A credit card offers an interest rate of 18% pa, compounding monthly.

Find the effective monthly rate, effective annual rate and the effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff monthly} , r_\text{eff yearly} , r_\text{eff daily} ###

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

When using the dividend discount model, care must be taken to avoid using a nominal dividend growth rate that exceeds the country's nominal GDP growth rate. Otherwise the firm is forecast to take over the country since it grows faster than the average business forever.

Suppose a firm's nominal dividend grows at 10% pa forever, and nominal GDP growth is 5% pa forever. The firm's total dividends are currently $1 billion (t=0). The country's GDP is currently $1,000 billion (t=0).

In approximately how many years will the company's total dividends be as large as the country's GDP?

Question 397 financial distress, leverage, capital structure, NPV

A levered firm has a market value of assets of $10m. Its debt is all comprised of zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

Therefore the current market capitalisation of debt ##(D_0)## is $9m and equity ##(E_0)## is $1m.

A new project presents itself which requires an investment of $2m and will provide a:

- $6.6m cash flow with probability 0.5 in the good state of the world, and a

- -$4.4m (notice the negative sign) cash flow with probability 0.5 in the bad state of the world.

The project can be funded using the company's excess cash, no debt or equity raisings are required.

What would be the new market capitalisation of equity ##(E_\text{0, with project})## if shareholders vote to proceed with the project, and therefore should shareholders proceed with the project?

You bought a house, primarily funded using a home loan from a bank. Which of the following statements is NOT correct?

You bought a 1.5 year (18 month) futures contract on oil. Oil storage costs are 4% pa continuously compounded and oil pays no dividends. The futures contract is entered into when the oil price is $40 per barrel and the risk-free rate of interest is 10% per annum with continuous compounding.

Which of the following statements is NOT correct?

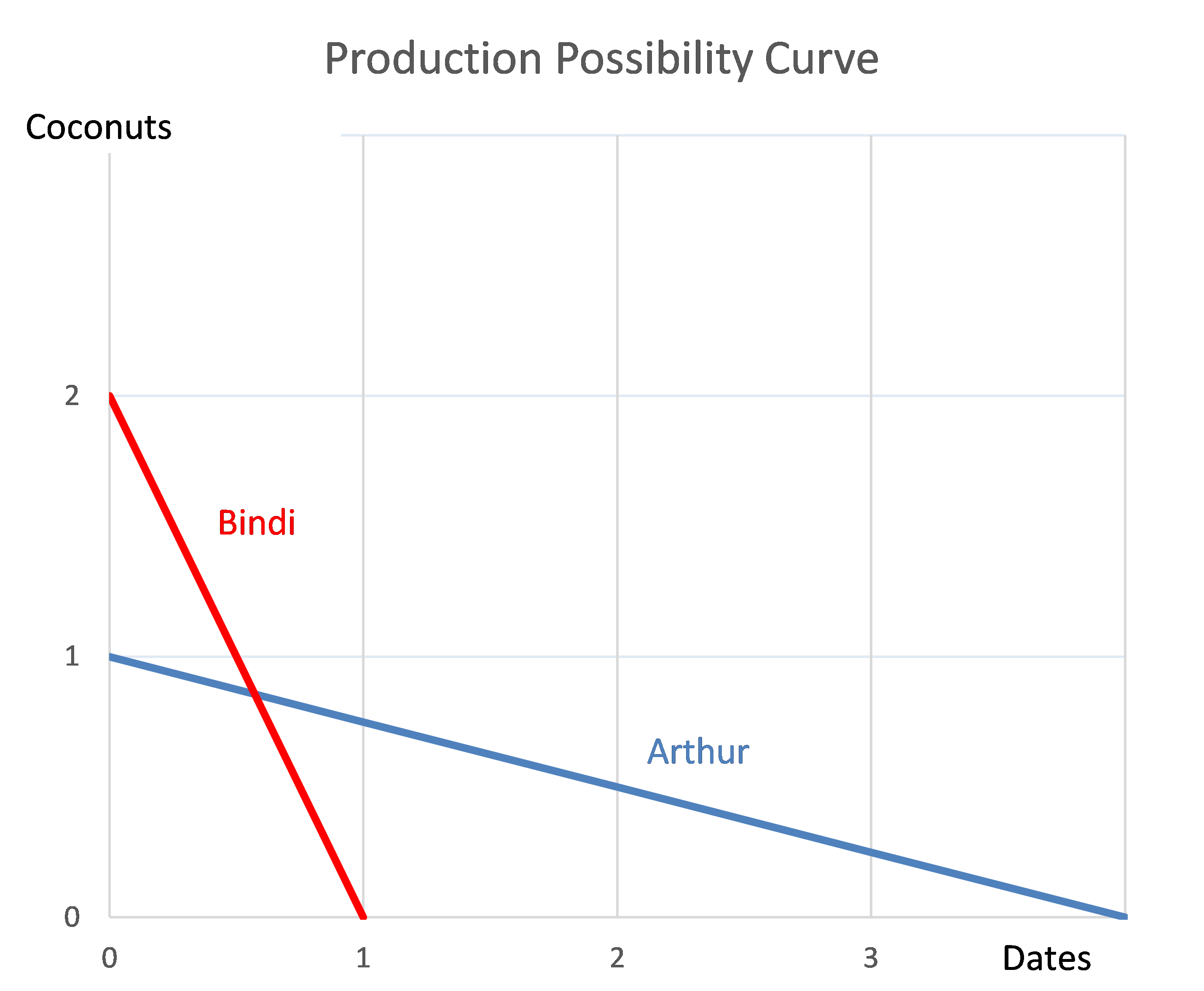

Question 975 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Arthur can pick 1 coconut per hour, 4 dates per hour or any linear combination of coconuts and dates. For example, he could pick 0.5 coconuts and 2 dates per hour.

Bindi can pick 2 coconuts per hour, 1 date per hour or any linear combination. For example, she could pick 0.5 coconuts and 0.75 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Arthur | 1 | 4 |

| Bindi | 2 | 1 |

Which of the following statements is NOT correct?

Find the Macaulay duration of a 2 year 5% pa annual fixed coupon bond which has a $100 face value and currently has a yield to maturity of 8% pa. The Macaulay duration is: