For certain shares, the forward-looking Price-Earnings Ratio (##P_0/EPS_1##) is equal to the inverse of the share's total expected return (##1/r_\text{total}##). For what shares is this true?

Use the general accounting definition of 'payout ratio' which is dividends per share (DPS) divided by earnings per share (EPS) and assume that all cash flows, earnings and rates are real rather than nominal.

A company's forward-looking PE ratio will be the inverse of its total expected return on equity when it has a:

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

Question 536 idiom, bond pricing, capital structure, leverage

The expression 'my word is my bond' is often used in everyday language to make a serious promise.

Why do you think this expression uses the metaphor of a bond rather than a share?

Estimate the French bank Societe Generale's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that EUR is the euro, the European monetary union's currency.

- The 4 major European banks Credit Agricole (ACA), Deutsche Bank AG (DBK), UniCredit (UCG) and Banco Santander (SAN) are comparable companies to Societe Generale (GLE);

- Societe Generale's (GLE's) historical earnings per share (EPS) is EUR 2.92;

- ACA's backward-looking PE ratio is 16.29 and historical EPS is EUR 0.84;

- DBK's backward-looking PE ratio is 25.01 and historical EPS is EUR 1.26;

- SAN's backward-looking PE ratio is 14.71 and historical EPS is EUR 0.47;

- UCG's backward-looking PE ratio is 15.78 and historical EPS is EUR 0.40;

Note: Figures sourced from Google Finance on 27 March 2015.

Many Australian home loans that are interest-only actually require payments to be made on a fully amortising basis after a number of years.

You decide to borrow $600,000 from the bank at an interest rate of 4.25% pa for 25 years. The payments will be interest-only for the first 10 years (t=0 to 10 years), then they will have to be paid on a fully amortising basis for the last 15 years (t=10 to 25 years).

Assuming that interest rates will remain constant, what will be your monthly payments over the first 10 years from now, and then the next 15 years after that? The answer options are given in the same order.

An equity index is currently at 5,000 points. The 2 year futures price is 5,400 points and the total required return is 8% pa with continuous compounding. Each index point is worth $25.

What is the implied continuous dividend yield as a continuously compounded rate per annum?

An equity index stands at 100 points and the one year equity futures price is 107.

The equity index is expected to have a dividend yield of 3% pa. Assume that investors are risk-neutral so their total required return on the shares is the same as the risk free Treasury bond yield which is 10% pa. Both are given as discrete effective annual rates.

Assuming that the equity index is fairly priced, an arbitrageur would recognise that the equity futures are:

Question 710 continuously compounding rate, continuously compounding rate conversion

A continuously compounded monthly return of 1% ##(r_\text{cc monthly})## is equivalent to a continuously compounded annual return ##(r_\text{cc annual})## of:

Question 767 idiom, corporate financial decision theory, no explanation

The sayings "Don't cry over spilt milk", "Don't regret the things that you can't change" and "What's done is done" are most closely related to which financial concept?

Question 980 balance of payments, current account, no explanation

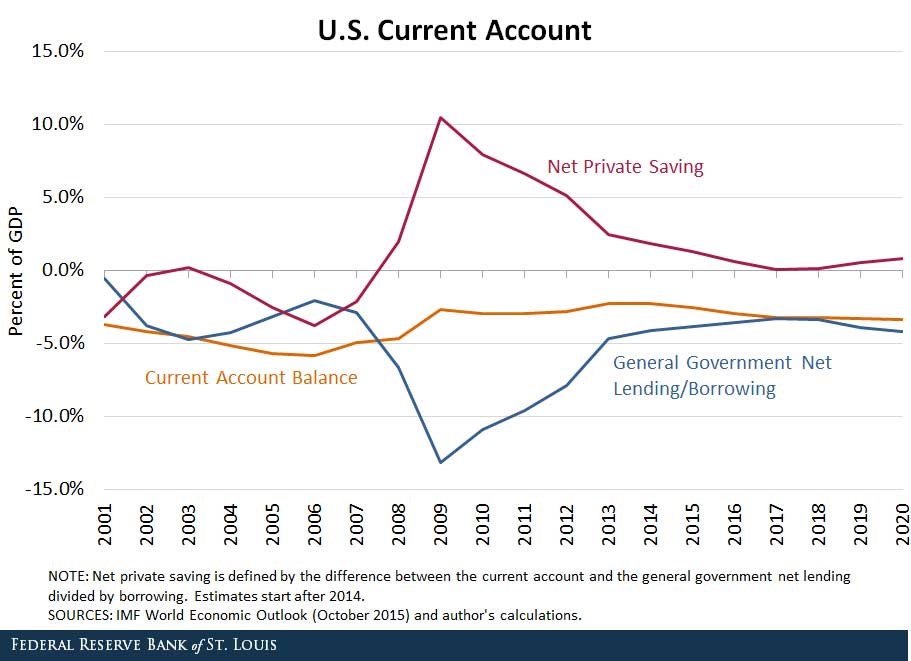

Observe the below graph of the US current account surplus as a proportion of GDP.

Define lending as buying (or saving or investing in) debt and equity assets.

The sum of US ‘net private saving’ plus ‘net general government lending’ equals the US: