In mid 2009 the listed mining company Rio Tinto announced a 21-for-40 renounceable rights issue. Below is the chronology of events:

- 04/06/2009. Share price opens at $69.00 and closes at $66.90.

- 05/06/2009. 21-for-40 rights issue announced at a subscription price of $28.29.

- 16/06/2009. Last day that shares trade cum-rights. Share price opens at $76.40 and closes at $75.50.

- 17/06/2009. Shares trade ex-rights. Rights trading commences.

All things remaining equal, what would you expect Rio Tinto's stock price to open at on the first day that it trades ex-rights (17/6/2009)? Ignore the time value of money since time is negligibly short. Also ignore taxes.

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

Below are some statements about loans and bonds. The first descriptive sentence is correct. But one of the second sentences about the loans' or bonds' prices is not correct. Which statement is NOT correct? Assume that interest rates are positive.

Note that coupons or interest payments are the periodic payments made throughout a bond or loan's life. The face or par value of a bond or loan is the amount paid at the end when the debt matures.

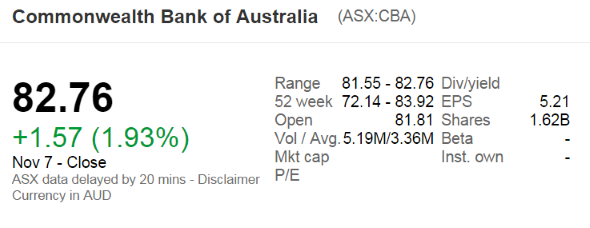

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

Question 490 expected and historical returns, accounting ratio

Which of the following is NOT a synonym of 'required return'?

A British man wants to calculate how many British pounds (GBP) he needs to buy a 1 million euro (EUR) apartment in Germany. The exchange rate is 1.42 USD per GBP and 1.23 USD per EUR. What is the EUR 1 million equivalent to in GBP?

Question 923 omitted variable bias, CAPM, single factor model, single index model, no explanation

Capital Asset Pricing Model (CAPM) and the Single Index Model (SIM) are single factor models whose only risk factor is the market portfolio’s return. Say a Taxi company and an Umbrella company are influenced by two factors, the market portfolio return and rainfall. When it rains, both the Taxi and Umbrella companies’ stock prices do well. When there’s no rain, both do poorly. Assume that rainfall risk is a systematic risk that cannot be diversified and that rainfall has zero correlation with the market portfolio’s returns.

Which of the following statements about these two stocks is NOT correct?

The CAPM and SIM: