A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 247 cross currency interest rate parity, no explanation

In the so called 'Swiss Loans Affair' of the 1980's, Australian banks offered loans denominated in Swiss Francs to Australian farmers at interest rates as low as 4% pa. This was far lower than interest rates on Australian Dollar loans which were above 10% due to very high inflation in Australia at the time.

In the late-1980's there was a large depreciation in the Australian Dollar. The Australian Dollar nearly halved in value against the Swiss Franc. Many Australian farmers went bankrupt since they couldn't afford the interest payments on the Swiss Franc loans because the Australian Dollar value of those payments nearly doubled. The farmers accused the banks of promoting Swiss Franc loans without making them aware of the risks.

What fundamental principal of finance did the Australian farmers (and the bankers) fail to understand?

Question 405 DDM, income and capital returns, no explanation

The perpetuity with growth formula is:

###P_0= \dfrac{C_1}{r-g}###

Which of the following is NOT equal to the total required return (r)?

A mature firm has constant expected future earnings and dividends. Both amounts are equal. So earnings and dividends are expected to be equal and unchanging.

Which of the following statements is NOT correct?

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

Which of the following statements about book and market equity is NOT correct?

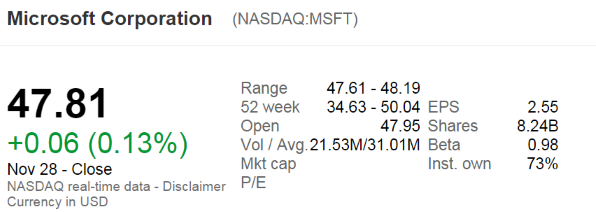

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

In February a company sold one December 40,000 pound (about 18 metric tons) lean hog futures contract. It closed out its position in May.

The spot price was $0.68 per pound in February. The December futures price was $0.70 per pound when the trader entered into the contract in February, $0.60 when he closed out his position in May, and $0.55 when the contract matured in December.

What was the total profit?

Question 693 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding semi-annually) | (pa, paid semi-annually) | ($) | ($) |

| 0.5 | 3% | 4% | 100 | 100.4926 |

| 1 | 4% | 4% | 100 | 100.0000 |

| 1.5 | 5% | 4% | 100 | 98.5720 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

Which derivatives position has the possibility of unlimited potential gains?