Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

You own an apartment which you rent out as an investment property.

What is the price of the apartment using discounted cash flow (DCF, same as NPV) valuation?

Assume that:

- You just signed a contract to rent the apartment out to a tenant for the next 12 months at $2,000 per month, payable in advance (at the start of the month, t=0). The tenant is just about to pay you the first $2,000 payment.

- The contract states that monthly rental payments are fixed for 12 months. After the contract ends, you plan to sign another contract but with rental payment increases of 3%. You intend to do this every year.

So rental payments will increase at the start of the 13th month (t=12) to be $2,060 (=2,000(1+0.03)), and then they will be constant for the next 12 months.

Rental payments will increase again at the start of the 25th month (t=24) to be $2,121.80 (=2,000(1+0.03)2), and then they will be constant for the next 12 months until the next year, and so on. - The required return of the apartment is 8.732% pa, given as an effective annual rate.

- Ignore all taxes, maintenance, real estate agent, council and strata fees, periods of vacancy and other costs. Assume that the apartment will last forever and so will the rental payments.

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

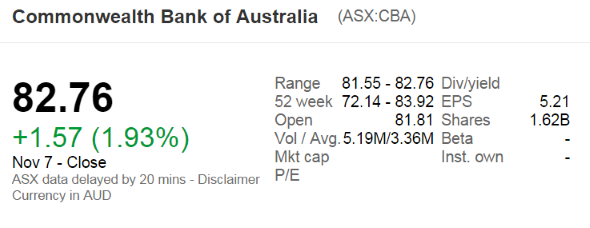

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's approximate payout ratio over the 2014 financial year?

Note that the firm's interim and final dividends were $1.83 and $2.18 respectively over the 2014 financial year.

A trader sells a one year futures contract on crude oil. The contract is for the delivery of 1,000 barrels. The current futures price is $38.94 per barrel. The initial margin is $3,410 per contract, and the maintenance margin is $3,100 per contract.

What is the smallest price change that would lead to a margin call for the seller?

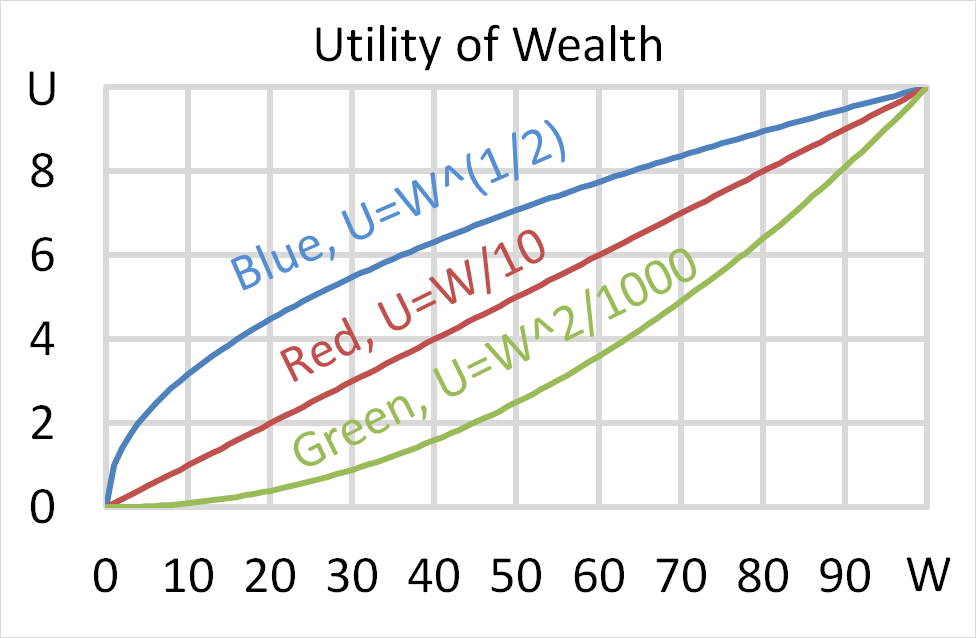

Below is a graph of 3 peoples’ utility functions, Mr Blue (U=W^(1/2) ), Miss Red (U=W/10) and Mrs Green (U=W^2/1000). Assume that each of them currently have $50 of wealth.

Which of the following statements about them is NOT correct?

(a) Mr Blue would prefer to invest his wealth in a well diversified portfolio of stocks rather than a single stock, assuming that all stocks had the same total risk and return.

Question 786 fixed for floating interest rate swap, intermediated swap

The below table summarises the borrowing costs confronting two companies A and B.

| Bond Market Yields | ||||

| Fixed Yield to Maturity (%pa) | Floating Yield (%pa) | |||

| Firm A | 3 | L - 0.4 | ||

| Firm B | 5 | L + 1 | ||

Firm A wishes to borrow at a floating rate and Firm B wishes to borrow at a fixed rate. Design an intermediated swap (which means there will actually be two swaps) that nets a bank 0.1% and shares the remaining swap benefits between Firms A and B equally. Which of the following statements about the swap is NOT correct?

Question 851 labour force, no explanation

Below is a table showing some figures about the Australian labour force.

| Australian Labour Force and Employment Data | |

| April 2017 Seasonally Adjusted figures | |

| Employed persons ('000) | 12 061.9 |

| Unemployed persons ('000) | 751.4 |

| Unemployment rate (%) | 5.9 |

| Participation rate (%) | 64.8 |

Source: ABS 6202.0 Labour Force, Australia, Apr 2017

What do you estimate is the size of working age population in thousands (‘000)?

Question 963 Bretton Woods, foreign exchange rate, foreign exchange system history, no explanation

Under the Bretton Woods System (1944 to 1971), currencies were priced relative to: