Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.15 | 1.10 | 1.05 | 1.00 | ... |

After year 4, the annual dividend will grow in perpetuity at -5% pa. Note that this is a negative growth rate, so the dividend will actually shrink. So,

- the dividend at t=5 will be ##$1(1-0.05) = $0.95##,

- the dividend at t=6 will be ##$1(1-0.05)^2 = $0.9025##, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

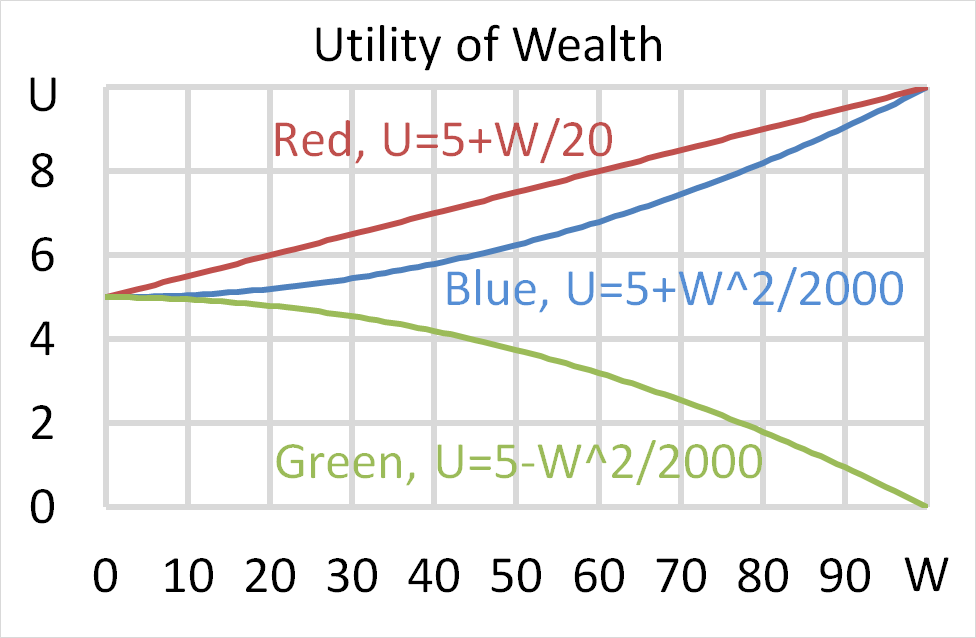

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

A 4.5% fixed coupon Australian Government bond was issued at par in mid-April 2009. Coupons are paid semi-annually in arrears in mid-April and mid-October each year. The face value is $1,000. The bond will mature in mid-April 2020, so the bond had an original tenor of 11 years.

Today is mid-September 2015 and similar bonds now yield 1.9% pa.

What is the bond's new price? Note: there are 10 semi-annual coupon payments remaining from now (mid-September 2015) until maturity (mid-April 2020); both yields are given as APR's compounding semi-annually; assume that the yield curve was flat before the change in yields, and remained flat afterwards as well.

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include:

Which form of production is included in the Gross Domestic Product (GDP) reported by the government statistics agency?

Question 981 margin loan, Basel accord, credit conversion factor

Margin loans secured by listed stock have a Basel III risk weight of 20%.

For margin loans that cannot be immediately cancelled by banks and asked to be repaid, the credit conversion factor (CCF) is 20%.

Suppose you have a stock portfolio worth $500,000, financed by:

- $300,000 of your own money; and

- $200,000 of the bank’s funds in the form of a margin loan which can only be cancelled by the bank after 5 days notice. The margin loan’s maximum LVR is 70%.

How much regulatory capital must the bank hold due to your margin loan? Assume that the bank wishes to pay dividends to its shareholders, so include the 2.5% capital conservation buffer in your calculations.

Which of the following statements about vanilla floating coupon bonds paying quarterly coupons is NOT correct? A vanilla floating coupon bond's: