An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0), in one year (t=1) and in two years (t=2), and still have $50,000 in the bank after that (t=2).

How much can you consume at each time?

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

The efficient markets hypothesis (EMH) and no-arbitrage pricing theory are most closely related to which of the following concepts?

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Question 711 continuously compounding rate, continuously compounding rate conversion

A continuously compounded semi-annual return of 5% ##(r_\text{cc 6mth})## is equivalent to a continuously compounded annual return ##(r_\text{cc annual})## of:

Question 771 debt terminology, interest expense, interest tax shield, credit risk, no explanation

You deposit money into a bank account. Which of the following statements about this deposit is NOT correct?

Short selling is a way to make money from falling prices. In what order must the following steps be completed to short-sell an asset? Let Tom, Dick and Harry be traders in the share market.

- Step P: Purchase the asset from Harry.

- Step G: Give the asset to Tom.

- Step W: Wait and hope that the asset price falls.

- Step B: Borrow the asset from Tom.

- Step S: Sell the asset to Dick.

Select the statement with the correct order of steps.

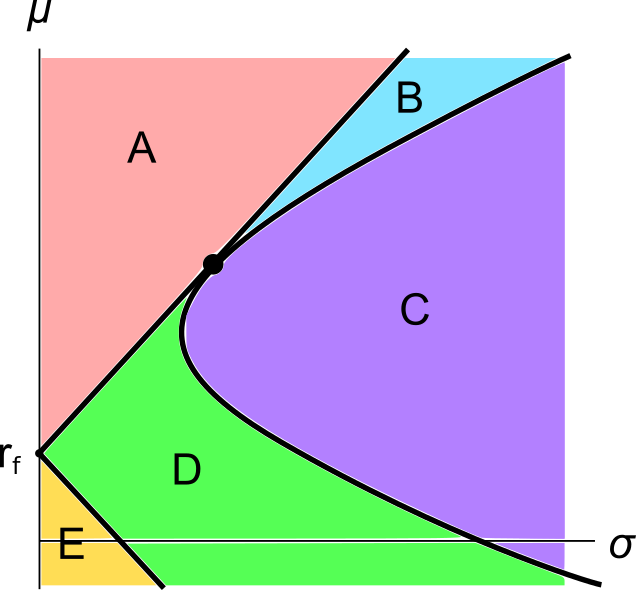

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the below diagram.

Each letter corresponds to a separate coloured area. The portfolios at the boundary of the areas, on the black lines, are excluded from each area. Assume that all assets represented in this graph are fairly priced, and that all risky assets can be short-sold.

Which of the following statements about this graph and Markowitz portfolio theory is NOT correct?

Question 856 credit terms, no explanation

Your supplier’s credit terms are "1/10 net 30". Which of the following statements about these credit terms is NOT correct?

If you intend to buy an item from your supplier for a tag price of $100 and you: