Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

A newly floated farming company is financed with senior bonds, junior bonds, cumulative non-voting preferred stock and common stock. The new company has no retained profits and due to floods it was unable to record any revenues this year, leading to a loss. The firm is not bankrupt yet since it still has substantial contributed equity (same as paid-up capital).

On which securities must it pay interest or dividend payments in this terrible financial year?

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

Fundamentalists who analyse company financial reports and news announcements (but who don't have inside information) will make positive abnormal returns if:

A 90-day $1 million Bank Accepted Bill (BAB) was bought for $990,000 and sold 30 days later for $996,000 (at t=30 days).

What was the total return, capital return and income return over the 30 days it was held?

Despite the fact that money market instruments such as bills are normally quoted with simple interest rates, please calculate your answers as compound interest rates, specifically, as effective 30-day rates, which is how the below answer choices are listed.

##r_\text{total}##, ##r_\text{capital}##, ## r_\text{income}##

Question 320 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to decrease the overnight cash rate at their next meeting.

Then unexpectedly, the RBA announce that they will keep the policy rate unchanged.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

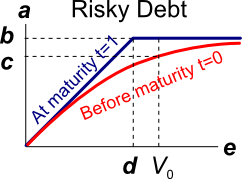

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Bob buys a future from Chris.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

Question 720 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

A stock has an arithmetic average continuously compounded return (AALGDR) of 10% pa, a standard deviation of continuously compounded returns (SDLGDR) of 80% pa and current stock price of $1. Assume that stock prices are log-normally distributed.

In 5 years, what do you expect the median and mean prices to be? The answer options are given in the same order.