Question 335 foreign exchange rate, American and European terms

Investors expect Australia's central bank, the RBA, to reduce the policy rate at their next meeting due to fears that the economy is slowing. Then unexpectedly, the policy rate is actually kept unchanged.

What do you expect to happen to Australia's exchange rate?

Question 584 option, option payoff at maturity, option profit

Which of the following statements about European call options on non-dividend paying stocks is NOT correct?

In general, stock prices tend to rise. What does this mean for futures on equity?

Question 743 price gains and returns over time, no explanation

How many years will it take for an asset's price to triple (increase from say $1 to $3) if it grows by 5% pa?

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

A stock's returns are normally distributed with a mean of 8% pa and a standard deviation of 15 percentage points pa. What is the 99% confidence interval of returns over the next year? Note that the Z-statistic corresponding to a one-tail:

- 90% normal probability density function is 1.282.

- 95% normal probability density function is 1.645.

- 97.5% normal probability density function is 1.960.

- 99% normal probability density function is 2.326.

- 99.5% normal probability density function is 2.576

The 99% confidence interval of annual returns is between:

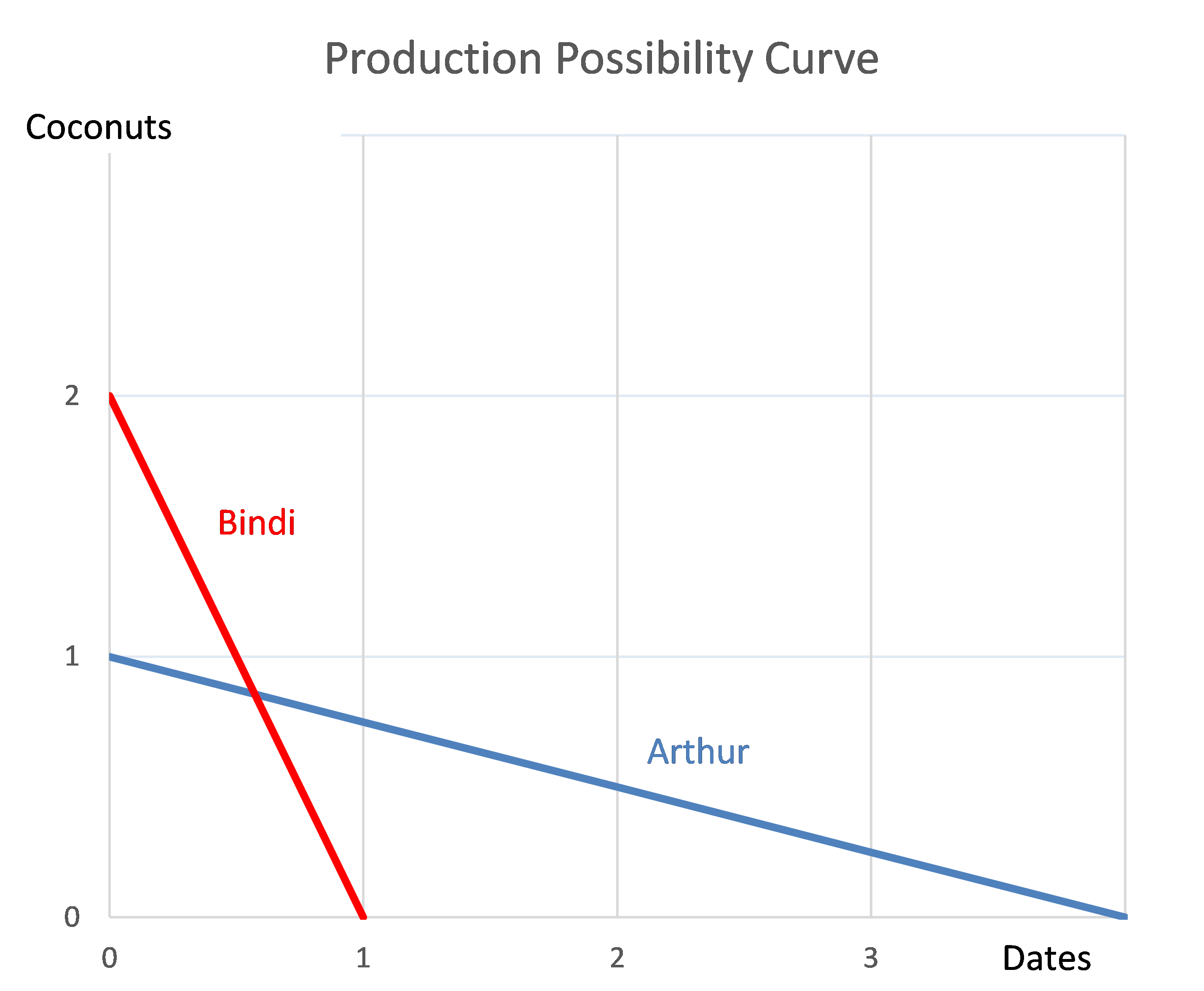

Question 976 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 1003 Black-Scholes-Merton option pricing, log-normal distribution, return distribution, hedge fund, risk, financial distress

A hedge fund issued zero coupon bonds with a combined $1 billion face value due to be paid in 3 years. The promised yield to maturity is currently 6% pa given as a continuously compounded return (or log gross discrete return, ##LGDR=\ln[P_T/P_0] \div T##).

The hedge fund owns stock assets worth $1.1 billion now which are expected to have a 10% pa arithmetic average log gross discrete return ##(\text{AALGDR} = \sum\limits_{t=1}^T{\left( \ln[P_t/P_{t-1}] \right)} \div T)## and 30pp pa standard deviation (SDLGDR) in the future.

Analyse the hedge fund using the Merton model of corporate equity as an option on the firm's assets.

The risk free government bond yield to maturity is currently 5% pa given as a continuously compounded return or LGDR.

Which of the below statements is NOT correct? All figures are rounded to the sixth decimal place.