The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Net Present Value (NPV) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

Question 327 bill pricing, simple interest rate, no explanation

On 27/09/13, three month Swiss government bills traded at a yield of -0.2%, given as a simple annual yield. That is, interest rates were negative.

If the face value of one of these 90 day bills is CHF1,000,000 (CHF represents Swiss Francs, the Swiss currency), what is the price of one of these bills?

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

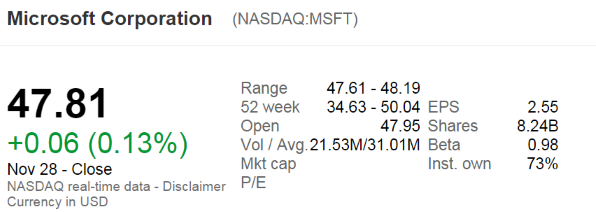

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

In the dividend discount model (DDM), share prices fall when dividends are paid. Let the high price before the fall be called the peak, and the low price after the fall be called the trough.

###P_0=\dfrac{C_1}{r-g}###

Which of the following statements about the DDM is NOT correct?

Question 888 foreign exchange rate, speculation, no explanation

The current Australian exchange rate is 0.8 USD per AUD.

If you think that the AUD will depreciate against the USD, contrary to the rest of the market, how could you profit? Right now you should:

You work for XYZ company and you’ve been asked to evaluate a new project which has double the systematic risk of the company’s other projects.

You use the Capital Asset Pricing Model (CAPM) formula and input the treasury yield ##(r_f )##, market risk premium ##(r_m-r_f )## and the company’s asset beta risk factor ##(\beta_{XYZ} )## into the CAPM formula which outputs a return.

This return that you’ve just found is:

The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

A stock has a beta of 0.7.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 2%. The risk free rate was unchanged. What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

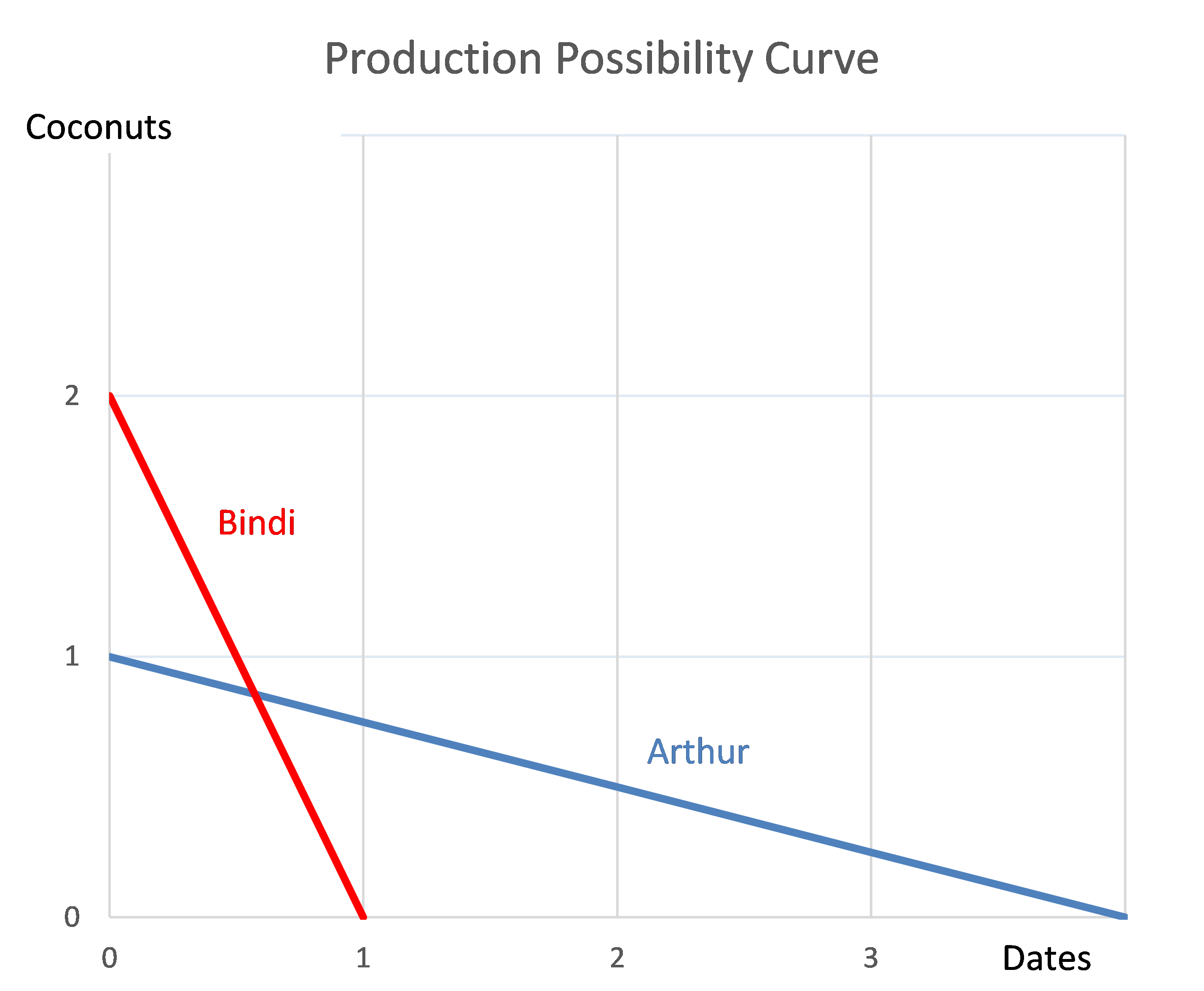

Question 976 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?