A three year project's NPV is negative. The cash flows of the project include a negative cash flow at the very start and positive cash flows over its short life. The required return of the project is 10% pa. Select the most correct statement.

A two year Government bond has a face value of $100, a yield of 2.5% pa and a fixed coupon rate of 0.5% pa, paid semi-annually. What is its price?

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

Bonds A and B are issued by the same Australian company. Both bonds yield 7% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond A pays coupons of 10% pa and bond B pays coupons of 5% pa. Which of the following statements is true about the bonds' prices?

Question 249 equivalent annual cash flow, effective rate conversion

Details of two different types of desserts or edible treats are given below:

- High-sugar treats like candy, chocolate and ice cream make a person very happy. High sugar treats are cheap at only $2 per day.

- Low-sugar treats like nuts, cheese and fruit make a person equally happy if these foods are of high quality. Low sugar treats are more expensive at $4 per day.

The advantage of low-sugar treats is that a person only needs to pay the dentist $2,000 for fillings and root canal therapy once every 15 years. Whereas with high-sugar treats, that treatment needs to be done every 5 years.

The real discount rate is 10%, given as an effective annual rate. Assume that there are 365 days in every year and that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the equivalent annual cash flow (EAC) of the high-sugar treats and low-sugar treats, including dental costs. The below choices are listed in that order.

Ignore the pain of dental therapy, personal preferences and other factors.

A 90-day $1 million Bank Accepted Bill (BAB) was bought for $990,000 and sold 30 days later for $996,000 (at t=30 days).

What was the total return, capital return and income return over the 30 days it was held?

Despite the fact that money market instruments such as bills are normally quoted with simple interest rates, please calculate your answers as compound interest rates, specifically, as effective 30-day rates, which is how the below answer choices are listed.

##r_\text{total}##, ##r_\text{capital}##, ## r_\text{income}##

A trader buys one crude oil futures contract on the CME expiring in one year with a locked-in futures price of $38.94 per barrel. If the trader doesn’t close out her contract before expiry then in one year she will have the:

Question 744 income and capital returns, real and nominal returns and cash flows, inflation

If someone says "my shares rose by 10% last year", what do you assume that they mean? The effective annual:

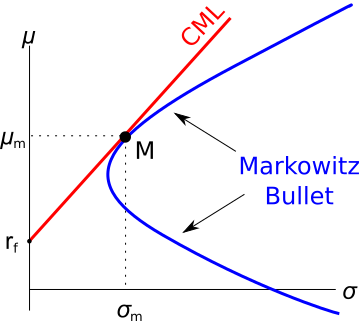

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 798 idiom, diversification, market efficiency, sunk cost, no explanation

The following quotes are most closely related to which financial concept?

- “Opportunity is missed by most people because it is dressed in overalls and looks like work” -Thomas Edison

- “The only place where success comes before work is in the dictionary” -Vidal Sassoon

- “The safest way to double your money is to fold it over and put it in your pocket” - Kin Hubbard