A wholesale store offers credit to its customers. Customers are given 60 days to pay for their goods, but if they pay immediately they will get a 1.5% discount.

What is the effective interest rate implicit in the discount being offered? Assume 365 days in a year and that all customers pay either immediately or the 60th day. All of the below answer choices are given as effective annual interest rates.

A stock pays annual dividends. It just paid a dividend of $5. The growth rate in the dividend is 1% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 2 | 2 | 2 | 10 | 3 | ... |

After year 4, the dividend will grow in perpetuity at 4% pa. The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

The required return on the project is 10%, given as an effective annual rate.

What is the Internal Rate of Return (IRR) of this project? The following choices are effective annual rates. Assume that the cash flows shown in the table are paid all at once at the given point in time.

Question 249 equivalent annual cash flow, effective rate conversion

Details of two different types of desserts or edible treats are given below:

- High-sugar treats like candy, chocolate and ice cream make a person very happy. High sugar treats are cheap at only $2 per day.

- Low-sugar treats like nuts, cheese and fruit make a person equally happy if these foods are of high quality. Low sugar treats are more expensive at $4 per day.

The advantage of low-sugar treats is that a person only needs to pay the dentist $2,000 for fillings and root canal therapy once every 15 years. Whereas with high-sugar treats, that treatment needs to be done every 5 years.

The real discount rate is 10%, given as an effective annual rate. Assume that there are 365 days in every year and that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the equivalent annual cash flow (EAC) of the high-sugar treats and low-sugar treats, including dental costs. The below choices are listed in that order.

Ignore the pain of dental therapy, personal preferences and other factors.

Question 455 income and capital returns, payout policy, DDM, market efficiency

A fairly priced unlevered firm plans to pay a dividend of $1 next year (t=1) which is expected to grow by 3% pa every year after that. The firm's required return on equity is 8% pa.

The firm is thinking about reducing its future dividend payments by 10% so that it can use the extra cash to invest in more projects which are expected to return 8% pa, and have the same risk as the existing projects. Therefore, next year's dividend will be $0.90. No new equity or debt will be issued to fund the new projects, they'll all be funded by the cut in dividends.

What will be the stock's new annual capital return (proportional increase in price per year) if the change in payout policy goes ahead?

Assume that payout policy is irrelevant to firm value (so there's no signalling effects) and that all rates are effective annual rates.

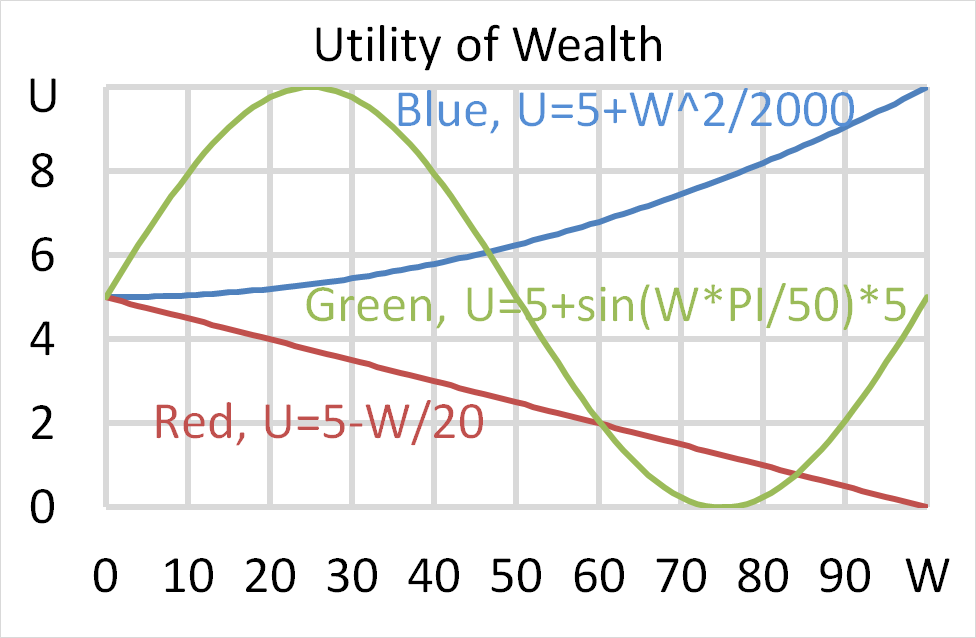

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Which of the below statements is NOT correct?

Question 768 accounting terminology, book and market values, no explanation

Accountants and finance professionals have lots of names for the same things which can be quite confusing.

Which of the following groups of items are NOT synonyms?