Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

A company has:

- 140 million shares outstanding.

- The market price of one share is currently $2.

- The company's debentures are publicly traded and their market price is equal to 93% of the face value.

- The debentures have a total face value of $50,000,000 and the current yield to maturity of corporate debentures is 12% per annum.

- The risk-free rate is 8.50% and the market return is 13.7%.

- Market analysts estimated that the company's stock has a beta of 0.90.

- The corporate tax rate is 30%.

What is the company's after-tax weighted average cost of capital (WACC) in a classical tax system?

A company runs a number of slaughterhouses which supply hamburger meat to McDonalds. The company is afraid that live cattle prices will increase over the next year, even though there is widespread belief in the market that they will be stable. What can the company do to hedge against the risk of increasing live cattle prices? Which statement(s) are correct?

(i) buy call options on live cattle.

(ii) buy put options on live cattle.

(iii) sell call options on live cattle.

Select the most correct response:

A stock pays annual dividends. It just paid a dividend of $5. The growth rate in the dividend is 1% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0 | 6 | 12 | 18 | 20 | ... |

After year 4, the dividend will grow in perpetuity at 5% pa. The required return of the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

If all of the dividends since time period zero were deposited into a bank account yielding 8% pa as an effective annual rate, how much money will be in the bank account in 2.5 years (in other words, at t=2.5)?

Question 793 option, hedging, delta hedging, gamma hedging, gamma, Black-Scholes-Merton option pricing

A bank buys 1000 European put options on a $10 non-dividend paying stock at a strike of $12. The bank wishes to hedge this exposure. The bank can trade the underlying stocks and European call options with a strike price of 7 on the same stock with the same maturity. Details of the call and put options are given in the table below. Each call and put option is on a single stock.

| European Options on a Non-dividend Paying Stock | |||

| Description | Symbol | Put Values | Call Values |

| Spot price ($) | ##S_0## | 10 | 10 |

| Strike price ($) | ##K_T## | 12 | 7 |

| Risk free cont. comp. rate (pa) | ##r## | 0.05 | 0.05 |

| Standard deviation of the stock's cont. comp. returns (pa) | ##\sigma## | 0.4 | 0.4 |

| Option maturity (years) | ##T## | 1 | 1 |

| Option price ($) | ##p_0## or ##c_0## | 2.495350486 | 3.601466138 |

| ##N[d_1]## | ##\partial c/\partial S## | 0.888138405 | |

| ##N[d_2]## | ##N[d_2]## | 0.792946442 | |

| ##-N[-d_1]## | ##\partial p/\partial S## | -0.552034778 | |

| ##N[-d_2]## | ##N[-d_2]## | 0.207053558 | |

| Gamma | ##\Gamma = \partial^2 c/\partial S^2## or ##\partial^2 p/\partial S^2## | 0.098885989 | 0.047577422 |

| Theta | ##\Theta = \partial c/\partial T## or ##\partial p/\partial T## | 0.348152078 | 0.672379961 |

Which of the following statements is NOT correct?

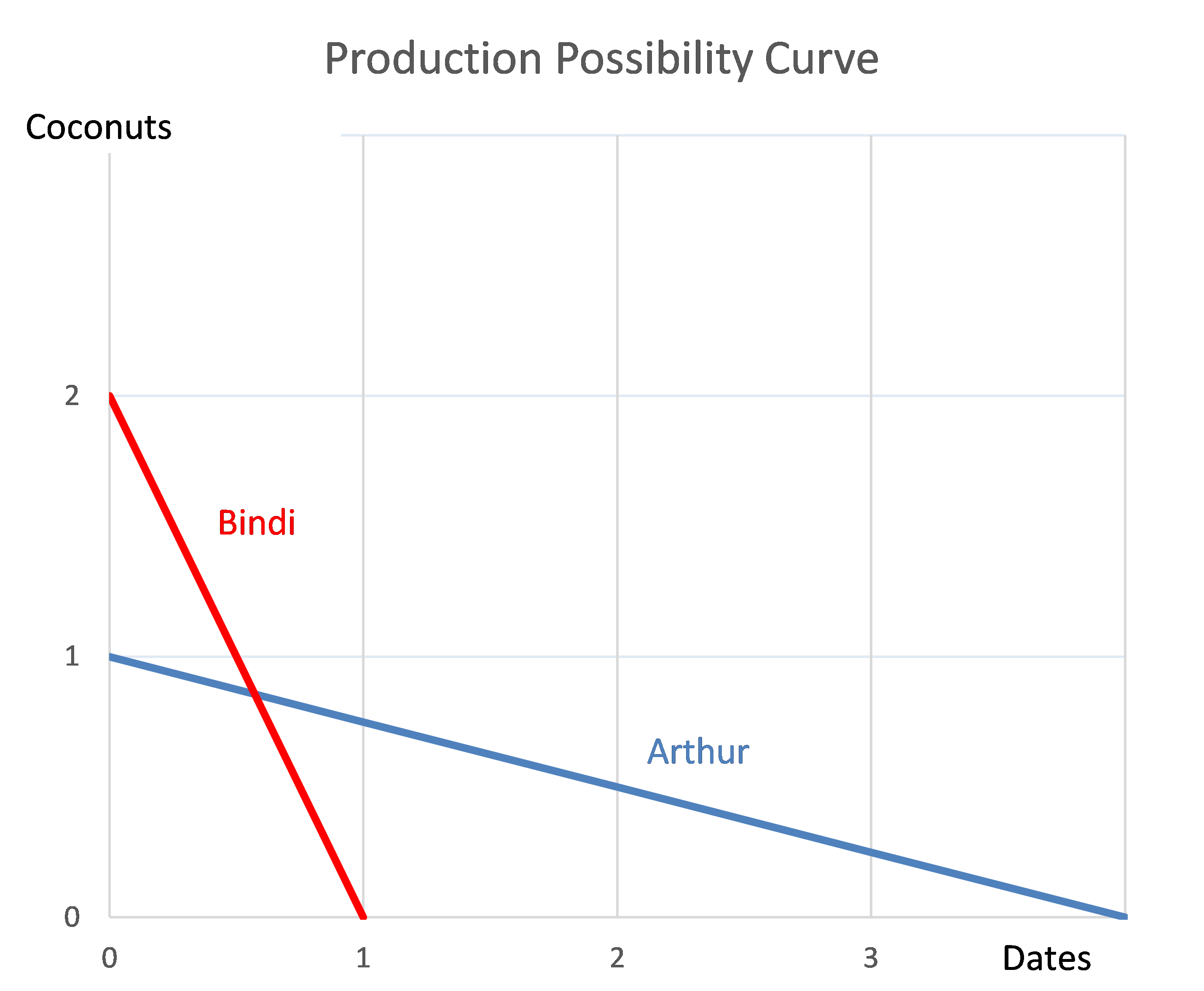

Question 977 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 987 interest tax shield, capital structure, debt terminology

What creates interest tax shields for a company?