Find Ching-A-Lings Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Ching-A-Lings Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 20 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 30 | |

| Taxes at 30% | 9 | |

| Net income | 21 | |

| Ching-A-Lings Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 49 | 38 |

| Trade debtors | 14 | 2 |

| Rent paid in advance | 5 | 5 |

| PPE | 400 | 400 |

| Total assets | 468 | 445 |

| Trade creditors | 4 | 10 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 145 | 145 |

| Retained profits | 119 | 100 |

| Total L and OE | 468 | 445 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Question 383 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying the company's assets and:

Which of the following investable assets is the LEAST suitable for valuation using PE multiples techniques?

Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

Question 546 income and capital returns, interest only loan, no explanation

Which of the following statements about the capital and income returns of an interest-only loan is correct?

Assume that the yield curve (which shows total returns over different maturities) is flat and is not expected to change.

An interest-only loan's expected:

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

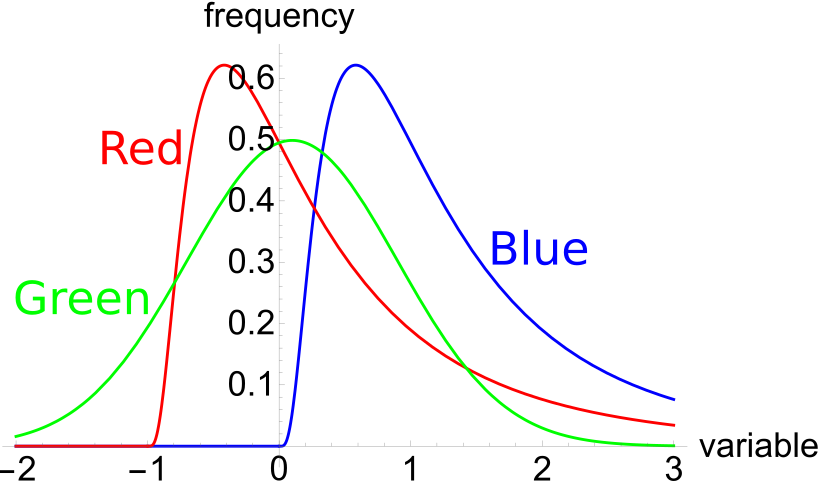

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let ##P_1## be the unknown price of a stock in one year. ##P_1## is a random variable. Let ##P_0 = 1##, so the share price now is $1. This one dollar is a constant, it is not a variable.

Which of the below statements is NOT correct? Financial practitioners commonly assume that the shape of the PDF represented in the colour:

Which Australian institution is in charge of monetary policy?

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration: