A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Diversification in a portfolio of two assets works best when the correlation between their returns is:

Bonds X and Y are issued by the same company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 6% pa and bond Y pays coupons of 8% pa. Which of the following statements is true?

A student won $1m in a lottery. Currently the money is in a bank account which pays interest at 6% pa, given as an APR compounding per month.

She plans to spend $20,000 at the beginning of every month from now on (so the first withdrawal will be at t=0). After each withdrawal, she will check how much money is left in the account. When there is less than $500,000 left, she will donate that remaining amount to charity.

In how many months will she make her last withdrawal and donate the remainder to charity?

A stock is just about to pay a dividend of $1 tonight. Future annual dividends are expected to grow by 2% pa. The next dividend of $1 will be paid tonight, and the year after that the dividend will be $1.02 (=1*(1+0.02)^1), and a year later 1.0404 (=1*(1+0.04)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Delta buys a future from Alice.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

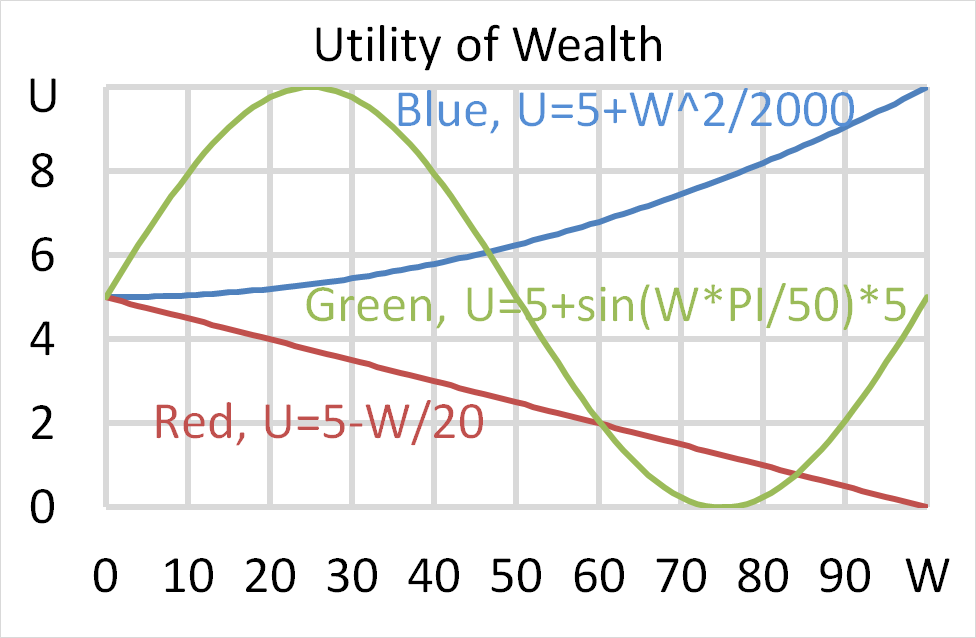

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 881 Nixon Shock, Bretton Woods, foreign exchange rate, foreign exchange system history, no explanation

In the ‘Nixon Shock’ on August 15, 1971, the United States government:

Question 1000 duration, duration of a perpetuity with growth, needs refinement

An unlevered firm cuts its dividends and re-invests in zero-NPV projects with the same risk as its existing projects. This decreases the dividend yield, but increases the firm's equity's dividend growth rate and duration, while its total required return on equity remains unchanged. The equity can be valued as a perpetuity and the duration of a perpetuity is given below:

###D_\text{Macaulay} = \dfrac{1+r}{r-g}###What will be the effect on the stock's CAPM beta? Assume that there's no change in the risk free rate or market risk premium. The company's equity beta will: