A four year bond has a face value of $100, a yield of 6% and a fixed coupon rate of 12%, paid semi-annually. What is its price?

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

A young lady is trying to decide if she should attend university or begin working straight away in her home town.

The young lady's grandma says that she should not go to university because she is less likely to marry the local village boy whom she likes because she will spend less time with him if she attends university.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The cost of not marrying the local village boy should be classified as:

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

A put option written on a risky non-dividend paying stock will mature in one month. As is normal, assume that the option's exercise price is non-zero and positive ##(K>0)## and the stock has limited liability ##(S>0)##.

Which of the following statements is NOT correct? The put option's:

Below is a table of the 'Risk-weights for residential mortgages' as shown in APRA Basel 3 Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk January 2013.

| LVR (%) |

Standard eligible mortgages |

Non-standard eligible mortgages |

||

|

|

Risk-weight (no mortgage insurance) % |

Risk-weight (with at least 40% of the mortgage insured by an acceptable LMI) % |

Risk-weight (no mortgage insurance) % |

Risk-weight (with at least 40% of the mortgage insured by an acceptable LMI) % |

| 0 – 60 |

35 |

35 |

50 |

35 |

| 60.01 – 80 |

35 |

35 |

75 |

50 |

| 80.01 – 90 |

50 |

35 |

100 |

75 |

| 90.01 – 100 |

75 |

50 |

100 |

75 |

| > 100.01 |

100 |

75 |

100 |

100 |

A bank is considering granting a home loan to a man to buy a house worth $1.25 million using his own funds and the loan. The loan would be standard with no lenders mortgage insurance (LMI) and an LVR of 80%.

What is the minimum regulatory capital that the bank requires to grant the home loan under the Basel 3 Accord? Ignore the capital conservation buffer.

Question 959 negative gearing, leverage, capital structure, interest tax shield, real estate

Last year, two friends Gear and Nogear invested in residential apartments. Each invested $1 million of their own money (their net wealth).

Apartments cost $1,000,000 last year and they earned net rents of $30,000 pa over the last year. Net rents are calculated as rent revenues less the costs of renting such as property maintenance, land tax and council rates. However, interest expense and personal income taxes are not deducted from net rents.

Gear and Nogear funded their purchases in different ways:

- Gear used $1,000,000 of her own money and borrowed $4,000,000 from the bank in the form of an interest-only loan with an interest rate of 5% pa to buy 5 apartments.

- Nogear used $1,000,000 of his own money to buy one apartment. He has no mortgage loan on his property.

Both Gear and Nogear also work in high-paying jobs and are subject personal marginal tax rates of 45%.

Which of the below statements about the past year is NOT correct?

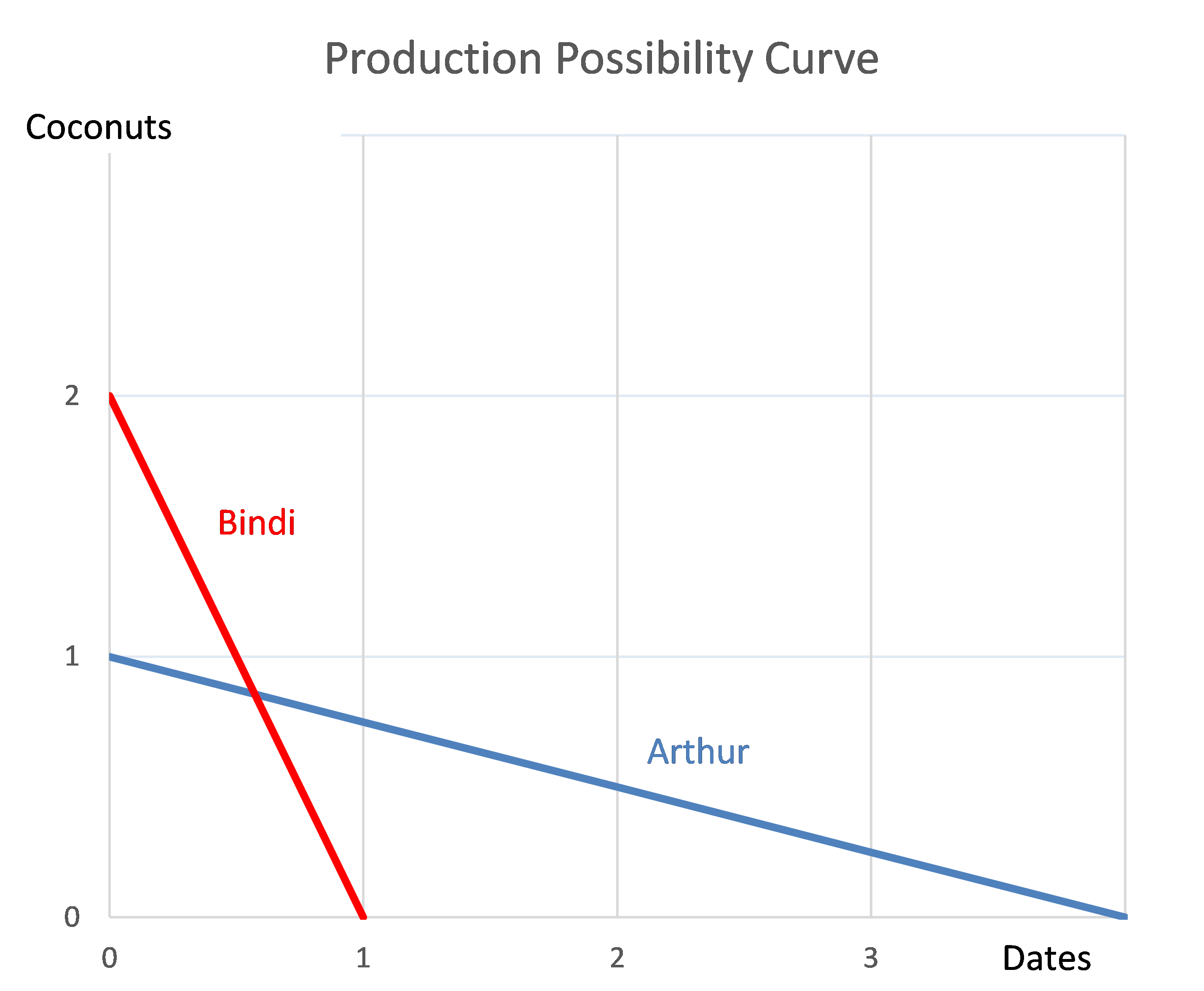

Question 976 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?