A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.15 | 1.10 | 1.05 | 1.00 | ... |

After year 4, the annual dividend will grow in perpetuity at -5% pa. Note that this is a negative growth rate, so the dividend will actually shrink. So,

- the dividend at t=5 will be ##$1(1-0.05) = $0.95##,

- the dividend at t=6 will be ##$1(1-0.05)^2 = $0.9025##, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

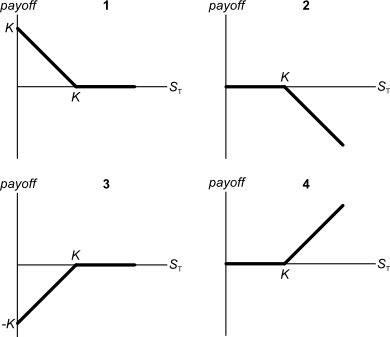

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

The accounting identity states that the book value of a company's assets (A) equals its liabilities (L) plus owners equity (OE), so A = L + OE.

The finance version states that the market value of a company's assets (V) equals the market value of its debt (D) plus equity (E), so V = D + E.

Therefore a business's assets can be seen as a portfolio of the debt and equity that fund the assets.

Let ##\sigma_\text{V total}^2## be the total variance of returns on assets, ##\sigma_\text{V syst}^2## be the systematic variance of returns on assets, and ##\sigma_\text{V idio}^2## be the idiosyncratic variance of returns on assets, and ##\rho_\text{D idio, E idio}## be the correlation between the idiosyncratic returns on debt and equity.

Which of the following equations is NOT correct?

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

An equity index is currently at 5,200 points. The 6 month futures price is 5,300 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

An equity index is currently at 4,800 points. The 1.5 year futures price is 5,100 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

Question 834 option, delta, theta, gamma, standard deviation, Black-Scholes-Merton option pricing

Which of the following statements about an option (either a call or put) and its underlying stock is NOT correct?

| European Call Option | ||

| on a non-dividend paying stock | ||

| Description | Symbol | Quantity |

| Spot price ($) | ##S_0## | 20 |

| Strike price ($) | ##K_T## | 18 |

| Risk free cont. comp. rate (pa) | ##r## | 0.05 |

| Standard deviation of the stock's cont. comp. returns (pa) | ##\sigma## | 0.3 |

| Option maturity (years) | ##T## | 1 |

| Call option price ($) | ##c_0## | 3.939488 |

| Delta | ##\Delta = N[d_1]## | 0.747891 |

| ##N[d_2]## | ##N[d_2]## | 0.643514 |

| Gamma | ##\Gamma## | 0.053199 |

| Theta ($/year) | ##\Theta = \partial c / \partial T## | 1.566433 |

Question 915 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For a share price to double over 7 years, what must its capital return be as an effective annual rate?