You really want to go on a back packing trip to Europe when you finish university. Currently you have $1,500 in the bank. Bank interest rates are 8% pa, given as an APR compounding per month. If the holiday will cost $2,000, how long will it take for your bank account to reach that amount?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

Question 418 capital budgeting, NPV, interest tax shield, WACC, CFFA, CAPM

| Project Data | ||

| Project life | 1 year | |

| Initial investment in equipment | $8m | |

| Depreciation of equipment per year | $8m | |

| Expected sale price of equipment at end of project | 0 | |

| Unit sales per year | 4m | |

| Sale price per unit | $10 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $2m | |

| Interest expense in first year (at t=1) | $0.562m | |

| Corporate tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 9% | |

| Market portfolio return | 10% | |

| Covariance of levered equity returns with market | 0.32 | |

| Variance of market portfolio returns | 0.16 | |

| Firm's and project's debt-to-equity ratio | 50% | |

Notes

- Due to the project, current assets will increase by $6m now (t=0) and fall by $6m at the end (t=1). Current liabilities will not be affected.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio.

- Millions are represented by 'm'.

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 2% pa. All rates are given as effective annual rates.

- The project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

Many Australian home loans that are interest-only actually require payments to be made on a fully amortising basis after a number of years.

You decide to borrow $600,000 from the bank at an interest rate of 4.25% pa for 25 years. The payments will be interest-only for the first 10 years (t=0 to 10 years), then they will have to be paid on a fully amortising basis for the last 15 years (t=10 to 25 years).

Assuming that interest rates will remain constant, what will be your monthly payments over the first 10 years from now, and then the next 15 years after that? The answer options are given in the same order.

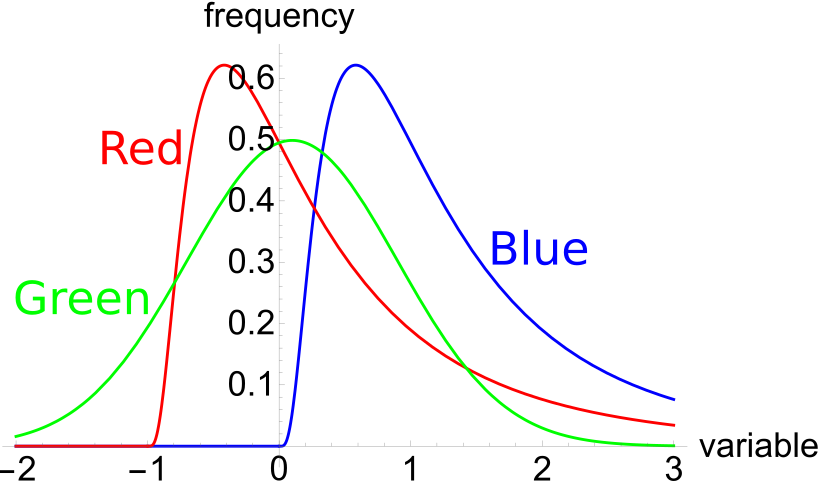

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let ##P_1## be the unknown price of a stock in one year. ##P_1## is a random variable. Let ##P_0 = 1##, so the share price now is $1. This one dollar is a constant, it is not a variable.

Which of the below statements is NOT correct? Financial practitioners commonly assume that the shape of the PDF represented in the colour:

Safe firms with low chances of bankruptcy will tend to have:

The DuPont formula is:

###\dfrac{\text{Net Profit}}{\text{Sales}} \times \dfrac{\text{Sales}}{\text{Total Assets}} \times \dfrac{\text{Total Assets}}{\text{Owners' Equity}}###

Which of the following statements about the DuPont formula is NOT correct?

A stock has an expected return of 10% pa and you're 90% sure that over the next year, the return will be between -15% and 35%. The stock's returns are normally distributed. Note that the Z-statistic corresponding to a one-tail:

- 90% normal probability density function is 1.282.

- 95% normal probability density function is 1.645.

- 97.5% normal probability density function is 1.960.

What is the stock’s standard deviation of returns in percentage points per annum (pp pa)?

Examine the below graph.

Which of the below statements is NOT correct?