Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

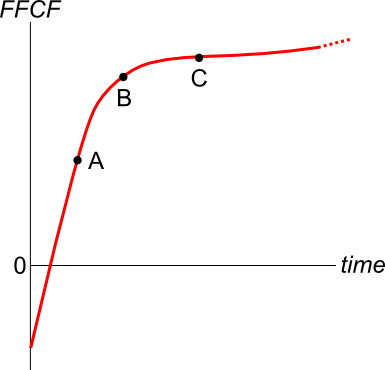

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

What type of present value equation is best suited to value a residential house investment property that is expected to pay constant rental payments forever? Note that 'constant' has the same meaning as 'level' in this context.

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

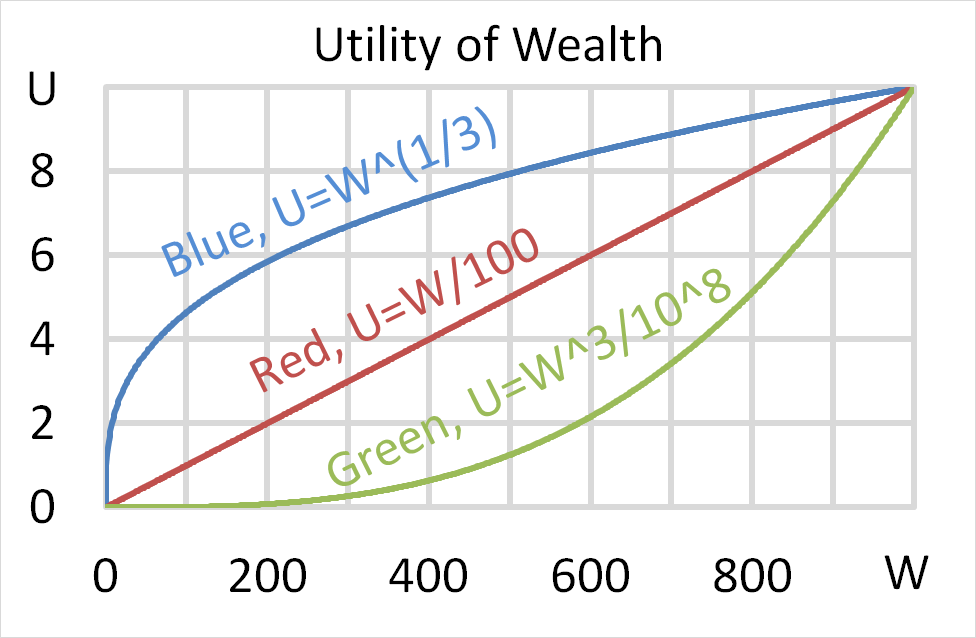

Question 703 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $500 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $500. Each player can flip a coin and if they flip heads, they receive $500. If they flip tails then they will lose $500. Which of the following statements is NOT correct?

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

Question 787 fixed for floating interest rate swap, intermediated swap

The below table summarises the borrowing costs confronting two companies A and B.

| Bond Market Yields | ||||

| Fixed Yield to Maturity (%pa) | Floating Yield (%pa) | |||

| Firm A | 2 | L - 0.1 | ||

| Firm B | 2.5 | L | ||

Firm A wishes to borrow at a floating rate and Firm B wishes to borrow at a fixed rate. Design an intermediated swap (which means there will actually be two swaps) that nets a bank 0.15% and grants the remaining swap benefits to Firm A only. Which of the following statements about the swap is NOT correct?

Question 869 economic order quantity

A Queensland farmer grows strawberries in greenhouses and supplies Australian supermarkets all year round. The farmer must decide how often he should contract the truck driver to deliver his strawberries and how many boxes to send on each delivery. The farmer:

- Sells 100,000 boxes of strawberries per year;

- Incurs holding costs (refrigeration and spoilage) of $16 per box per year; and

- Must pay the truck driver delivery fees at $0.20 per box plus a $500 fixed fee per delivery.

Which of the following statements about the Economic Order Quantity is NOT correct?

Question 981 margin loan, Basel accord, credit conversion factor

Margin loans secured by listed stock have a Basel III risk weight of 20%.

For margin loans that cannot be immediately cancelled by banks and asked to be repaid, the credit conversion factor (CCF) is 20%.

Suppose you have a stock portfolio worth $500,000, financed by:

- $300,000 of your own money; and

- $200,000 of the bank’s funds in the form of a margin loan which can only be cancelled by the bank after 5 days notice. The margin loan’s maximum LVR is 70%.

How much regulatory capital must the bank hold due to your margin loan? Assume that the bank wishes to pay dividends to its shareholders, so include the 2.5% capital conservation buffer in your calculations.