A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

Select the most correct statement from the following.

'Chartists', also known as 'technical traders', believe that:

The price of gold is currently $700 per ounce. The forward price for delivery in 1 year is $800. An arbitrageur can borrow money at 10% per annum given as an effective discrete annual rate. Assume that gold is fairly priced and the cost of storing gold is zero.

What is the best way to conduct an arbitrage in this situation? The best arbitrage strategy requires zero capital, has zero risk and makes money straight away. An arbitrageur should sell 1 forward on gold and:

An equity index stands at 100 points and the one year equity futures price is 107.

The equity index is expected to have a dividend yield of 3% pa. Assume that investors are risk-neutral so their total required return on the shares is the same as the risk free Treasury bond yield which is 10% pa. Both are given as discrete effective annual rates.

Assuming that the equity index is fairly priced, an arbitrageur would recognise that the equity futures are:

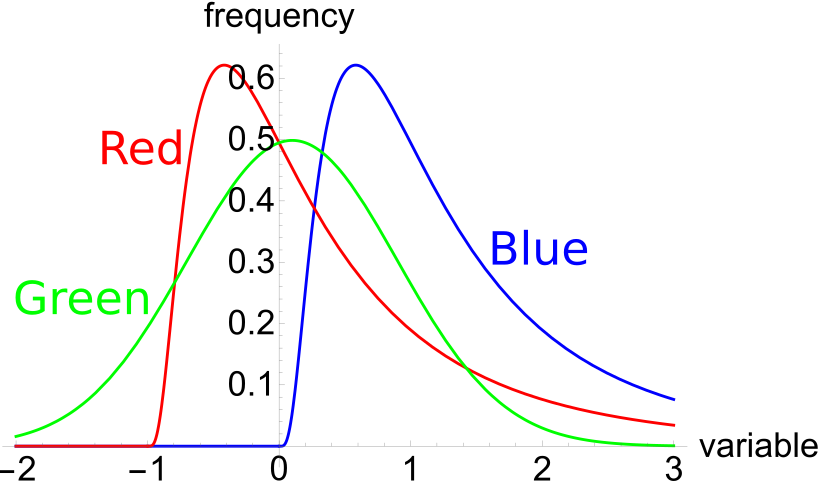

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Which of the below statements is NOT correct?

Question 790 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate, log-normal distribution, VaR, confidence interval

A risk manager has identified that their hedge fund’s continuously compounded portfolio returns are normally distributed with a mean of 10% pa and a standard deviation of 30% pa. The hedge fund’s portfolio is currently valued at $100 million. Assume that there is no estimation error in these figures and that the normal cumulative density function at 1.644853627 is 95%.

Which of the following statements is NOT correct? All answers are rounded to the nearest dollar.

Question 861 open interest, closing out future contract, no explanation

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys 2 future from Bob.

2. Chris buys 5 futures from Delta.

3. Chris buys 9 futures from Bob.

These were the only trades made in this equity index future.

Which of the following statements is NOT correct?

Question 862 yield curve, bond pricing, bill pricing, monetary policy, no explanation

Refer to the below graph when answering the questions.

Which of the following statements is NOT correct?

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration: