Here are the Net Income (NI) and Cash Flow From Assets (CFFA) equations:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

What is the formula for calculating annual interest expense (IntExp) which is used in the equations above?

Select one of the following answers. Note that D is the value of debt which is constant through time, and ##r_D## is the cost of debt.

A zero coupon bond that matures in 6 months has a face value of $1,000.

The firm that issued this bond is trying to forecast its income statement for the year. It needs to calculate the interest expense of the bond this year.

The bond is highly illiquid and hasn't traded on the market. But the finance department have assessed the bond's fair value to be $950 and this is its book value right now at the start of the year.

Assume that:

- the firm uses the 'effective interest method' to calculate interest expense.

- the market value of the bond is the same as the book value.

- the firm is only interested in this bond's interest expense. Do not include the interest expense for a new bond issued to refinance the current one, as would normally happen.

What will be the interest expense of the bond this year for the purpose of forecasting the income statement?

Question 282 expected and historical returns, income and capital returns

You're the boss of an investment bank's equities research team. Your five analysts are each trying to find the expected total return over the next year of shares in a mining company. The mining firm:

- Is regarded as a mature company since it's quite stable in size and was floated around 30 years ago. It is not a high-growth company;

- Share price is very sensitive to changes in the price of the market portfolio, economic growth, the exchange rate and commodities prices. Due to this, its standard deviation of total returns is much higher than that of the market index;

- Experienced tough times in the last 10 years due to unexpected falls in commodity prices.

- Shares are traded in an active liquid market.

- The analysts' source data is correct and true, but their inferences might be wrong;

- All returns and yields are given as effective annual nominal rates.

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

Question 574 inflation, real and nominal returns and cash flows, NPV

What is the present value of a nominal payment of $100 in 5 years? The real discount rate is 10% pa and the inflation rate is 3% pa.

Question 691 continuously compounding rate, effective rate, continuously compounding rate conversion, no explanation

A bank quotes an interest rate of 6% pa with quarterly compounding. Note that another way of stating this rate is that it is an annual percentage rate (APR) compounding discretely every 3 months.

Which of the following statements about this rate is NOT correct? All percentages are given to 6 decimal places. The equivalent:

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

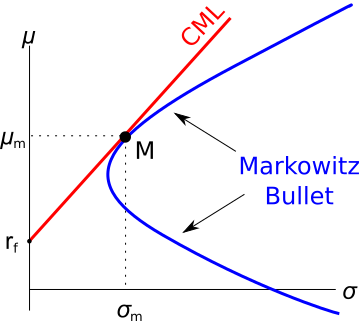

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 791 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate, log-normal distribution, VaR, confidence interval

A risk manager has identified that their pension fund’s continuously compounded portfolio returns are normally distributed with a mean of 5% pa and a standard deviation of 20% pa. The fund’s portfolio is currently valued at $1 million. Assume that there is no estimation error in the above figures. To simplify your calculations, all answers below use 2.33 as an approximation for the normal inverse cumulative density function at 99%. All answers are rounded to the nearest dollar. Which of the following statements is NOT correct?

Question 983 corporate financial decision theory, DuPont formula, accounting ratio

A company manager is thinking about the firm's book assets-to-equity ratio, also called the 'equity multiplier' in the DuPont formula:

###\text{Equity multiplier} = \dfrac{\text{Total Assets}}{\text{Owners' Equity}}###What's the name of the decision that the manager is thinking about? In other words, the assets-to-equity ratio is the main subject of what decision?

Note: DuPont formula for analysing book return on equity:

###\begin{aligned} \text{ROE} &= \dfrac{\text{Net Profit}}{\text{Sales}} \times \dfrac{\text{Sales}}{\text{Total Assets}} \times \dfrac{\text{Total Assets}}{\text{Owners' Equity}} \\ &= \text{Net profit margin} \times \text{Total asset turnover} \times \text{Equity multiplier} \\ \end{aligned}###