A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0 | 6 | 12 | 18 | 20 | ... |

After year 4, the dividend will grow in perpetuity at 5% pa. The required return of the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

If all of the dividends since time period zero were deposited into a bank account yielding 8% pa as an effective annual rate, how much money will be in the bank account in 2.5 years (in other words, at t=2.5)?

You're advising your superstar client 40-cent who is weighing up buying a private jet or a luxury yacht. 40-cent is just as happy with either, but he wants to go with the more cost-effective option. These are the cash flows of the two options:

- The private jet can be bought for $6m now, which will cost $12,000 per month in fuel, piloting and airport costs, payable at the end of each month. The jet will last for 12 years.

- Or the luxury yacht can be bought for $4m now, which will cost $20,000 per month in fuel, crew and berthing costs, payable at the end of each month. The yacht will last for 20 years.

What's unusual about 40-cent is that he is so famous that he will actually be able to sell his jet or yacht for the same price as it was bought since the next generation of superstar musicians will buy it from him as a status symbol.

Bank interest rates are 10% pa, given as an effective annual rate. You can assume that 40-cent will live for another 60 years and that when the jet or yacht's life is at an end, he will buy a new one with the same details as above.

Would you advise 40-cent to buy the or the ?

Note that the effective monthly rate is ##r_\text{eff monthly}=(1+0.1)^{1/12}-1=0.00797414##

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

The CAPM can be used to find a business's expected opportunity cost of capital:

###r_i=r_f+β_i (r_m-r_f)###

What should be used as the risk free rate ##r_f##?

A semi-annual coupon bond has a yield of 3% pa. Which of the following statements about the yield is NOT correct? All rates are given to four decimal places.

A trader buys a one year futures contract on crude oil. The contract is for the delivery of 1,000 barrels. The current futures price is $38.94 per barrel. The initial margin is $3,410 per contract, and the maintenance margin is $3,100 per contract.

What is the smallest price change that would lead to a margin call for the buyer?

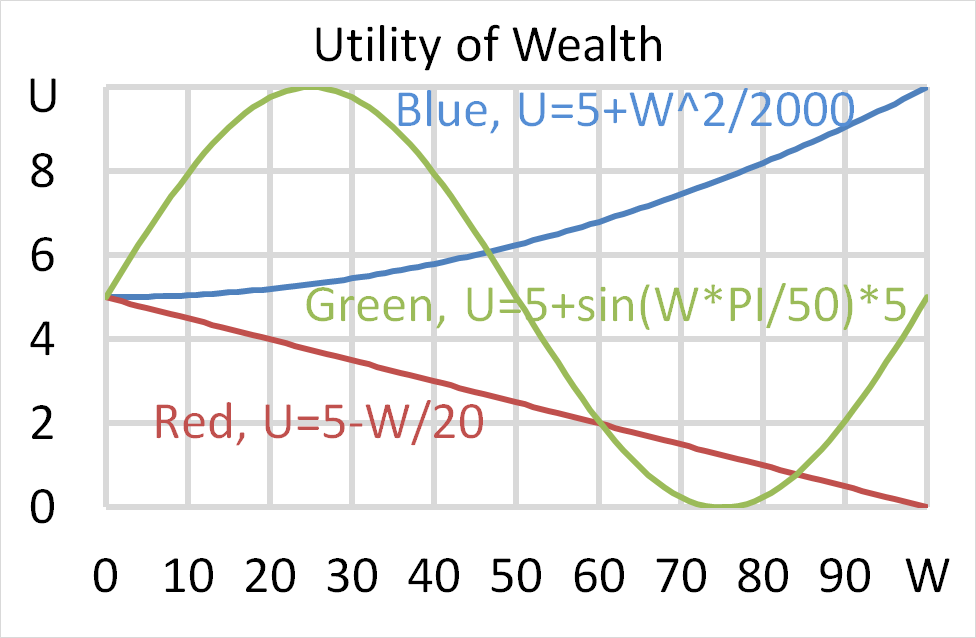

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

When does a European option's last-traded market price become a sunk cost?