If a project's net present value (NPV) is zero, then its internal rate of return (IRR) will be:

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

What is the payback period of the project in years?

Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $500 at time 2 is actually earned smoothly from t=1 to t=2.

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 531 bankruptcy or insolvency, capital structure, risk, limited liability

Who is most in danger of being personally bankrupt? Assume that all of their businesses' assets are highly liquid and can therefore be sold immediately.

A stock just paid a dividend of $1. Future annual dividends are expected to grow by 2% pa. The next dividend of $1.02 (=1*(1+0.02)^1) will be in one year, and the year after that the dividend will be $1.0404 (=1*(1+0.02)^2), and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

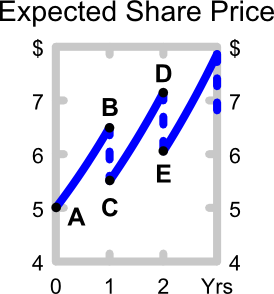

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0 = \frac{d_1}{r - g} ###

Which expression is NOT equal to the expected dividend yield?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

An industrial chicken farmer grows chickens for their meat. Chickens:

- Cost $0.50 each to buy as chicks. They are bought on the day they’re born, at t=0.

- Grow at a rate of $0.70 worth of meat per chicken per week for the first 6 weeks (t=0 to t=6).

- Grow at a rate of $0.40 worth of meat per chicken per week for the next 4 weeks (t=6 to t=10) since they’re older and grow more slowly.

- Feed costs are $0.30 per chicken per week for their whole life. Chicken feed is bought and fed to the chickens once per week at the beginning of the week. So the first amount of feed bought for a chicken at t=0 costs $0.30, and so on.

- Can be slaughtered (killed for their meat) and sold at no cost at the end of the week. The price received for the chicken is their total value of meat (note that the chicken grows fast then slow, see above).

The required return of the chicken farm is 0.5% given as an effective weekly rate.

Ignore taxes and the fixed costs of the factory. Ignore the chicken’s welfare and other environmental and ethical concerns.

Find the equivalent weekly cash flow of slaughtering a chicken at 6 weeks and at 10 weeks so the farmer can figure out the best time to slaughter his chickens. The choices below are given in the same order, 6 and 10 weeks.

An investor owns an empty block of land that has local government approval to be developed into a petrol station, car wash or car park. The council will only allow a single development so the projects are mutually exclusive.

All of the development projects have the same risk and the required return of each is 10% pa. Each project has an immediate cost and once construction is finished in one year the land and development will be sold. The table below shows the estimated costs payable now, expected sale prices in one year and the internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cost now ($) |

Sale price in one year ($) |

IRR (% pa) |

| Petrol station | 9,000,000 | 11,000,000 | 22.22 |

| Car wash | 800,000 | 1,100,000 | 37.50 |

| Car park | 70,000 | 110,000 | 57.14 |

Which project should the investor accept?

Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

In Australia, domestic university students are allowed to buy concession tickets for the bus, train and ferry which sell at a discount of 50% to full-price tickets.

The Australian Government do not allow international university students to buy concession tickets, they have to pay the full price.

Some international students see this as unfair and they are willing to pay for fake university identification cards which have the concession sticker.

What is the most that an international student would be willing to pay for a fake identification card?

Assume that international students:

- consider buying their fake card on the morning of the first day of university from their neighbour, just before they leave to take the train into university.

- buy their weekly train tickets on the morning of the first day of each week.

- ride the train to university and back home again every day seven days per week until summer holidays 40 weeks from now. The concession card only lasts for those 40 weeks. Assume that there are 52 weeks in the year for the purpose of interest rate conversion.

- a single full-priced one-way train ride costs $5.

- have a discount rate of 11% pa, given as an effective annual rate.

Approach this question from a purely financial view point, ignoring the illegality, embarrassment and the morality of committing fraud.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

Which of the below statements about effective rates and annualised percentage rates (APR's) is NOT correct?

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as an interest only loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage payments are paid in arrears (at the end of the month).

Question 239 income and capital returns, inflation, real and nominal returns and cash flows, interest only loan

A bank grants a borrower an interest-only residential mortgage loan with a very large 50% deposit and a nominal interest rate of 6% that is not expected to change. Assume that inflation is expected to be a constant 2% pa over the life of the loan. Ignore credit risk.

From the bank's point of view, what is the long term expected nominal capital return of the loan asset?

"Buy low, sell high" is a phrase commonly heard in financial markets. It states that traders should try to buy assets at low prices and sell at high prices.

Traders in the fixed-coupon bond markets often quote promised bond yields rather than prices. Fixed-coupon bond traders should try to:

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

A young lady is trying to decide if she should attend university or not.

The young lady's parents say that she must attend university because otherwise all of her hard work studying and attending school during her childhood was a waste.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The hard work studying at school in her childhood should be classified as:

What is the net present value (NPV) of undertaking a full-time Australian undergraduate business degree as an Australian citizen? Only include the cash flows over the duration of the degree, ignore any benefits or costs of the degree after it's completed.

Assume the following:

- The degree takes 3 years to complete and all students pass all subjects.

- There are 2 semesters per year and 4 subjects per semester.

- University fees per subject per semester are $1,277, paid at the start of each semester. Fees are expected to remain constant in real terms for the next 3 years.

- There are 52 weeks per year.

- The first semester is just about to start (t=0). The first semester lasts for 19 weeks (t=0 to 19).

- The second semester starts immediately afterwards (t=19) and lasts for another 19 weeks (t=19 to 38).

- The summer holidays begin after the second semester ends and last for 14 weeks (t=38 to 52). Then the first semester begins the next year, and so on.

- Working full time at the grocery store instead of studying full-time pays $20/hr and you can work 35 hours per week. Wages are paid at the end of each week and are expected to remain constant in real terms.

- Full-time students can work full-time during the summer holiday at the grocery store for the same rate of $20/hr for 35 hours per week.

- The discount rate is 9.8% pa. All rates and cash flows are real. Inflation is expected to be 3% pa. All rates are effective annual.

The NPV of costs from undertaking the university degree is:

Why is Capital Expenditure (CapEx) subtracted in the Cash Flow From Assets (CFFA) formula?

###CFFA=NI+Depr-CapEx - \Delta NWC+IntExp###

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

The US firm Google operates in the online advertising business. In 2011 Google bought Motorola Mobility which manufactures mobile phones.

Assume the following:

- Google had a 10% after-tax weighted average cost of capital (WACC) before it bought Motorola.

- Motorola had a 20% after-tax WACC before it merged with Google.

- Google and Motorola have the same level of gearing.

- Both companies operate in a classical tax system.

You are a manager at Motorola. You must value a project for making mobile phones. Which method(s) will give the correct valuation of the mobile phone manufacturing project? Select the most correct answer.

The mobile phone manufacturing project's:

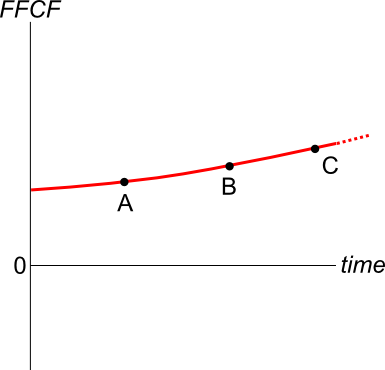

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

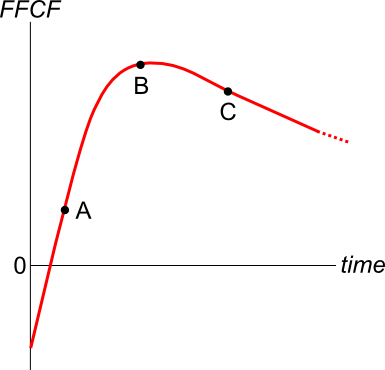

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

The 'time value of money' is most closely related to which of the following concepts?

A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

A fixed coupon bond was bought for $90 and paid its annual coupon of $3 one year later (at t=1 year). Just after the coupon was paid, the bond price was $92 (at t=1 year). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

When using the dividend discount model to price a stock:

### p_{0} = \frac{d_1}{r - g} ###

The growth rate of dividends (g):

The following is the Dividend Discount Model used to price stocks:

### p_0=\frac{d_1}{r-g} ###

Which of the following statements about the Dividend Discount Model is NOT correct?

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

A low-quality second-hand car can be bought now for $1,000 and will last for 1 year before it will be scrapped for nothing.

A high-quality second-hand car can be bought now for $4,900 and it will last for 5 years before it will be scrapped for nothing.

What is the equivalent annual cost of each car? Assume a discount rate of 10% pa, given as an effective annual rate.

The answer choices are given as the equivalent annual cost of the low-quality car and then the high quality car.

One year ago you bought $100,000 of shares partly funded using a margin loan. The margin loan size was $70,000 and the other $30,000 was your own wealth or 'equity' in the share assets.

The interest rate on the margin loan was 7.84% pa.

Over the year, the shares produced a dividend yield of 4% pa and a capital gain of 5% pa.

What was the total return on your wealth? Ignore taxes, assume that all cash flows (interest payments and dividends) were paid and received at the end of the year, and all rates above are effective annual rates.

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

There are a number of ways that assets can be depreciated. Generally the government's tax office stipulates a certain method.

But if it didn't, what would be the ideal way to depreciate an asset from the perspective of a businesses owner?

One method for calculating a firm's free cash flow (FFCF, or CFFA) is to ignore interest expense. That is, pretend that interest expense ##(IntExp)## is zero:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp \\ &= (Rev - COGS - Depr - FC - 0)(1-t_c) + Depr - CapEx -\Delta NWC - 0\\ \end{aligned}###

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

Fundamentalists who analyse company financial reports and news announcements (but who don't have inside information) will make positive abnormal returns if:

Question 339 bond pricing, inflation, market efficiency, income and capital returns

Economic statistics released this morning were a surprise: they show a strong chance of consumer price inflation (CPI) reaching 5% pa over the next 2 years.

This is much higher than the previous forecast of 3% pa.

A vanilla fixed-coupon 2-year risk-free government bond was issued at par this morning, just before the economic news was released.

What is the expected change in bond price after the economic news this morning, and in the next 2 years? Assume that:

- Inflation remains at 5% over the next 2 years.

- Investors demand a constant real bond yield.

- The bond price falls by the (after-tax) value of the coupon the night before the ex-coupon date, as in real life.

The efficient markets hypothesis (EMH) and no-arbitrage pricing theory are most closely related to which of the following concepts?

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

All things remaining equal, the variance of a portfolio of two positively-weighted stocks rises as:

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

What is the correlation of a variable X with itself?

The corr(X, X) or ##\rho_{X,X}## equals:

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum ##(\% pa)##.

What are the units of the covariance ##(\sigma_{X,Y})## and correlation ##(\rho_{X,Y})## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

Question 566 capital structure, capital raising, rights issue, on market repurchase, dividend, stock split, bonus issue

A company's share price fell by 20% and its number of shares rose by 25%. Assume that there are no taxes, no signalling effects and no transaction costs.

Which one of the following corporate events may have happened?

A company announces that it will pay a dividend, as the market expected. The company's shares trade on the stock exchange which is open from 10am in the morning to 4pm in the afternoon each weekday. When would the share price be expected to fall by the amount of the dividend? Ignore taxes.

The share price is expected to fall during the:

Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

Question 490 expected and historical returns, accounting ratio

Which of the following is NOT a synonym of 'required return'?

Question 807 market efficiency, expected and historical returns, CAPM, beta, systematic risk, no explanation

You work in Asia and just woke up. It looked like a nice day but then you read the news and found out that last night the American share market fell by 10% while you were asleep due to surprisingly poor macro-economic world news. You own a portfolio of liquid stocks listed in Asia with a beta of 1.6. When the Asian equity markets open, what do you expect to happen to your share portfolio? Assume that the capital asset pricing model (CAPM) is correct and that the market portfolio contains all shares in the world, of which American shares are a big part. Your portfolio beta is measured against this world market portfolio.

When the Asian equity market opens for trade, you would expect your portfolio value to:

Stock A has a beta of 0.5 and stock B has a beta of 1. Which statement is NOT correct?

