A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.15 | 1.10 | 1.05 | 1.00 | ... |

After year 4, the annual dividend will grow in perpetuity at -5% pa. Note that this is a negative growth rate, so the dividend will actually shrink. So,

- the dividend at t=5 will be ##$1(1-0.05) = $0.95##,

- the dividend at t=6 will be ##$1(1-0.05)^2 = $0.9025##, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0 | 6 | 12 | 18 | 20 | ... |

After year 4, the dividend will grow in perpetuity at 5% pa. The required return of the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in 7 years (t = 7), just after the dividend at that time has been paid?

A 2 year corporate bond yields 3% pa with a coupon rate of 5% pa, paid semi-annually.

Find the effective monthly rate, effective six month rate, and effective annual rate.

##r_\text{eff monthly}##, ##r_\text{eff 6 month}##, ##r_\text{eff annual}##.

Read the following financial statements and calculate the firm's free cash flow over the 2014 financial year.

| UBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2014 | ||

| $m | ||

| Sales | 293 | |

| COGS | 200 | |

| Rent expense | 15 | |

| Gas expense | 8 | |

| Depreciation | 10 | |

| EBIT | 60 | |

| Interest expense | 0 | |

| Taxable income | 60 | |

| Taxes | 18 | |

| Net income | 42 | |

| UBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2014 | 2013 |

| $m | $m | |

| Assets | ||

| Cash | 30 | 29 |

| Accounts receivable | 5 | 7 |

| Pre-paid rent expense | 1 | 0 |

| Inventory | 50 | 46 |

| PPE | 290 | 300 |

| Total assets | 376 | 382 |

| Liabilities | ||

| Trade payables | 20 | 18 |

| Accrued gas expense | 3 | 2 |

| Non-current liabilities | 0 | 0 |

| Contributed equity | 212 | 212 |

| Retained profits | 136 | 150 |

| Asset revaluation reserve | 5 | 0 |

| Total L and OE | 376 | 382 |

Note: all figures are given in millions of dollars ($m).

The firm's free cash flow over the 2014 financial year was:

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 664 real and nominal returns and cash flows, inflation, no explanation

What is the present value of real payments of $100 every year forever, with the first payment in one year? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

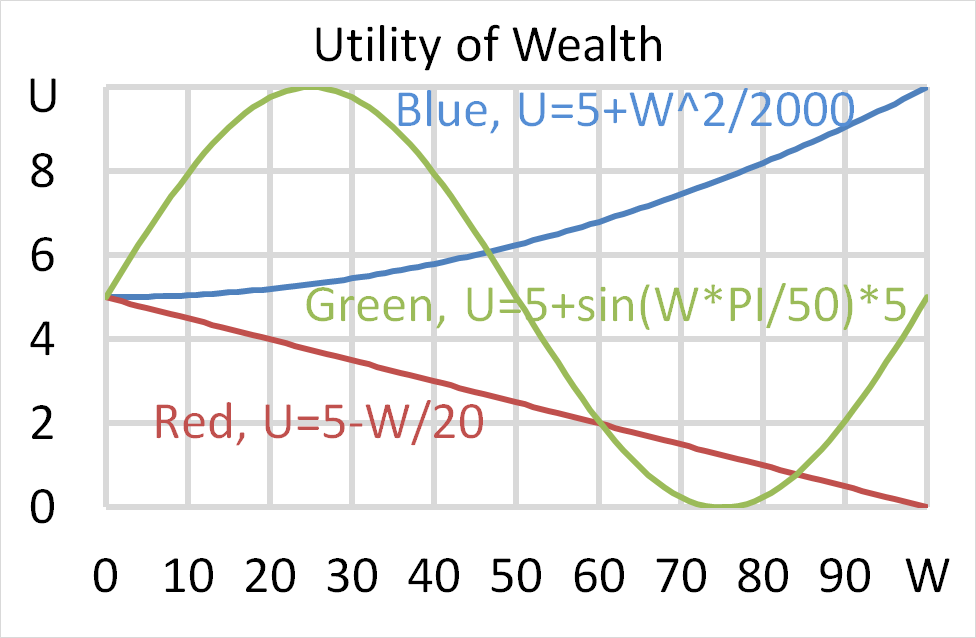

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

A home loan company advertises an interest rate of 4.5% pa, payable monthly. Which of the following statements about the interest rate is NOT correct?

Question 759 time calculation, fully amortising loan, no explanation

Five years ago you entered into a fully amortising home loan with a principal of $500,000, an interest rate of 4.5% pa compounding monthly with a term of 25 years.

Then interest rates suddenly fall to 3% pa (t=0), but you continue to pay the same monthly home loan payments as you did before. How long will it now take to pay off your home loan? Measure the time taken to pay off the home loan from the current time which is 5 years after the home loan was first entered into.

Assume that the lower interest rate was given to you immediately after the loan repayment at the end of year 5, which was the 60th payment since the loan was granted. Also assume that rates were and are expected to remain constant.