A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Find the sample standard deviation of returns using the data in the table:

| Stock Returns | |

| Year | Return pa |

| 2008 | 0.3 |

| 2009 | 0.02 |

| 2010 | -0.2 |

| 2011 | 0.4 |

The returns above and standard deviations below are given in decimal form.

Question 415 income and capital returns, real estate, no explanation

You just bought a residential apartment as an investment property for $500,000.

You intend to rent it out to tenants. They are ready to move in, they would just like to know how much the monthly rental payments will be, then they will sign a twelve-month lease.

You require a total return of 8% pa and a rental yield of 5% pa.

What would the monthly paid-in-advance rental payments have to be this year to receive that 5% annual rental yield?

Also, if monthly rental payments can be increased each year when a new lease agreement is signed, by how much must you increase rents per year to realise the 8% pa total return on the property?

Ignore all taxes and the costs of renting such as maintenance costs, real estate agent fees, utilities and so on. Assume that there will be no periods of vacancy and that tenants will promptly pay the rental prices you charge.

Note that the first rental payment will be received at t=0. The first lease agreement specifies the first 12 equal payments from t=0 to 11. The next lease agreement can have a rental increase, so the next twelve equal payments from t=12 to 23 can be higher than previously, and so on forever.

An effective semi-annual return of 5% ##(r_\text{eff 6mth})## is equivalent to an effective annual return ##(r_\text{eff annual})## of:

You bought a house, primarily funded using a home loan from a bank. Which of the following statements is NOT correct?

A share will pay its next dividend of ##C_1## in one year, and will continue to pay a dividend every year after that forever, growing at a rate of ##g##. So the next dividend will be ##C_2=C_1 (1+g)^1##, then ##C_3=C_2 (1+g)^1##, and so on forever.

The current price of the share is ##P_0## and its required return is ##r##

Which of the following is NOT equal to the expected share price in 2 years ##(P_2)## just after the dividend at that time ##(C_2)## has been paid?

Question 834 option, delta, theta, gamma, standard deviation, Black-Scholes-Merton option pricing

Which of the following statements about an option (either a call or put) and its underlying stock is NOT correct?

| European Call Option | ||

| on a non-dividend paying stock | ||

| Description | Symbol | Quantity |

| Spot price ($) | ##S_0## | 20 |

| Strike price ($) | ##K_T## | 18 |

| Risk free cont. comp. rate (pa) | ##r## | 0.05 |

| Standard deviation of the stock's cont. comp. returns (pa) | ##\sigma## | 0.3 |

| Option maturity (years) | ##T## | 1 |

| Call option price ($) | ##c_0## | 3.939488 |

| Delta | ##\Delta = N[d_1]## | 0.747891 |

| ##N[d_2]## | ##N[d_2]## | 0.643514 |

| Gamma | ##\Gamma## | 0.053199 |

| Theta ($/year) | ##\Theta = \partial c / \partial T## | 1.566433 |

Question 954 option, at the money option

Question 976 comparative advantage in trade, production possibilities curve, no explanation

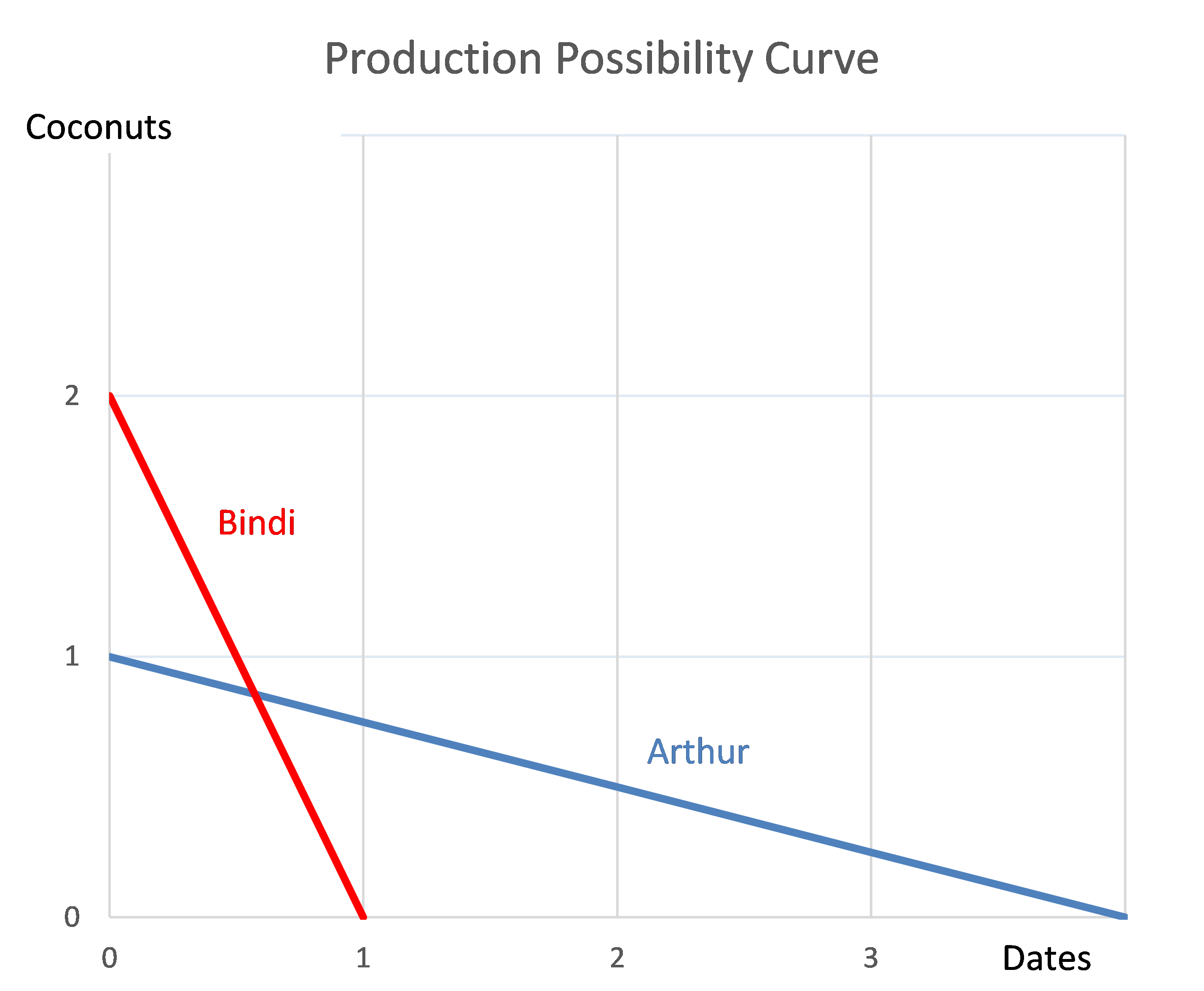

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?