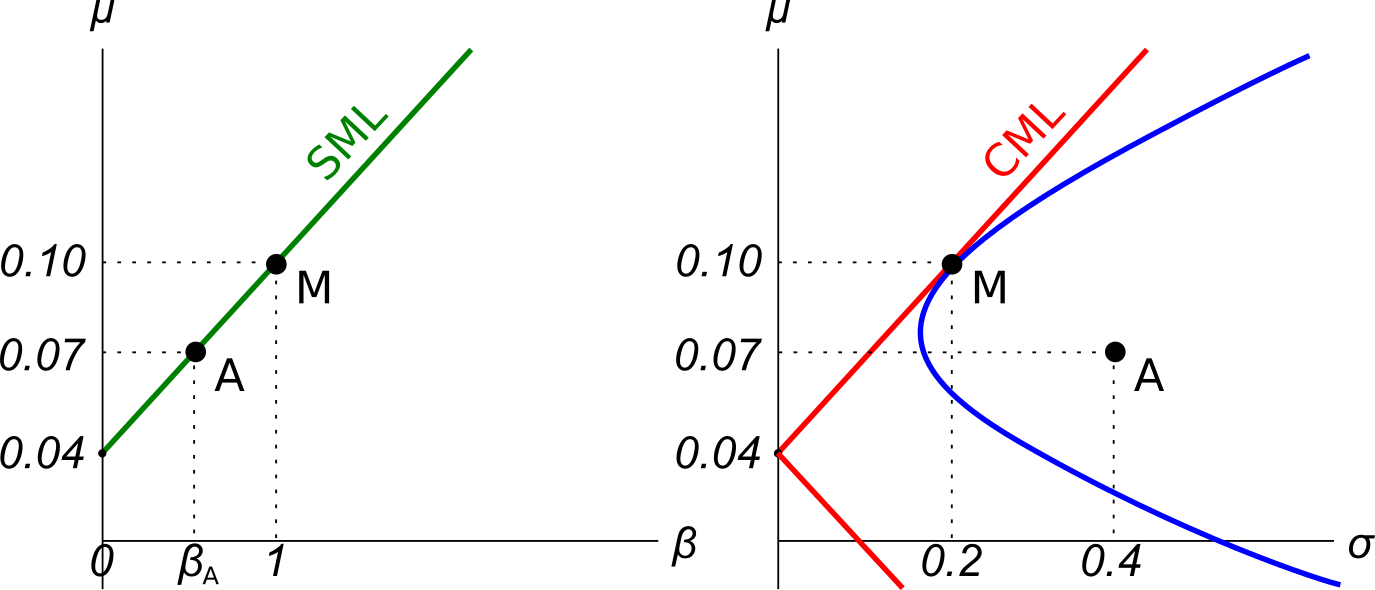

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

What do you think will be the stock's expected return over the next year, given as an effective annual rate?

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

Over the last year, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. So ##r_{m} = (P_{0} - P_{-1})/P_{-1} = -0.01##, where the current time is zero and one year ago is time -1. The risk free rate was unchanged.

What do you think was the stock's historical return over the last year, given as an effective annual rate?

A firm changes its capital structure by issuing a large amount of equity and using the funds to repay debt. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

The CAPM can be used to find a business's expected opportunity cost of capital:

###r_i=r_f+β_i (r_m-r_f)###

What should be used as the risk free rate ##r_f##?

Question 448 franking credit, personal tax on dividends, imputation tax system

A small private company has a single shareholder. This year the firm earned a $100 profit before tax. All of the firm's after tax profits will be paid out as dividends to the owner.

The corporate tax rate is 30% and the sole shareholder's personal marginal tax rate is 45%.

The Australian imputation tax system applies because the company generates all of its income in Australia and pays corporate tax to the Australian Tax Office. Therefore all of the company's dividends are fully franked. The sole shareholder is an Australian for tax purposes and can therefore use the franking credits to offset his personal income tax liability.

What will be the personal tax payable by the shareholder and the corporate tax payable by the company?

Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only ##(P_\text{0 one-off})## , and the second assumes that the increase is permanent ##(P_\text{0 permanent})##:

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

Question 625 dividend re-investment plan, capital raising

Which of the following statements about dividend re-investment plans (DRP's) is NOT correct?

An established mining firm announces that it expects large losses over the following year due to flooding which has temporarily stalled production at its mines. Which statement(s) are correct?

(i) If the firm adheres to a full dividend payout policy it will not pay any dividends over the following year.

(ii) If the firm wants to signal that the loss is temporary it will maintain the same level of dividends. It can do this so long as it has enough retained profits.

(iii) By law, the firm will be unable to pay a dividend over the following year because it cannot pay a dividend when it makes a loss.

Select the most correct response:

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

Question 49 inflation, real and nominal returns and cash flows, APR, effective rate

In Australia, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 2.83% pa.

The inflation rate is currently 2.2% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

You want to buy an apartment worth $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising mortgage loan with a term of 25 years. The interest rate is 6% pa and is not expected to change.

What will be your monthly payments?

A three year corporate bond yields 12% pa with a coupon rate of 10% pa, paid semi-annually.

Find the effective six month yield, effective annual yield and the effective daily yield. Assume that each month has 30 days and that there are 360 days in a year.

All answers are given in the same order:

##r_\text{eff semi-annual}##, ##r_\text{eff yearly}##, ##r_\text{eff daily}##.

You're trying to save enough money for a deposit to buy a house. You want to buy a house worth $400,000 and the bank requires a 20% deposit ($80,000) before it will give you a loan for the other $320,000 that you need.

You currently have no savings, but you just started working and can save $2,000 per month, with the first payment in one month from now. Bank interest rates on savings accounts are 4.8% pa with interest paid monthly and interest rates are not expected to change.

How long will it take to save the $80,000 deposit? Round your answer up to the nearest month.

A student won $1m in a lottery. Currently the money is in a bank account which pays interest at 6% pa, given as an APR compounding per month.

She plans to spend $20,000 at the beginning of every month from now on (so the first withdrawal will be at t=0). After each withdrawal, she will check how much money is left in the account. When there is less than $500,000 left, she will donate that remaining amount to charity.

In how many months will she make her last withdrawal and donate the remainder to charity?

An investor owns a whole level of an old office building which is currently worth $1 million. There are three mutually exclusive projects that can be started by the investor. The office building level can be:

- Rented out to a tenant for one year at $0.1m paid immediately, and then sold for $0.99m in one year.

- Refurbished into more modern commercial office rooms at a cost of $1m now, and then sold for $2.4m when the refurbishment is finished in one year.

- Converted into residential apartments at a cost of $2m now, and then sold for $3.4m when the conversion is finished in one year.

All of the development projects have the same risk so the required return of each is 10% pa. The table below shows the estimated cash flows and internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cash flow now ($) |

Cash flow in one year ($) |

IRR (% pa) |

| Rent then sell as is | -900,000 | 990,000 | 10 |

| Refurbishment into modern offices | -2,000,000 | 2,400,000 | 20 |

| Conversion into residential apartments | -3,000,000 | 3,400,000 | 13.33 |

Which project should the investor accept?

Question 312 foreign exchange rate, American and European terms

If the current AUD exchange rate is USD 0.9686 = AUD 1, what is the American terms quote of the AUD against the USD?

Question 319 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to keep the policy rate steady at their next meeting.

Then unexpectedly, the RBA announce that they will increase the policy rate by 25 basis points due to fears that the economy is growing too fast and that inflation will be above their target rate of 2 to 3 per cent.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

Question 984 principal agent problem, moral hazard, asymmetric information, no explanation

When does the ‘principal-agent problem’ occur? Is it when:

I. The principal has conflicting incentives (moral hazard);

II. The agent has conflicting incentives (moral hazard);

III. The principal has incomplete information about the agent (asymmetric information); or

IV. The agent has incomplete information about the principal (asymmetric information)?

The principal-agent problem occurs when statements:

Question 810 CAPM, systematic and idiosyncratic risk, market efficiency

Examine the graphs below. Assume that asset A is a single stock. Which of the following statements is NOT correct? Asset A:

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

Assume that the market portfolio has a duration of 15 years and an individual stock has a duration of 20 years.

What can you say about the stock's (single factor CAPM) beta with respect to the market portfolio? The stock's beta is likely to be:

Question 876 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity

Suppose the yield curve in the USA and Germany is flat and the:

- USD federal funds rate at the Federal Reserve is 1% pa;

- EUR deposit facility at the European Central Bank is -0.4% pa (note the negative sign);

- Spot EUR exchange rate is 1 USD per EUR;

- One year forward EUR exchange rate is 1.011 USD per EUR.

You suspect that there’s an arbitrage opportunity. Which one of the following statements about the potential arbitrage opportunity is NOT correct?

Stocks in the United States usually pay quarterly dividends. For example, the software giant Microsoft paid a $0.23 dividend every quarter over the 2013 financial year and plans to pay a $0.28 dividend every quarter over the 2014 financial year.

Using the dividend discount model and net present value techniques, calculate the stock price of Microsoft assuming that:

- The time now is the beginning of July 2014. The next dividend of $0.28 will be received in 3 months (end of September 2014), with another 3 quarterly payments of $0.28 after this (end of December 2014, March 2015 and June 2015).

- The quarterly dividend will increase by 2.5% every year, but each quarterly dividend over the year will be equal. So each quarterly dividend paid in the financial year beginning in September 2015 will be $ 0.287 ##(=0.28×(1+0.025)^1)##, with the last at the end of June 2016. In the next financial year beginning in September 2016 each quarterly dividend will be $0.294175 ##(=0.28×(1+0.025)^2)##, with the last at the end of June 2017, and so on forever.

- The total required return on equity is 6% pa.

- The required return and growth rate are given as effective annual rates.

- Dividend payment dates and ex-dividend dates are at the same time.

- Remember that there are 4 quarters in a year and 3 months in a quarter.

What is the current stock price?

A firm is about to conduct a 2-for-7 rights issue with a subscription price of $10 per share. They haven’t announced the capital raising to the market yet and the share price is currently $13 per share. Assume that every shareholder will exercise their rights, the cash raised will simply be put in the bank, and the rights issue is completed so quickly that the time value of money can be ignored. Disregard signalling, taxes and agency-related effects.

Which of the following statements about the rights issue is NOT correct? After the rights issue is completed:

A moped is a bicycle with pedals and a little motor that can be switched on to assist the rider. Mopeds are useful for quick transport using the motor, and for physical exercise when using the pedals unassisted. This offers the rider:

Question 539 debt terminology, fully amortising loan, bond pricing

A 'fully amortising' loan can also be called a:

A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 851 labour force, no explanation

Below is a table showing some figures about the Australian labour force.

| Australian Labour Force and Employment Data | |

| April 2017 Seasonally Adjusted figures | |

| Employed persons ('000) | 12 061.9 |

| Unemployed persons ('000) | 751.4 |

| Unemployment rate (%) | 5.9 |

| Participation rate (%) | 64.8 |

Source: ABS 6202.0 Labour Force, Australia, Apr 2017

What do you estimate is the size of working age population in thousands (‘000)?

Find Candys Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Candys Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 50 | |

| Operating expense | 10 | |

| Depreciation | 20 | |

| Interest expense | 10 | |

| Income before tax | 110 | |

| Tax at 30% | 33 | |

| Net income | 77 | |

| Candys Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 220 | 180 |

| PPE | ||

| Cost | 300 | 340 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 240 | 300 |

| Total assets | 460 | 480 |

| Liabilities | ||

| Current liabilities | 175 | 190 |

| Non-current liabilities | 135 | 130 |

| Owners' equity | ||

| Retained earnings | 50 | 60 |

| Contributed equity | 100 | 100 |

| Total L and OE | 460 | 480 |

Note: all figures are given in millions of dollars ($m).

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

You just spent $1,000 on your credit card. The interest rate is 24% pa compounding monthly. Assume that your credit card account has no fees and no minimum monthly repayment.

If you can't make any interest or principal payments on your credit card debt over the next year, how much will you owe one year from now?

The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

A stock has a beta of 0.7.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 2%. The risk free rate was unchanged. What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

Read the following financial statements and calculate the firm's free cash flow over the 2014 financial year.

| UBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2014 | ||

| $m | ||

| Sales | 293 | |

| COGS | 200 | |

| Rent expense | 15 | |

| Gas expense | 8 | |

| Depreciation | 10 | |

| EBIT | 60 | |

| Interest expense | 0 | |

| Taxable income | 60 | |

| Taxes | 18 | |

| Net income | 42 | |

| UBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2014 | 2013 |

| $m | $m | |

| Assets | ||

| Cash | 30 | 29 |

| Accounts receivable | 5 | 7 |

| Pre-paid rent expense | 1 | 0 |

| Inventory | 50 | 46 |

| PPE | 290 | 300 |

| Total assets | 376 | 382 |

| Liabilities | ||

| Trade payables | 20 | 18 |

| Accrued gas expense | 3 | 2 |

| Non-current liabilities | 0 | 0 |

| Contributed equity | 212 | 212 |

| Retained profits | 136 | 150 |

| Asset revaluation reserve | 5 | 0 |

| Total L and OE | 376 | 382 |

Note: all figures are given in millions of dollars ($m).

The firm's free cash flow over the 2014 financial year was:

Below is the Australian federal government’s budget balance as a percent of GDP. Note that the columns to the right of the vertical black line were a forecast at the time. The x-axis shows financial years, so for example the 06/07 financial year represents the time period from 1 July 2006 to 30 June 2007.

Comparing the 2008/09 financial year to the previous one, the Australian federal government implemented:

Below is the Australian central bank’s cash rate.

From 2011 to 2017 the Australian central bank has implemented:

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

A company conducts a 10 for 3 stock split. What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

The famous investor Warren Buffett is one of few portfolio managers who appears to have consistently beaten the market. His company Berkshire Hathaway (BRK) appears to have outperformed the US S&P500 market index, shown in the graph below.

Read the below statements about Warren Buffett and the implications for the Efficient Markets Hypothesis (EMH) theory of Eugene Fama. Assume that the first sentence is true. Analyse the second sentence and select the answer option which is NOT correct. In other words, find the false statement in the second sentence.

Question 235 SML, NPV, CAPM, risk

The security market line (SML) shows the relationship between beta and expected return.

Investment projects that plot on the SML would have:

A firm is considering a business project which costs $11m now and is expected to pay a constant $1m at the end of every year forever.

Assume that the initial $11m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use earnings before interest and tax (EBIT).

###\begin{aligned} FFCF &= (EBIT)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ \end{aligned} \\###

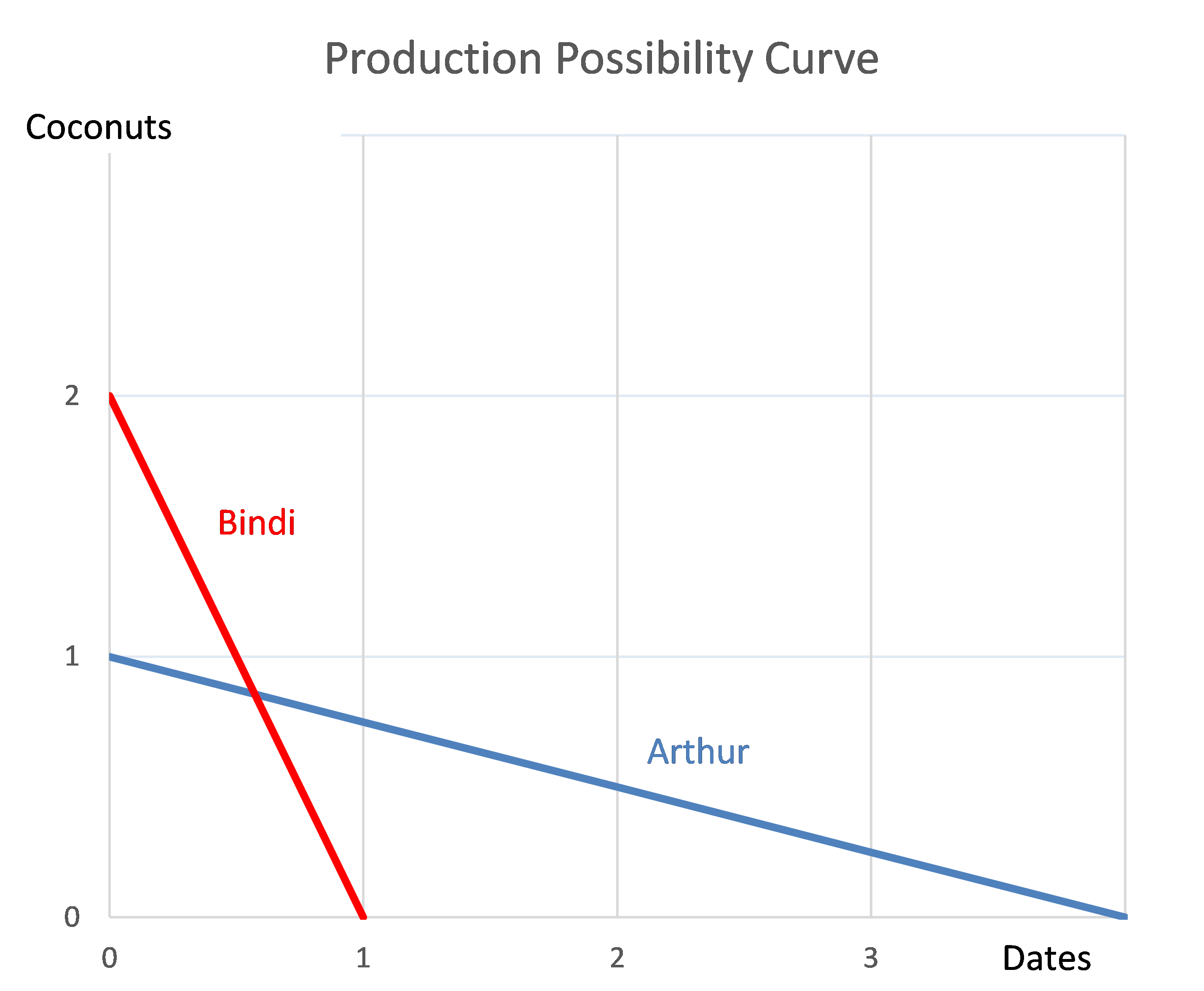

Question 976 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

A highly levered risky firm is trying to raise more debt. The types of debt being considered, in no particular order, are senior bonds, junior bonds, bank accepted bills, promissory notes and bank loans.

Which of these forms of debt is the safest from the perspective of the debt investors who are thinking of investing in the firm's new debt?

Which of the below statements about utility is NOT generally accepted by economists? Most people are thought to:

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100) and maturity (3 years).

The only difference is that bond X and Y's yields are 8 and 12% pa respectively. Which of the following statements is true?

Question 708 continuously compounding rate, continuously compounding rate conversion

Convert a 10% continuously compounded annual rate ##(r_\text{cc annual})## into an effective annual rate ##(r_\text{eff annual})##. The equivalent effective annual rate is:

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Which of the below statements is NOT correct?

Question 721 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Fred owns some Commonwealth Bank (CBA) shares. He has calculated CBA’s monthly returns for each month in the past 20 years using this formula:

###r_\text{t monthly}=\ln \left( \dfrac{P_t}{P_{t-1}} \right)###He then took the arithmetic average and found it to be 1% per month using this formula:

###\bar{r}_\text{monthly}= \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( r_\text{t monthly} \right)} }{T} =0.01=1\% \text{ per month}###He also found the standard deviation of these monthly returns which was 5% per month:

###\sigma_\text{monthly} = \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( \left( r_\text{t monthly} - \bar{r}_\text{monthly} \right)^2 \right)} }{T} =0.05=5\%\text{ per month}###Which of the below statements about Fred’s CBA shares is NOT correct? Assume that the past historical average return is the true population average of future expected returns.

Question 722 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Here is a table of stock prices and returns. Which of the statements below the table is NOT correct?

| Price and Return Population Statistics | ||||

| Time | Prices | LGDR | GDR | NDR |

| 0 | 100 | |||

| 1 | 50 | -0.6931 | 0.5 | -0.5 |

| 2 | 100 | 0.6931 | 2 | 1 |

| Arithmetic average | 0 | 1.25 | 0.25 | |

| Arithmetic standard deviation | 0.9802 | 1.0607 | 1.0607 | |

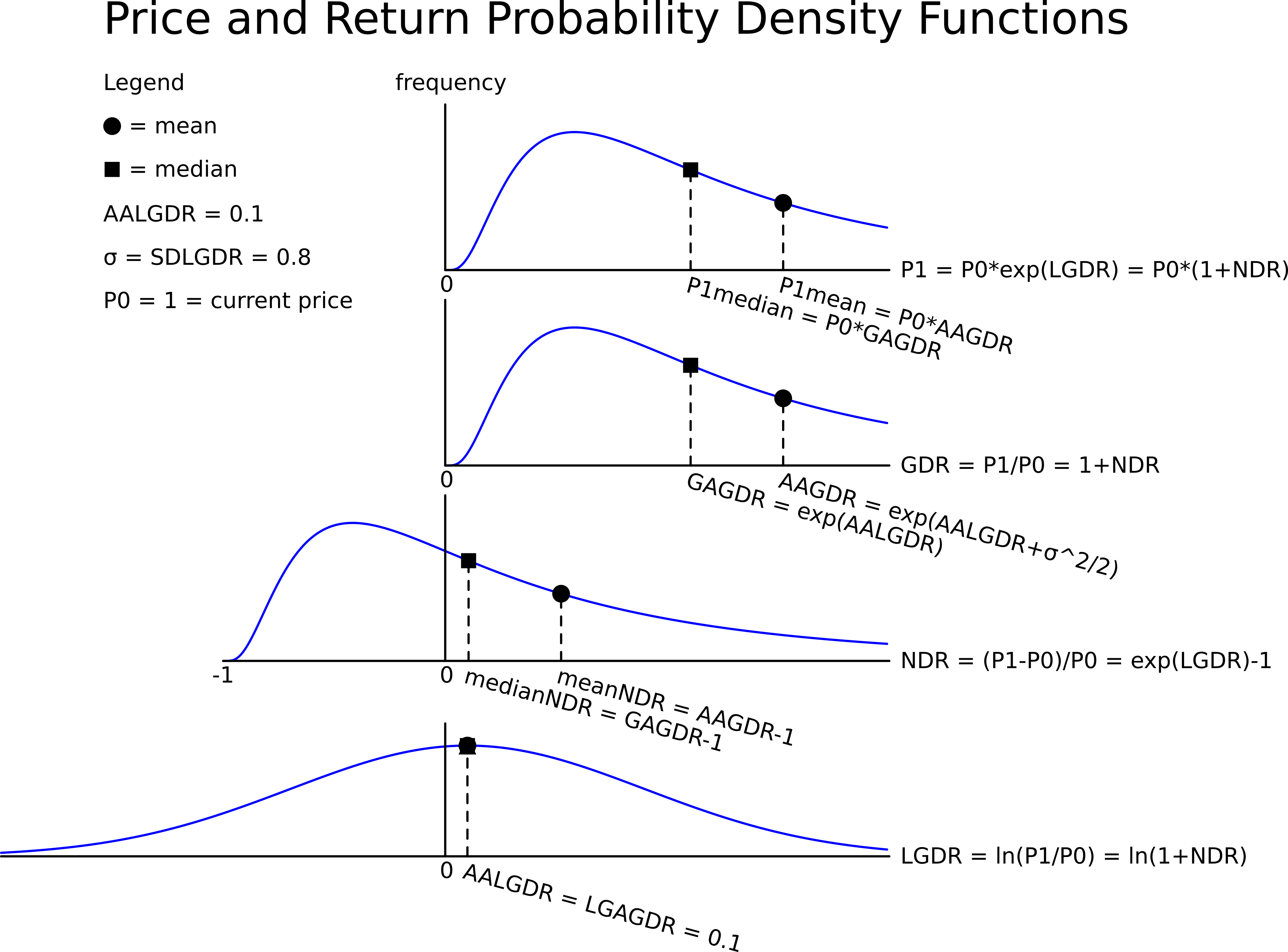

Question 719 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

A stock has an arithmetic average continuously compounded return (AALGDR) of 10% pa, a standard deviation of continuously compounded returns (SDLGDR) of 80% pa and current stock price of $1. Assume that stock prices are log-normally distributed. The graph below summarises this information and provides some helpful formulas.

In one year, what do you expect the median and mean prices to be? The answer options are given in the same order.

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates. What is the current price of the stock?

Question 968 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity, no explanation

Below is a graph showing the spread or difference between government bond yields in different countries compared to the US. Assume that all governments have zero credit risk.

According to the principle of cross-currency interest rate parity, which country is likely to have the greatest expected currency appreciation against the USD over the next 2 years?

You're considering a business project which costs $11m now and is expected to pay a single cash flow of $11m in one year. So you pay $11m now, then one year later you receive $11m.

Assume that the initial $11m cost is funded using the your firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about the net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Question 859 money supply, no explanation

The below table shows Australian monetary aggregates. Note that ‘M3’ is the sum of all the figures in the table and ‘ADI’ stands for Authorised Deposit-taking Institution such as a bank, building society or credit union.

| Australian Monetary Aggregates | ||||||

| March 2017, AUD billions | ||||||

| Currency | Current deposits with banks |

Certificates of deposit issued by banks |

Term deposits with banks |

Other deposits with banks |

Deposits with non-bank ADIs |

M3 |

| 69.3 | 271.6 | 207.2 | 562.3 | 838.7 | 36.9 | 1986.0 |

Source: RBA Statistical Table D3 Monetary Aggregates.

Which of the following statements is NOT correct?

A company issues a large amount of bonds to raise money for new projects of similar risk to the company's existing projects. The net present value (NPV) of the new projects is positive but small. Assume a classical tax system. Which statement is NOT correct?

Question 882 Asian currency crisis, foreign exchange rate, original sin, no explanation

In the 1997 Asian currency crisis, the businesses most vulnerable to bankruptcy were those that:

Which of the following decisions relates to the current assets and current liabilities of the firm?

Which of the following statements about an asset’s standard deviation of returns is NOT correct? All other things remaining equal, the higher the asset’s standard deviation of returns:

A firm can issue 5 year annual coupon bonds at a yield of 8% pa and a coupon rate of 12% pa.

The beta of its levered equity is 1. Five year government bonds yield 5% pa with a coupon rate of 6% pa. The market's expected dividend return is 4% pa and its expected capital return is 6% pa.

The firm's debt-to-equity ratio is 2:1. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

Which of the following statements about short-selling is NOT true?

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's approximate payout ratio over the 2014 financial year?

Note that the firm's interim and final dividends were $1.83 and $2.18 respectively over the 2014 financial year.

Which of the following is NOT the Australian central bank’s responsibility?

A share currently worth $100 is expected to pay a constant dividend of $4 for the next 5 years with the first dividend in one year (t=1) and the last in 5 years (t=5).

The total required return is 10% pa.

What do you expected the share price to be in 5 years, just after the dividend at that time has been paid?

A company's shares just paid their annual dividend of $2 each.

The stock price is now $40 (just after the dividend payment). The annual dividend is expected to grow by 3% every year forever. The assumptions of the dividend discount model are valid for this company.

What do you expect the effective annual dividend yield to be in 3 years (dividend yield from t=3 to t=4)?

Question 246 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity

Suppose the Australian cash rate is expected to be 8.15% pa and the US federal funds rate is expected to be 3.00% pa over the next 2 years, both given as nominal effective annual rates. The current exchange rate is at parity, so 1 USD = 1 AUD.

What is the implied 2 year forward foreign exchange rate?

The Chinese government attempts to fix its exchange rate against the US dollar and at the same time use monetary policy to fix its interest rate at a set level.

To be able to fix its exchange rate and interest rate in this way, what does the Chinese government actually do?

- Adopts capital controls to prevent financial arbitrage by private firms and individuals.

- Adopts the same interest rate (monetary policy) as the United States.

- Fixes inflation so that the domestic real interest rate is equal to the United States' real interest rate.

Which of the above statements is or are true?

Question 322 foreign exchange rate, monetary policy, American and European terms

The market expects the Reserve Bank of Australia (RBA) to decrease the policy rate by 25 basis points at their next meeting.

Then unexpectedly, the RBA announce that they will decrease the policy rate by 50 basis points due to fears of a recession and deflation.

What do you expect to happen to Australia's exchange rate? The Australian dollar will:

Question 873 Sharpe ratio, Treynor ratio, Jensens alpha, SML, CAPM

Which of the following statements is NOT correct? Fairly-priced assets should:

Which one of the following statements is NOT correct? A 1-for-4 bonus issue:

Question 538 bond pricing, income and capital returns, no explanation

Risk-free government bonds that have coupon rates greater than their yields:

Question 419 capital budgeting, NPV, interest tax shield, WACC, CFFA, CAPM, no explanation

| Project Data | ||

| Project life | 1 year | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $6m | |

| Expected sale price of equipment at end of project | 0 | |

| Unit sales per year | 9m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $6 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense in first year (at t=1) | $0.53m | |

| Tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 6% | |

| Market portfolio return | 10% | |

| Covariance of levered equity returns with market | 0.08 | |

| Variance of market portfolio returns | 0.16 | |

| Firm's and project's debt-to-assets ratio | 50% | |

Notes

- Due to the project, current assets will increase by $5m now (t=0) and fall by $5m at the end (t=1). Current liabilities will not be affected.

Assumptions

- The debt-to-assets ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio.

- Millions are represented by 'm'.

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 2% pa.

- All rates are given as effective annual rates.

- The 50% capital gains tax discount is not available since the project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

Bonds A and B are issued by the same Australian company. Both bonds yield 7% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond A pays coupons of 10% pa and bond B pays coupons of 5% pa. Which of the following statements is true about the bonds' prices?

A $100 stock has a continuously compounded expected total return of 10% pa. Its dividend yield is 2% pa with continuous compounding. What do you expect its price to be in one year?

A company has:

- 50 million shares outstanding.

- The market price of one share is currently $6.

- The risk-free rate is 5% and the market return is 10%.

- Market analysts believe that the company's ordinary shares have a beta of 2.

- The company has 1 million preferred stock which have a face (or par) value of $100 and pay a constant dividend of 10% of par. They currently trade for $80 each.

- The company's debentures are publicly traded and their market price is equal to 90% of their face value.

- The debentures have a total face value of $60,000,000 and the current yield to maturity of corporate debentures is 10% per annum. The corporate tax rate is 30%.

What is the company's after-tax weighted average cost of capital (WACC)? Assume a classical tax system.

Question 323 foreign exchange rate, monetary policy, American and European terms

The market expects the Reserve Bank of Australia (RBA) to increase the policy rate by 25 basis points at their next meeting.

As expected, the RBA increases the policy rate by 25 basis points.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar will:

Question 320 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to decrease the overnight cash rate at their next meeting.

Then unexpectedly, the RBA announce that they will keep the policy rate unchanged.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

The perpetuity with growth equation is:

###P_0=\dfrac{C_1}{r-g}###

Which of the following is NOT equal to the expected capital return as an effective annual rate?

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

Question 875 omitted variable bias, systematic and idiosyncratic risk, CAPM, single factor model, two factor model

The Capital Asset Pricing Model (CAPM) and the Single Index Model (SIM) are single factor models whose only risk factor is the market portfolio’s return. Say a Solar electricity generator company and a Beach bathing chair renting company are influenced by two factors, the market portfolio return and cloud cover in the sky. When it's sunny and not cloudy, both the Solar and Beach companies’ stock prices do well. When there’s dense cloud cover and no sun, both do poorly. Assume that cloud coverage risk is a systematic risk that cannot be diversified and that cloud cover has zero correlation with the market portfolio’s returns.

Which of the following statements about these two stocks is NOT correct?

The CAPM and SIM:

A firm's weighted average cost of capital before tax (##r_\text{WACC before tax}##) would increase due to:

The equations for Net Income (NI, also known as Earnings or Net Profit After Tax) and Cash Flow From Assets (CFFA, also known as Free Cash Flow to the Firm) per year are:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

For a firm with debt, what is the formula for the present value of interest tax shields if the tax shields occur in perpetuity?

You may assume:

- the value of debt (D) is constant through time,

- The cost of debt and the yield on debt are equal and given by ##r_D##.

- the appropriate rate to discount interest tax shields is ##r_D##.

- ##\text{IntExp}=D.r_D##

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

Question 213 income and capital returns, bond pricing, premium par and discount bonds

The coupon rate of a fixed annual-coupon bond is constant (always the same).

What can you say about the income return (##r_\text{income}##) of a fixed annual coupon bond? Remember that:

###r_\text{total} = r_\text{income} + r_\text{capital}###

###r_\text{total, 0 to 1} = \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0}###

Assume that there is no change in the bond's total annual yield to maturity from when it is issued to when it matures.

Select the most correct statement.

From its date of issue until maturity, the income return of a fixed annual coupon:

Find Ching-A-Lings Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Ching-A-Lings Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 20 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 30 | |

| Taxes at 30% | 9 | |

| Net income | 21 | |

| Ching-A-Lings Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 49 | 38 |

| Trade debtors | 14 | 2 |

| Rent paid in advance | 5 | 5 |

| PPE | 400 | 400 |

| Total assets | 468 | 445 |

| Trade creditors | 4 | 10 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 145 | 145 |

| Retained profits | 119 | 100 |

| Total L and OE | 468 | 445 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Below is a graph of the USD against the JPY and EUR from 1980 to 2015, compiled by the RBA. Select the correct statement about what occurred between 1980 and 2015. Note that in 1980 the euro was around 1.3 USD per EUR and the Yen was around 250 JPY per USD.

Suppose the current Australian exchange rate is 0.8 USD per AUD.

If you think that the AUD will appreciate against the USD, contrary to the rest of the market, how could you profit? Right now you should:

A firm wishes to raise $100 million now. The firm's current market value of equity is $300m and the market price per share is $5. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $4. All answers are rounded to 6 decimal places. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

Find World Bar's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| World Bar | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 300 | |

| COGS | 150 | |

| Operating expense | 50 | |

| Depreciation | 40 | |

| Interest expense | 10 | |

| Taxable income | 50 | |

| Tax at 30% | 15 | |

| Net income | 35 | |

| World Bar | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 200 | 230 |

| PPE | ||

| Cost | 400 | 400 |

| Accumul. depr. | 75 | 35 |

| Carrying amount | 325 | 365 |

| Total assets | 525 | 595 |

| Liabilities | ||

| Current liabilities | 150 | 205 |

| Non-current liabilities | 235 | 250 |

| Owners' equity | ||

| Retained earnings | 100 | 100 |

| Contributed equity | 40 | 40 |

| Total L and OE | 525 | 595 |

Note: all figures above and below are given in millions of dollars ($m).

Question 920 SML, CAPM, Sharpe ratio, Treynor ratio, Jensens alpha, no explanation

Over-priced assets should NOT:

A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will be generated in one year from now. Note that ‘k’ means kilo or 1,000. So the $30k is $30,000.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $30k | Operating free cash flow |

| ##g## | 1.5% pa | Growth rate of OFCF |

| ##r_\text{D}## | 4% pa | Cost of debt |

| ##r_\text{EL}## | 16.3% pa | Cost of levered equity |

| ##D/V_L## | 80% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

| ##n_\text{shares}## | 100k | Number of shares |

Which of the following statements is NOT correct?

Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

To receive the dividend you must own the stock when the market closes on which date?

You deposit money into a bank. Which of the following statements is NOT correct? You:

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

A firm conducts a two-for-one stock split. Which of the following consequences would NOT be expected?

Question 218 NPV, IRR, profitability index, average accounting return

Which of the following statements is NOT correct?

Which of the following is NOT a valid method for estimating the beta of a company's stock? Assume that markets are efficient, a long history of past data is available, the stock possesses idiosyncratic and market risk. The variances and standard deviations below denote total risks.

A very low-risk stock just paid its semi-annual dividend of $0.14, as it has for the last 5 years. You conservatively estimate that from now on the dividend will fall at a rate of 1% every 6 months.

If the stock currently sells for $3 per share, what must be its required total return as an effective annual rate?

If risk free government bonds are trading at a yield of 4% pa, given as an effective annual rate, would you consider buying or selling the stock?

The stock's required total return is:

Which one of the following businesses is likely to be a public company in Australia, judging by its name?

A stock's total standard deviation of returns is 20% pa. The market portfolio's total standard deviation of returns is 15% pa. The beta of the stock is 0.8.

What is the stock's diversifiable standard deviation?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

Question 667 forward foreign exchange rate, foreign exchange rate, cross currency interest rate parity, no explanation

The Australian cash rate is expected to be 2% pa over the next one year, while the US cash rate is expected to be 0% pa, both given as nominal effective annual rates. The current exchange rate is 0.73 USD per AUD.

What is the implied 1 year USD per AUD forward foreign exchange rate?

Question 973 foreign exchange rate, monetary policy, no explanation