A fixed coupon bond was bought for $90 and paid its annual coupon of $3 one year later (at t=1 year). Just after the coupon was paid, the bond price was $92 (at t=1 year). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

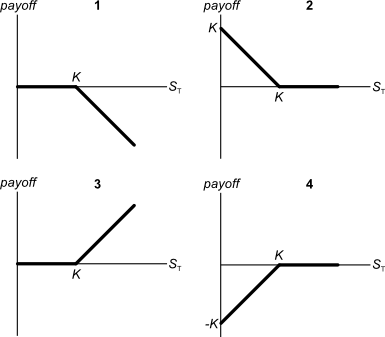

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered

You just started work at your new job which pays $48,000 per year.

The human resources department have given you the option of being paid at the end of every week or every month.

Assume that there are 4 weeks per month, 12 months per year and 48 weeks per year.

Bank interest rates are 12% pa given as an APR compounding per month.

What is the dollar gain over one year, as a net present value, of being paid every week rather than every month?

A home loan company advertises an interest rate of 6% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

Question 598 future, tailing the hedge, cross hedging

The standard deviation of monthly changes in the spot price of lamb is $0.015 per pound. The standard deviation of monthly changes in the futures price of live cattle is $0.012 per pound. The correlation between the spot price of lamb and the futures price of cattle is 0.4.

It is now January. A lamb producer is committed to selling 1,000,000 pounds of lamb in May. The spot price of live cattle is $0.30 per pound and the June futures price is $0.32 per pound. The spot price of lamb is $0.60 per pound.

The producer wants to use the June live cattle futures contracts to hedge his risk. Each futures contract is for the delivery of 50,000 pounds of cattle.

How many live cattle futures should the lamb farmer sell to hedge his risk? Round your answer to the nearest whole number of contracts.

Below is a graph of the USD against the JPY and EUR from 1980 to 2015, compiled by the RBA. Select the correct statement about what occurred between 1980 and 2015. Note that in 1980 the euro was around 1.3 USD per EUR and the Yen was around 250 JPY per USD.

The Australian central bank implements monetary policy by directly controlling which interest rate?

On which date would the stock price increase if the dividend and earnings are higher than expected?

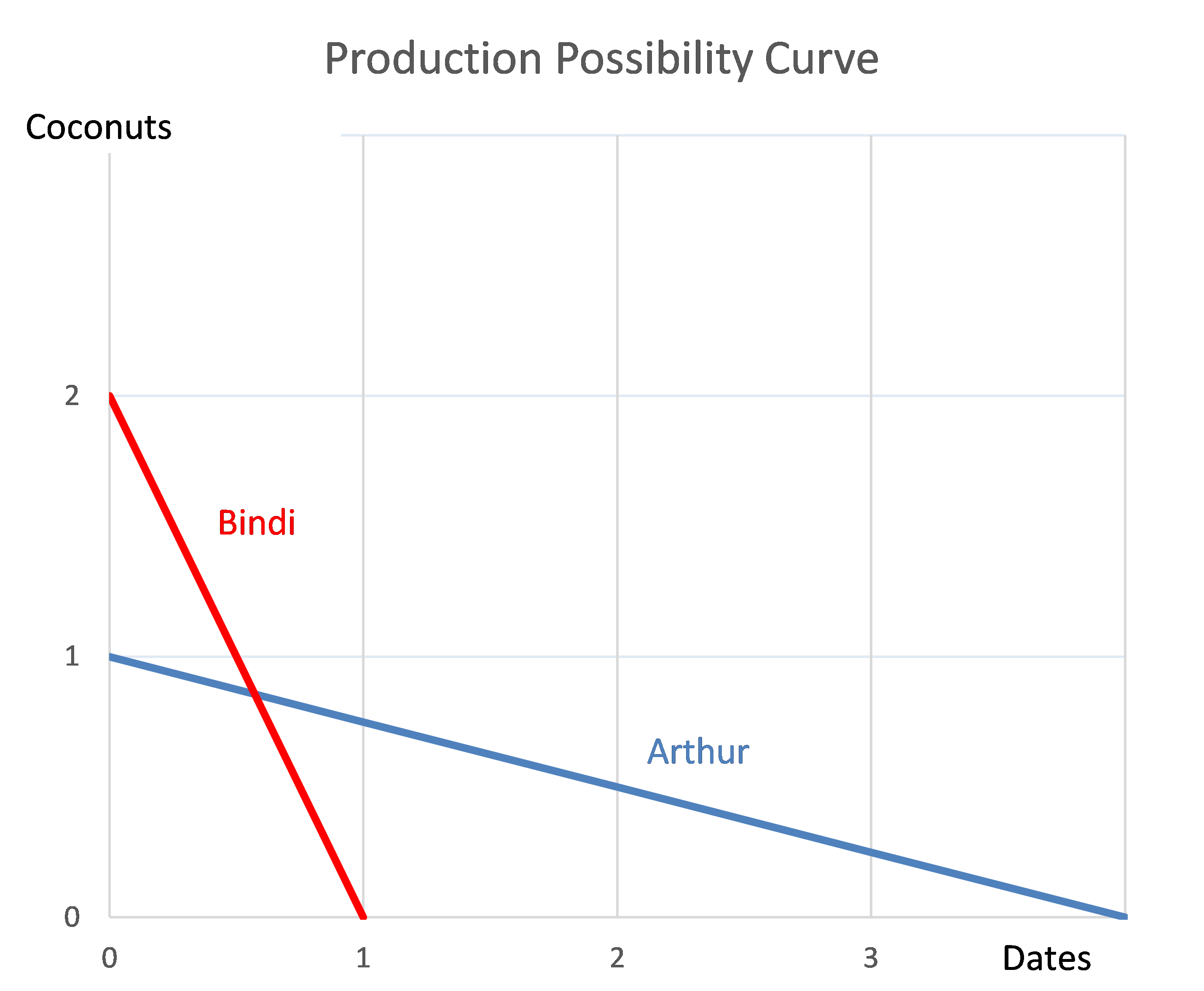

Question 977 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 988 variance, covariance, beta, CAPM, risk, no explanation

| Price Data Time Series | |||||||||||

| Sourced from Yahoo Finance Historical Price Data | |||||||||||

| Date | S&P500 Index (^GSPC) | Apple (AAPL) | |||||||||

| Open | High | Low | Close | Adj close | Open | High | Low | Close | Adj close | ||

| 2007, Wed 3 Jan | 1418 | 1429 | 1408 | 1417 | 1417 | 12.33 | 12.37 | 11.7 | 11.97 | 10.42 | |

| 2008, Wed 2 Jan | 1468 | 1472 | 1442 | 1447 | 1447 | 28.47 | 28.61 | 27.51 | 27.83 | 24.22 | |

| 2009, Fri 2 Jan | 903 | 935 | 899 | 932 | 932 | 12.27 | 13.01 | 12.17 | 12.96 | 11.28 | |

| 2010, Mon 4 Jan | 1117 | 1134 | 1117 | 1133 | 1133 | 30.49 | 30.64 | 30.34 | 30.57 | 26.6 | |

| Source: Yahoo Finance. | |||||||||||

Which of the following statements about the above table which is used to calculate Apple's equity beta is NOT correct?