Question 319 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to keep the policy rate steady at their next meeting.

Then unexpectedly, the RBA announce that they will increase the policy rate by 25 basis points due to fears that the economy is growing too fast and that inflation will be above their target rate of 2 to 3 per cent.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

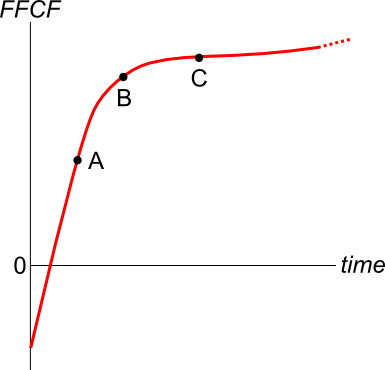

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

A large proportion of a levered firm's assets is cash held at the bank. The firm is financed with half equity and half debt.

Which of the following statements about this firm's enterprise value (EV) and total asset value (V) is NOT correct?

A mining firm has just discovered a new mine. So far the news has been kept a secret.

The net present value of digging the mine and selling the minerals is $250 million, but $500 million of new equity and $300 million of new bonds will need to be issued to fund the project and buy the necessary plant and equipment.

The firm will release the news of the discovery and equity and bond raising to shareholders simultaneously in the same announcement. The shares and bonds will be issued shortly after.

Once the announcement is made and the new shares and bonds are issued, what is the expected increase in the value of the firm's assets ##(\Delta V)##, market capitalisation of debt ##(\Delta D)## and market cap of equity ##(\Delta E)##? Assume that markets are semi-strong form efficient.

The triangle symbol ##\Delta## is the Greek letter capital delta which means change or increase in mathematics.

Ignore the benefit of interest tax shields from having more debt.

Remember: ##\Delta V = \Delta D+ \Delta E##

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

Question 662 APR, effective rate, effective rate conversion, no explanation

Which of the following interest rate labels does NOT make sense?

A trader sells one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Question 796 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the risk-neutral probability that a European call option will be exercised?

Question 798 idiom, diversification, market efficiency, sunk cost, no explanation

The following quotes are most closely related to which financial concept?

- “Opportunity is missed by most people because it is dressed in overalls and looks like work” -Thomas Edison

- “The only place where success comes before work is in the dictionary” -Vidal Sassoon

- “The safest way to double your money is to fold it over and put it in your pocket” - Kin Hubbard