Question 25 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 2 year zero coupon bond at a yield of 8% pa, and a

- 3 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the third year (from t=2 to t=3)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

A manufacturing company is considering a new project in the more risky services industry. The cash flows from assets (CFFA) are estimated for the new project, with interest expense excluded from the calculations. To get the levered value of the project, what should these unlevered cash flows be discounted by?

Assume that the manufacturing firm has a target debt-to-assets ratio that it sticks to.

You just signed up for a 30 year fully amortising mortgage with monthly payments of $1,000 per month. The interest rate is 6% pa which is not expected to change.

How much did you borrow? After 20 years, how much will be owing on the mortgage? The interest rate is still 6% and is not expected to change.

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $0.5 million, but investment bank fees and integration costs with a present value of $1.5 million is expected. A 10% cash and 90% scrip offer will be made that pays the fair price for the target's shares only. Assume that the Target and Acquirer agree to the deal. The cash will be paid out of the firms' cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

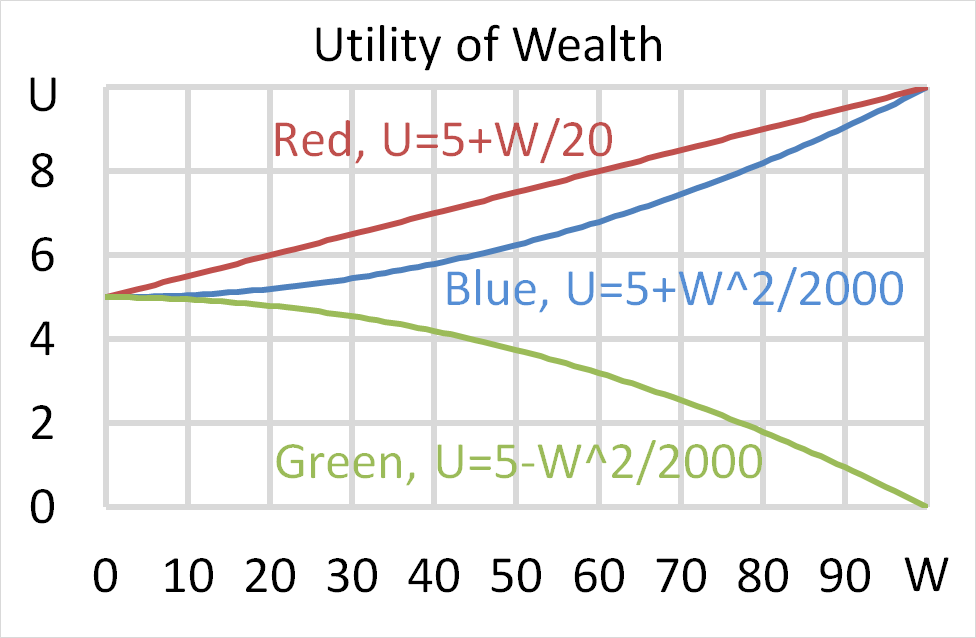

Question 701 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

A put option written on a risky non-dividend paying stock will mature in one month. As is normal, assume that the option's exercise price is non-zero and positive ##(K>0)## and the stock has limited liability ##(S>0)##.

Which of the following statements is NOT correct? The put option's:

Question 888 foreign exchange rate, speculation, no explanation

The current Australian exchange rate is 0.8 USD per AUD.

If you think that the AUD will depreciate against the USD, contrary to the rest of the market, how could you profit? Right now you should: