Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

Find UniBar Corp's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| UniBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 80 | |

| COGS | 40 | |

| Operating expense | 15 | |

| Depreciation | 10 | |

| Interest expense | 5 | |

| Income before tax | 10 | |

| Tax at 30% | 3 | |

| Net income | 7 | |

| UniBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 90 |

| PPE | ||

| Cost | 360 | 320 |

| Accumul. depr. | 40 | 30 |

| Carrying amount | 320 | 290 |

| Total assets | 440 | 380 |

| Liabilities | ||

| Current liabilities | 110 | 60 |

| Non-current liabilities | 190 | 180 |

| Owners' equity | ||

| Retained earnings | 95 | 95 |

| Contributed equity | 45 | 45 |

| Total L and OE | 440 | 380 |

Note: all figures are given in millions of dollars ($m).

Find Piano Bar's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Piano Bar | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 310 | |

| COGS | 185 | |

| Operating expense | 20 | |

| Depreciation | 15 | |

| Interest expense | 10 | |

| Income before tax | 80 | |

| Tax at 30% | 24 | |

| Net income | 56 | |

| Piano Bar | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 240 | 230 |

| PPE | ||

| Cost | 420 | 400 |

| Accumul. depr. | 50 | 35 |

| Carrying amount | 370 | 365 |

| Total assets | 610 | 595 |

| Liabilities | ||

| Current liabilities | 180 | 190 |

| Non-current liabilities | 290 | 265 |

| Owners' equity | ||

| Retained earnings | 90 | 90 |

| Contributed equity | 50 | 50 |

| Total L and OE | 610 | 595 |

Note: all figures are given in millions of dollars ($m).

One of the reasons why firms may not begin projects with relatively small positive net present values (NPV's) is because they wish to maximise the value of their:

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

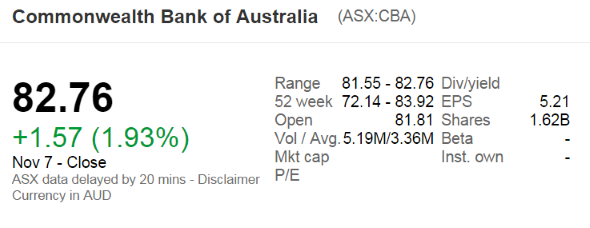

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's approximate payout ratio over the 2014 financial year?

Note that the firm's interim and final dividends were $1.83 and $2.18 respectively over the 2014 financial year.

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

Question 876 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity

Suppose the yield curve in the USA and Germany is flat and the:

- USD federal funds rate at the Federal Reserve is 1% pa;

- EUR deposit facility at the European Central Bank is -0.4% pa (note the negative sign);

- Spot EUR exchange rate is 1 USD per EUR;

- One year forward EUR exchange rate is 1.011 USD per EUR.

You suspect that there’s an arbitrage opportunity. Which one of the following statements about the potential arbitrage opportunity is NOT correct?

You work for XYZ company and you’ve been asked to evaluate a new project which has double the systematic risk of the company’s other projects.

You use the Capital Asset Pricing Model (CAPM) formula and input the treasury yield ##(r_f )##, market risk premium ##(r_m-r_f )## and the company’s asset beta risk factor ##(\beta_{XYZ} )## into the CAPM formula which outputs a return.

This return that you’ve just found is: