Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

Diversification in a portfolio of two assets works best when the correlation between their returns is:

Question 442 economic depreciation, no explanation

A fairly valued share's current price is $4 and it has a total required return of 30%. Dividends are paid annually and next year's dividend is expected to be $1. After that, dividends are expected to grow by 5% pa. All rates are effective annual returns.

What is the expected dividend cash flow, economic depreciation, and economic income and economic value added (EVA) that will be earned over the second year (from t=1 to t=2) and paid at the end of that year (t=2)?

Question 472 quick ratio, accounting ratio

A firm has current assets totaling $1.5b of which cash is $0.25b and inventories is $0.5b. Current liabilities total $2b of which accounts payable is $1b.

What is the firm's quick ratio, also known as the acid test ratio?

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

RBA analyst Adam Hamilton wrote in the December 2018 Bulletin article ‘Understanding Exchange Rates and Why They Are Important’ the following passage about bilateral exchange rates:

A bilateral exchange rate refers to the value of one currency relative to another. It is the most commonly referenced type of exchange rate. Most bilateral exchange rates are quoted against the US dollar (USD), as it is the most traded currency globally. Looking at the Australian dollar (AUD), the AUD/USD exchange rate gives you the amount of US dollars that you will receive for each Australian dollar that you convert (or sell). For example, an AUD/USD exchange rate of 0.75 means that you will get US75 cents for every 1 AUD.

An appreciation of the Australian dollar is an increase in its value compared with a foreign currency. This means that each Australian dollar buys you more foreign currency than before. Equivalently, if you are buying an item that is priced in foreign currency it will now cost you less in Australian dollars than before. If there is a depreciation of the Australian dollar, the opposite is true.

Based on this information, which of the following statements is NOT correct?

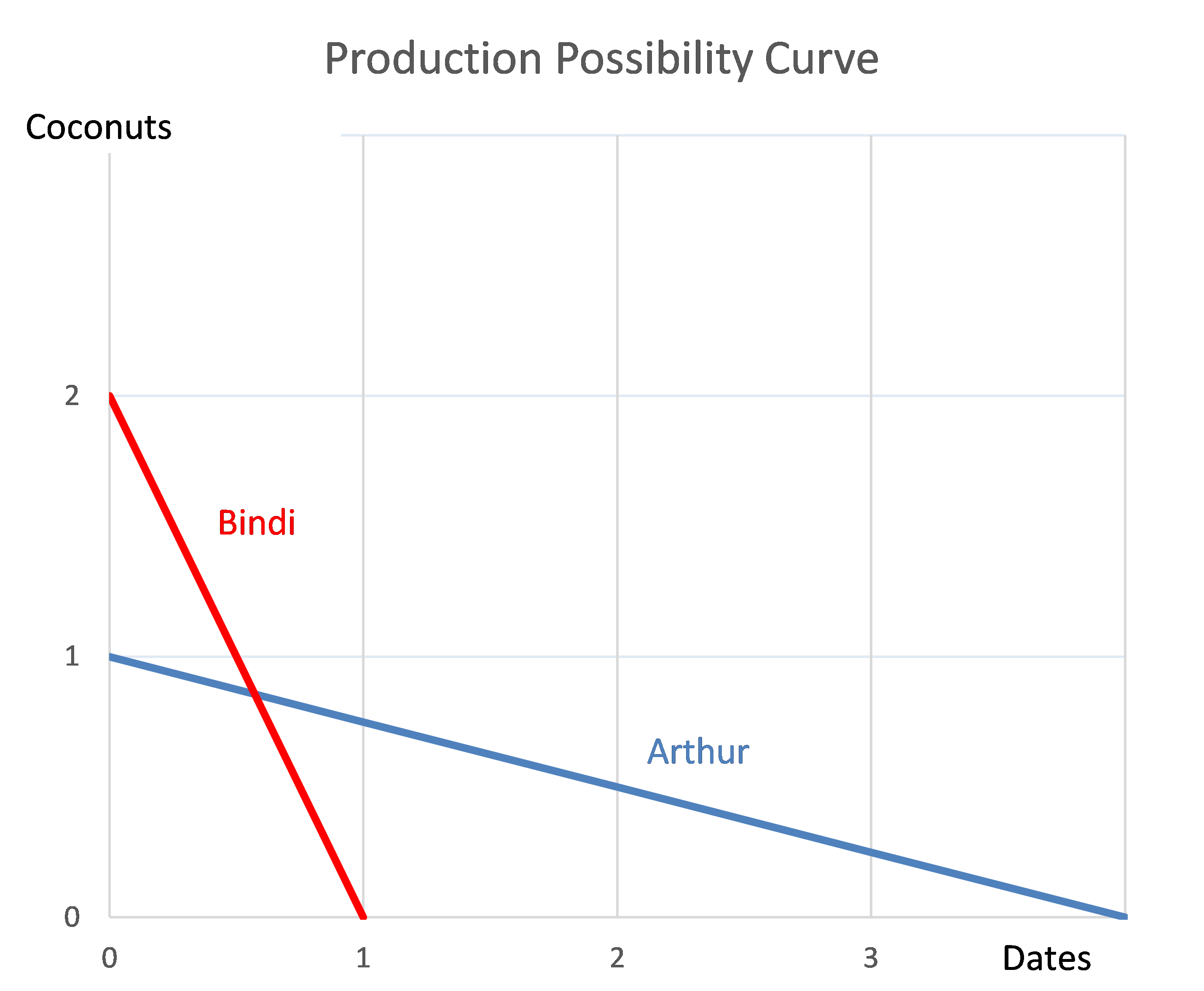

Question 975 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Arthur can pick 1 coconut per hour, 4 dates per hour or any linear combination of coconuts and dates. For example, he could pick 0.5 coconuts and 2 dates per hour.

Bindi can pick 2 coconuts per hour, 1 date per hour or any linear combination. For example, she could pick 0.5 coconuts and 0.75 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Arthur | 1 | 4 |

| Bindi | 2 | 1 |

Which of the following statements is NOT correct?