Question 50 DDM, stock pricing, inflation, real and nominal returns and cash flows

Most listed Australian companies pay dividends twice per year, the 'interim' and 'final' dividends, which are roughly 6 months apart.

You are an equities analyst trying to value the company BHP. You decide to use the Dividend Discount Model (DDM) as a starting point, so you study BHP's dividend history and you find that BHP tends to pay the same interim and final dividend each year, and that both grow by the same rate.

You expect BHP will pay a $0.55 interim dividend in six months and a $0.55 final dividend in one year. You expect each to grow by 4% next year and forever, so the interim and final dividends next year will be $0.572 each, and so on in perpetuity.

Assume BHP's cost of equity is 8% pa. All rates are quoted as nominal effective rates. The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What is the current price of a BHP share?

A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

An equity index is currently at 5,000 points. The 2 year futures price is 5,400 points and the total required return is 8% pa with continuous compounding. Each index point is worth $25.

What is the implied continuous dividend yield as a continuously compounded rate per annum?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

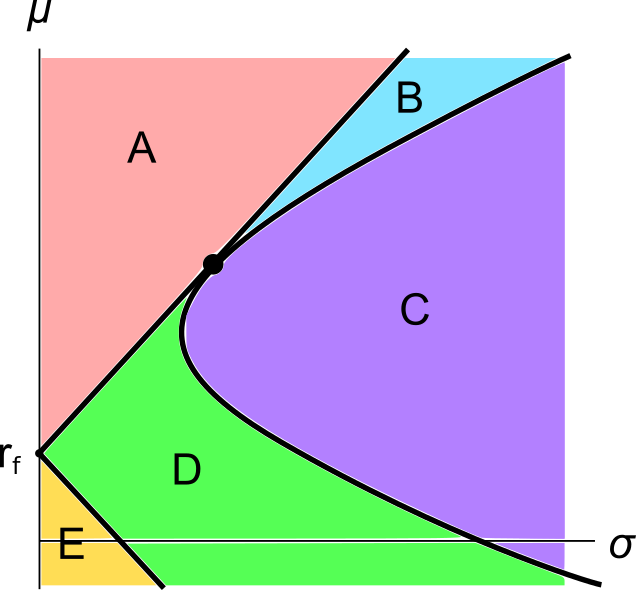

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the below diagram.

Each letter corresponds to a separate coloured area. The portfolios at the boundary of the areas, on the black lines, are excluded from each area. Assume that all assets represented in this graph are fairly priced, and that all risky assets can be short-sold.

Which of the following statements about this graph and Markowitz portfolio theory is NOT correct?

Question 823 option, option payoff at maturity, option profit, no explanation

A European call option should only be exercised if:

A stock has a beta of 1.2. Its next dividend is expected to be $20, paid one year from now.

Dividends are expected to be paid annually and grow by 1.5% pa forever.

Treasury bonds yield 3% pa and the market portfolio's expected return is 7% pa. All returns are effective annual rates.

What is the price of the stock now?