of 0.75 means that you will get US75 cents for every 1 AUD.

An appreciation of the Australian dollar is an increase in its value compared with a foreign currency. This means that each Australian dollar buys you more foreign currency than before. Equivalently, if you are buying an item that is priced in foreign currency it will now cost you less in Australian dollars than before. If there is a depreciation of the Australian dollar, the opposite is true.

Based on this information, which of the following statements is NOT correct?