Government bonds currently have a return of 5% pa. A stock has an expected return of 6% pa and the market return is 7% pa. What is the beta of the stock?

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Which of the following companies is most suitable for valuation using PE multiples techniques?

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

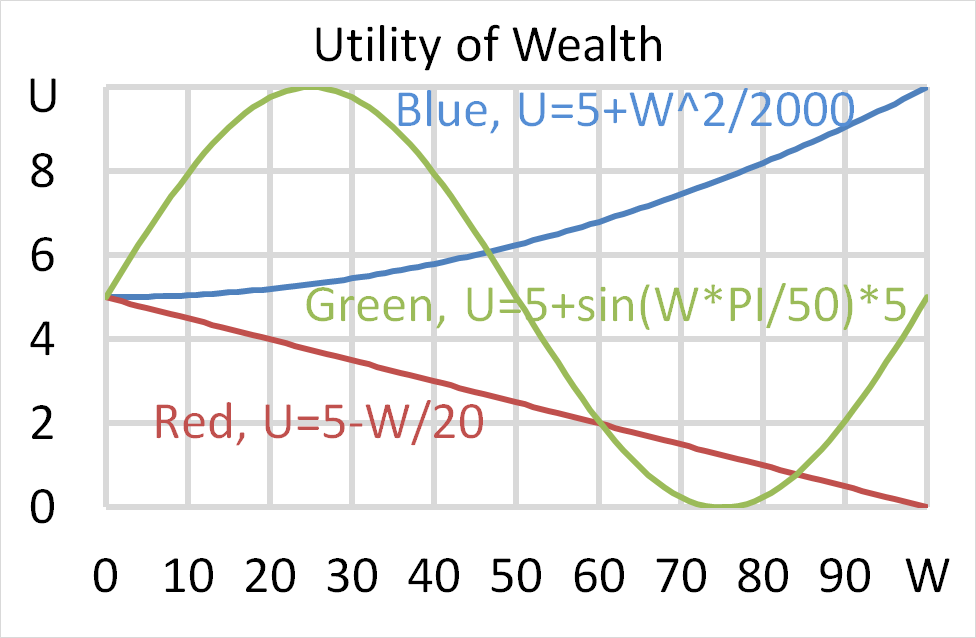

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

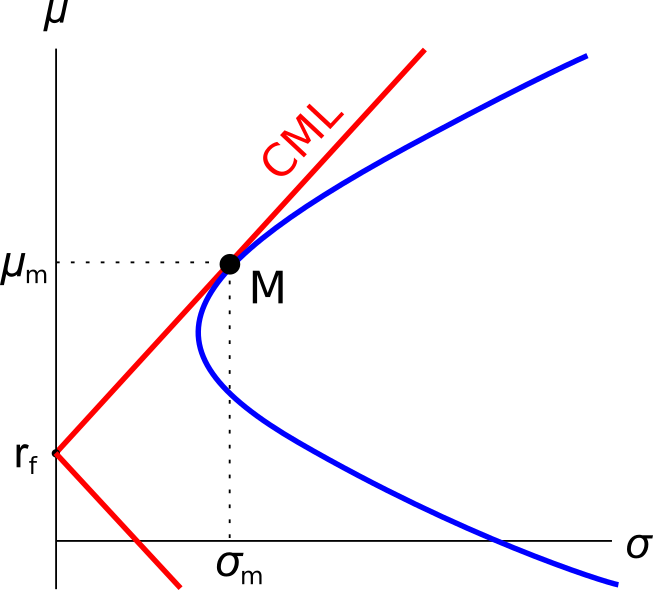

Question 809 Markowitz portfolio theory, CAPM, Jensens alpha, CML, systematic and idiosyncratic risk

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the graph below. The CML is the capital market line.

Which of the following statements about this graph, Markowitz portfolio theory and the Capital Asset Pricing Model (CAPM) theory is NOT correct?

Question 823 option, option payoff at maturity, option profit, no explanation

A European call option should only be exercised if:

Question 825 future, hedging, tailing the hedge, speculation, no explanation

An equity index fund manager controls a USD500 million diversified equity portfolio with a beta of 0.9. The equity manager expects a significant rally in equity prices next year. The market does not think that this will happen. If the fund manager wishes to increase his portfolio beta to 1.5, how many S&P500 futures should he buy?

The US market equity index is the S&P500. One year CME futures on the S&P500 currently trade at 2,155 points and the spot price is 2,180 points. Each point is worth $250.

The number of one year S&P500 futures contracts that the fund manager should buy is: