Question 154 implicit interest rate in wholesale credit, no explanation

A wholesale vitamin supplements store offers credit to its customers. Customers are given 30 days to pay for their goods, but if they pay within 5 days they will get a 1% discount.

What is the effective interest rate implicit in the discount being offered? Assume 365 days in a year and that all customers pay on either the 5th day or the 30th day. All of the below answer choices are given as effective annual interest rates.

Here's the Dividend Discount Model, used to price stocks:

### p_0=\frac{d_1}{r-g} ###

All rates are effective annual rates and the cash flows (##d_1##) are received every year. Note that the r and g terms in the above DDM could also be labelled: ###r = r_{\text{total, 0}\rightarrow\text{1yr, eff 1yr}}### ###g = r_{\text{capital, 0}\rightarrow\text{1yr, eff 1yr}}### Which of the following statements is NOT correct?

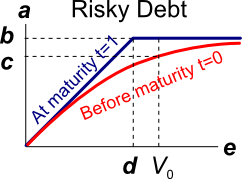

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Which of the following investable assets is the LEAST suitable for valuation using PE multiples techniques?

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

An equity index is currently at 5,000 points. The 2 year futures price is 5,400 points and the total required return is 8% pa with continuous compounding. Each index point is worth $25.

What is the implied continuous dividend yield as a continuously compounded rate per annum?

How much more can you borrow using an interest-only loan compared to a 25-year fully amortising loan if interest rates are 6% pa compounding per month and are not expected to change? If it makes it easier, assume that you can afford to pay $2,000 per month on either loan. Express your answer as a proportional increase using the following formula:

###\text{Proportional Increase} = \dfrac{V_\text{0,interest only}}{V_\text{0,fully amortising}} - 1###Question 664 real and nominal returns and cash flows, inflation, no explanation

What is the present value of real payments of $100 every year forever, with the first payment in one year? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

You deposit money into a bank. Which of the following statements is NOT correct? You:

Question 890 foreign exchange rate, monetary policy, no explanation

The market expects the Reserve Bank of Australia (RBA) to increase the policy rate by 25 basis points at their next meeting. The current exchange rate is 0.8 USD per AUD.

Then unexpectedly, the RBA announce that they will increase the policy rate by 50 basis points due to increased fears of inflation.

What do you expect to happen to Australia's exchange rate on the day when the surprise announcement is made? The Australian dollar is likely to suddenly: