Harvey Norman the large retailer often runs sales advertising 2 years interest free when you purchase its products. This offer can be seen as a free personal loan from Harvey Norman to its customers.

Assume that banks charge an interest rate on personal loans of 12% pa given as an APR compounding per month. This is the interest rate that Harvey Norman deserves on the 2 year loan it extends to its customers. Therefore Harvey Norman must implicitly include the cost of this loan in the advertised sale price of its goods.

If you were a customer buying from Harvey Norman, and you were paying immediately, not in 2 years, what is the minimum percentage discount to the advertised sale price that you would insist on? (Hint: if it makes it easier, assume that you’re buying a product with an advertised price of $100).

A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

Estimate the Chinese bank ICBC's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that the renminbi (RMB) is the Chinese currency, also known as the yuan (CNY).

- The 4 major Chinese banks ICBC, China Construction Bank (CCB), Bank of China (BOC) and Agricultural Bank of China (ABC) are comparable companies;

- ICBC 's historical earnings per share (EPS) is RMB 0.74;

- CCB's backward-looking PE ratio is 4.59;

- BOC 's backward-looking PE ratio is 4.78;

- ABC's backward-looking PE ratio is also 4.78;

Note: Figures sourced from Google Finance on 25 March 2014. Share prices are from the Shanghai stock exchange.

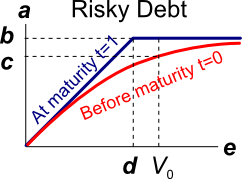

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

Question 823 option, option payoff at maturity, option profit, no explanation

A European call option should only be exercised if:

Question 834 option, delta, theta, gamma, standard deviation, Black-Scholes-Merton option pricing

Which of the following statements about an option (either a call or put) and its underlying stock is NOT correct?

| European Call Option | ||

| on a non-dividend paying stock | ||

| Description | Symbol | Quantity |

| Spot price ($) | ##S_0## | 20 |

| Strike price ($) | ##K_T## | 18 |

| Risk free cont. comp. rate (pa) | ##r## | 0.05 |

| Standard deviation of the stock's cont. comp. returns (pa) | ##\sigma## | 0.3 |

| Option maturity (years) | ##T## | 1 |

| Call option price ($) | ##c_0## | 3.939488 |

| Delta | ##\Delta = N[d_1]## | 0.747891 |

| ##N[d_2]## | ##N[d_2]## | 0.643514 |

| Gamma | ##\Gamma## | 0.053199 |

| Theta ($/year) | ##\Theta = \partial c / \partial T## | 1.566433 |

Question 854 speculation motive for keeping money, no explanation

What is the speculation motive for keeping money? The speculation motive encourages people to keep money available: