The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

Your credit card shows a $600 debt liability. The interest rate is 24% pa, payable monthly. You can't pay any of the debt off, except in 6 months when it's your birthday and you'll receive $50 which you'll use to pay off the credit card. If that is your only repayment, how much will the credit card debt liability be one year from now?

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Question 494 franking credit, personal tax on dividends, imputation tax system

A firm pays a fully franked cash dividend of $100 to one of its Australian shareholders who has a personal marginal tax rate of 15%. The corporate tax rate is 30%.

What will be the shareholder's personal tax payable due to the dividend payment?

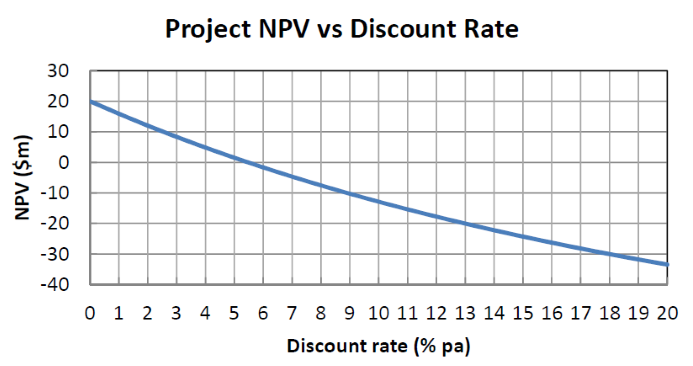

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

Question 513 stock split, reverse stock split, stock dividend, bonus issue, rights issue

Which of the following statements is NOT correct?

In 2014 the median starting salaries of male and female Australian bachelor degree accounting graduates aged less than 25 years in their first full-time industry job was $50,000 before tax, according to Graduate Careers Australia. See page 9 of this report. Personal income tax rates published by the Australian Tax Office are reproduced for the 2014-2015 financial year in the table below.

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $80,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $80,001 – $180,000 | $17,547 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,547 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%. Exclude the Medicare levy from your calculations

How much personal income tax would you have to pay per year if you earned $50,000 per annum before-tax?

A trader buys one crude oil European style put option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the: