Question 215 equivalent annual cash flow, effective rate conversion

You're about to buy a car. These are the cash flows of the two different cars that you can buy:

- You can buy an old car for $5,000 now, for which you will have to buy $90 of fuel at the end of each week from the date of purchase. The old car will last for 3 years, at which point you will sell the old car for $500.

- Or you can buy a new car for $14,000 now for which you will have to buy $50 of fuel at the end of each week from the date of purchase. The new car will last for 4 years, at which point you will sell the new car for $1,000.

Bank interest rates are 10% pa, given as an effective annual rate. Assume that there are exactly 52 weeks in a year. Ignore taxes and environmental and pollution factors.

Should you buy the or the ?

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

Question 312 foreign exchange rate, American and European terms

If the current AUD exchange rate is USD 0.9686 = AUD 1, what is the American terms quote of the AUD against the USD?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

Question 523 income and capital returns, real and nominal returns and cash flows, inflation

A low-growth mature stock has an expected nominal total return of 6% pa and nominal capital return of 2% pa. Inflation is expected to be 3% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the stock's expected real total, capital and income returns?

The answer choices below are given in the same order.

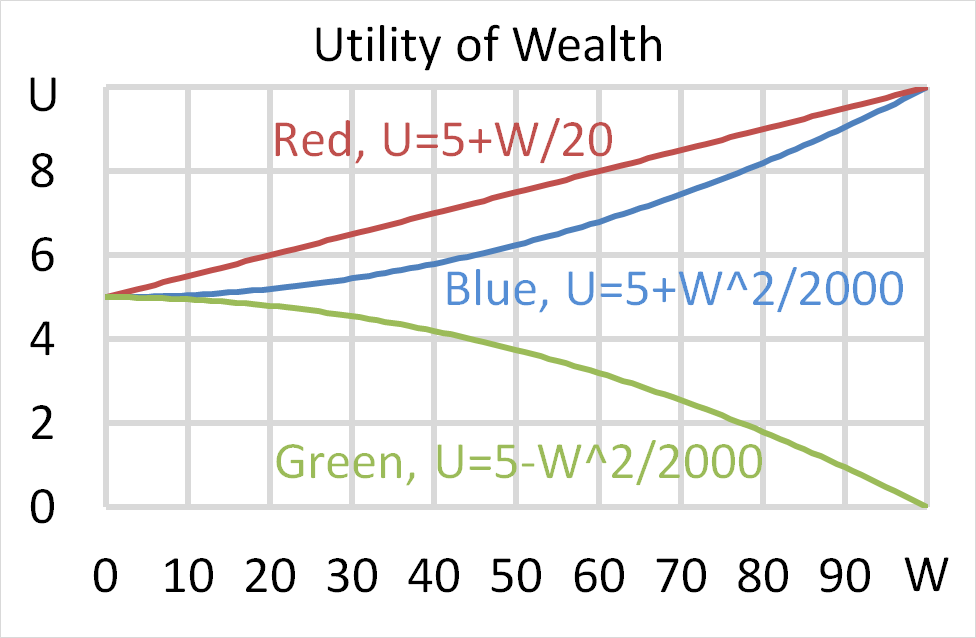

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Telsa Motors advertises that its Model S electric car saves $570 per month in fuel costs. Assume that Tesla cars last for 10 years, fuel and electricity costs remain the same, and savings are made at the end of each month with the first saving of $570 in one month from now.

The effective annual interest rate is 15.8%, and the effective monthly interest rate is 1.23%. What is the present value of the savings?

The Australian central bank implements monetary policy by directly controlling which interest rate?

Question 979 balance of payments, current account, no explanation

This question is about the Balance of Payments.

Assume that all foreign and domestic assets are either debt which makes interest income or equity which makes dividend income, and vice versa for liabilities which cost interest and dividend payments, respectively.

Which of the following statements is NOT correct?