For a price of $95, Nicole will sell you a 10 year bond paying semi-annual coupons of 8% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 8% pa.

You really want to go on a back packing trip to Europe when you finish university. Currently you have $1,500 in the bank. Bank interest rates are 8% pa, given as an APR compounding per month. If the holiday will cost $2,000, how long will it take for your bank account to reach that amount?

Question 241 Miller and Modigliani, leverage, payout policy, diversification, NPV

One of Miller and Modigliani's (M&M's) important insights is that a firm's managers should not try to achieve a particular level of leverage in a world with zero taxes and perfect information since investors can make their own leverage. Therefore corporate capital structure policy is irrelevant since investors can achieve their own desired leverage at the personal level by borrowing or lending on their own.

This principal of 'home-made' or 'do-it-yourself' leverage can also be applied to other topics. Read the following statements to decide which are true:

(I) Payout policy: a firm's managers should not try to achieve a particular pattern of equity payout.

(II) Agency costs: a firm's managers should not try to minimise agency costs.

(III) Diversification: a firm's managers should not try to diversify across industries.

(IV) Shareholder wealth: a firm's managers should not try to maximise shareholders' wealth.

Which of the above statement(s) are true?

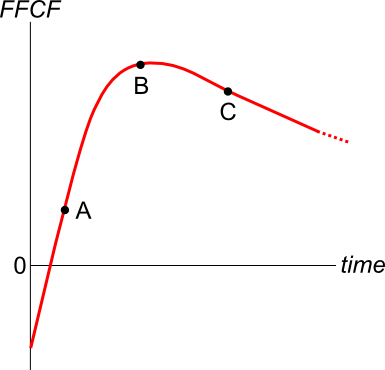

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

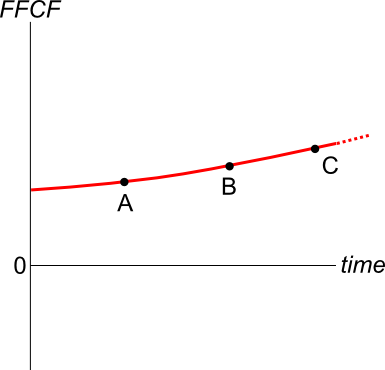

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

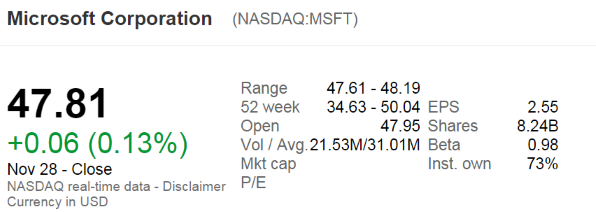

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

An effective monthly return of 1% ##(r_\text{eff monthly})## is equivalent to an effective annual return ##(r_\text{eff annual})## of:

The risk-weight on "Margin lending against listed instruments on recognised exchanges" is 20% according to APRA's interpretation of the Basel 3 Accord in 'Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk, Attachment A: Risk-weights for on-balance sheet assets'.

A bank is considering lending a $100,000 margin loan secured by an ASX-listed stock. How much regulatory capital will the bank require to grant this loan under the Basel 3 Accord? Ignore the capital conservation buffer and the off-balance sheet exposure.