For a price of $95, Nicole will sell you a 10 year bond paying semi-annual coupons of 8% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 8% pa.

You just started work at your new job which pays $48,000 per year.

The human resources department have given you the option of being paid at the end of every week or every month.

Assume that there are 4 weeks per month, 12 months per year and 48 weeks per year.

Bank interest rates are 12% pa given as an APR compounding per month.

What is the dollar gain over one year, as a net present value, of being paid every week rather than every month?

Suppose you had $100 in a savings account and the interest rate was 2% per year.

After 5 years, how much do you think you would have in the account if you left the money to grow?

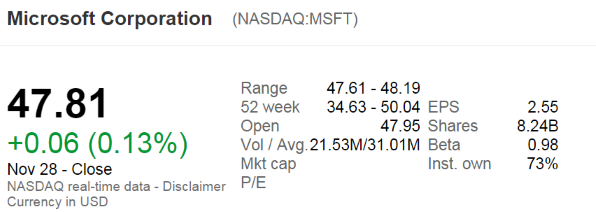

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's backwards-looking price-earnings ratio?

An investor bought a 10 year 2.5% pa fixed coupon government bond priced at par. The face value is $100. Coupons are paid semi-annually and the next one is in 6 months.

Six months later, just after the coupon at that time was paid, yields suddenly and unexpectedly fell to 2% pa. Note that all yields above are given as APR's compounding semi-annually.

What was the bond investors' historical total return over that first 6 month period, given as an effective semi-annual rate?

Question 578 inflation, real and nominal returns and cash flows

Which of the following statements about inflation is NOT correct?

Question 691 continuously compounding rate, effective rate, continuously compounding rate conversion, no explanation

A bank quotes an interest rate of 6% pa with quarterly compounding. Note that another way of stating this rate is that it is an annual percentage rate (APR) compounding discretely every 3 months.

Which of the following statements about this rate is NOT correct? All percentages are given to 6 decimal places. The equivalent:

An effective monthly return of 1% ##(r_\text{eff monthly})## is equivalent to an effective annual return ##(r_\text{eff annual})## of:

Question 730 DDM, income and capital returns, no explanation

A stock’s current price is $1. Its expected total return is 10% pa and its long term expected capital return is 4% pa. It pays an annual dividend and the next one will be paid in one year. All rates are given as effective annual rates. The dividend discount model is thought to be a suitable model for the stock. Ignore taxes. Which of the following statements about the stock is NOT correct?

A Malaysian man wishes to convert 1 million Malaysian Ringgit (MYR) into Indian Rupees (IND). The exchange rate is 4.2 MYR per USD and 71 IND per USD. How much is the MYR 1 million worth in IND?